Definition and Purpose of the 2015 Form 8867

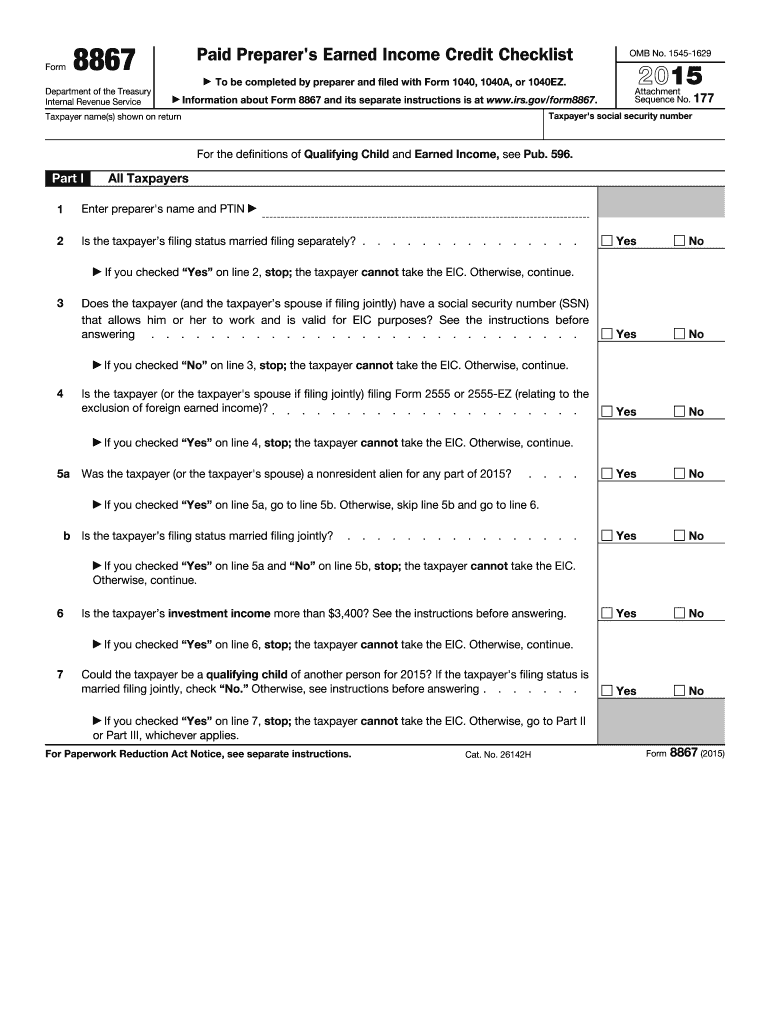

The 2015 Form 8867, also known as the Paid Preparer's Earned Income Credit (EIC) Checklist, is a form mandated by the IRS for tax preparers to confirm a taxpayer's eligibility for the Earned Income Credit. This form is essential in ensuring that preparers meet due diligence requirements when filing taxes that claim this specific credit.

The form serves several purposes:

- Eligibility Assessment: It helps determine whether a taxpayer qualifies for the Earned Income Credit by collecting necessary information about their income, filing status, and dependent children.

- Documentation: Form 8867 provides detailed sections to capture information related to both taxpayers with and without qualifying children. For example, it inquires about adjusted gross income (AGI) and the number of dependents.

- Due Diligence Enforcement: By requiring certain questions to be answered, it aims to prevent fraudulent claims and ensure that taxpayers are receiving appropriate credits they qualify for based on current laws.

How to Use the 2015 Form 8867

Using the 2015 Form 8867 involves several key steps that a tax preparer must follow to ensure compliance and accuracy. The form is designed to be a guideline for preparers to gather the necessary information needed to claim the Earned Income Credit.

- Review Eligibility Criteria: Before filling out the form, one must understand the eligibility requirements for the Earned Income Credit.

- Complete the Form: Fill in all sections of the form, ensuring accurate data about the taxpayer's income, filing status, and qualifying children is documented.

- If claiming children, confirm their relationship to the taxpayer and residency.

- Provide Required Additional Documentation: Prepare supporting documents, such as W-2s or other income statements, that verify the information provided on the form.

It is not just filling out the form; it requires comprehensive knowledge of a taxpayer's financial situation to prevent errors that can lead to penalties.

Steps to Complete the 2015 Form 8867

Completing the 2015 Form 8867 requires a methodical approach to ensure every necessary section is addressed accurately. The following steps provide a clear guide:

- Gather Information:

- Assemble necessary documents, such as prior year's tax returns, W-2 forms, and any proof of dependent eligibility.

- Fill Out Taxpayer Information:

- Input the taxpayer’s name, Social Security number, and other required identification details.

- Evaluating Qualifying Child(s):

- Complete the sections requesting information about qualifying children, including their names, Social Security numbers, and the relationship to the taxpayer.

- Determine AGI and Filing Status:

- Carefully document the taxpayer’s AGI based on current records to correctly assess their eligibility for the EIC.

- Identify Potential Flags:

- Address questions that may raise doubts regarding eligibility, such as income thresholds or residency requirements.

- Review and Sign:

- Once the form is completed, review for accuracy, and sign as the preparer to certify due diligence was performed.

Following these detailed steps can minimize errors and enhance the chances of a successful credit claim.

Key Elements of the 2015 Form 8867

Understanding the key elements contained within the 2015 Form 8867 is critical for effective use. This form comprises several essential features that guide tax preparers during their assessments:

- Personal Information Section: This section captures vital information about the taxpayer, including identification details and filing status.

- Income Verification: The form requires preparers to document and verify income details from various sources, ensuring compliance with IRS standards.

- Eligibility Assessment Checklist: The form includes a checklist for the preparer to ensure that all qualification criteria for the Earned Income Credit are met.

- Preparer's Certification: At the end of the form, there is a certification section where the preparer indicates due diligence has been maintained throughout the process.

These elements are significant in distinguishing between accurately claimed credits and fraudulent submissions.

Examples of Using the 2015 Form 8867

Real-world scenarios illustrate the application of the 2015 Form 8867, offering insights into its practical use. Here are a few illustrative examples:

-

Scenario 1: A single parent with two children earning low income wishes to claim the Earned Income Credit. The tax preparer uses the form to document their AGI and ensure that both children meet qualifying criteria, correctly filing for the EIC.

-

Scenario 2: A tax preparer mistakenly fails to complete Form 8867 when submitting a return for a client. If the IRS audits the return, the lack of documentation can lead to penalties for both the taxpayer and the preparer, demonstrating the necessity of this form.

-

Scenario 3: A self-employed individual with no children qualifies under certain conditions for the EIC. The preparer uses the form to substantiate their eligibility, specifically referring to the income thresholds outlined in the checklist.

These examples reveal the diverse applications of Form 8867, highlighting the importance of diligent preparation and submission.

Filing Deadlines and Important Dates for the 2015 Form 8867

Adhering to filing deadlines is crucial for the timely processing of the 2015 Form 8867. Tax preparers should be aware of the following important dates:

- Tax Filing Season: The typical tax filing season runs from January through April. The exact deadlines vary each year, often falling on April 15.

- Extension Deadlines: If a taxpayer requests an extension, the form and tax return must be submitted by the extended due date, typically six months past the original filing deadline.

- EIC Claims: The IRS emphasizes the importance of submitting Form 8867 alongside any claims for the Earned Income Credit to prevent potential audits or delays.

Monitoring these deadlines ensures compliance and timely receipt of potential refunds.