Definition and Purpose of the 2013 W-3C Form

The 2013 W-3C form is a critical document used to transmit corrected wage and tax statements, specifically the W-2c forms, to the Social Security Administration (SSA). This form is essential for employers who need to amend previously submitted wage data. It serves as a summary of the corrections made to the wage information provided by the employer throughout the tax year. By accurately reflecting the corrected data, the W-3C form ensures that employees' earnings are properly reported and recorded, which is vital for their future Social Security benefits.

Importance of the W-3C Form

- Corrects Errors: The W-3C form is used to correct errors on previously filed W-2 forms, which may include incorrect names, Social Security numbers, or amounts.

- Maintains Compliance: Filing the W-3C ensures compliance with IRS regulations and avoids potential penalties associated with incorrect reporting.

- Employee Benefit Protection: Accurate wage reporting helps protect employees' rights regarding their Social Security benefits, ensuring they receive credit for their earnings.

How to Obtain the 2013 W-3C Form

Employers can obtain the 2013 W-3C form from several sources. The most common method is downloading it directly from the IRS website, where forms and publications are made available. In addition to the online option, forms can also be requested through the following ways:

Methods to Obtain the Form

- IRS Website: The IRS provides the W-3C form in PDF format, allowing users to fill it out digitally or print it for completion.

- Office Supply Stores: Many office supply retailers carry various IRS forms, including the W-3C form, especially during tax season.

- Tax Preparation Software: Most tax software options include features that generate the W-3C form for employers needing to report corrections.

Steps to Complete the 2013 W-3C Form

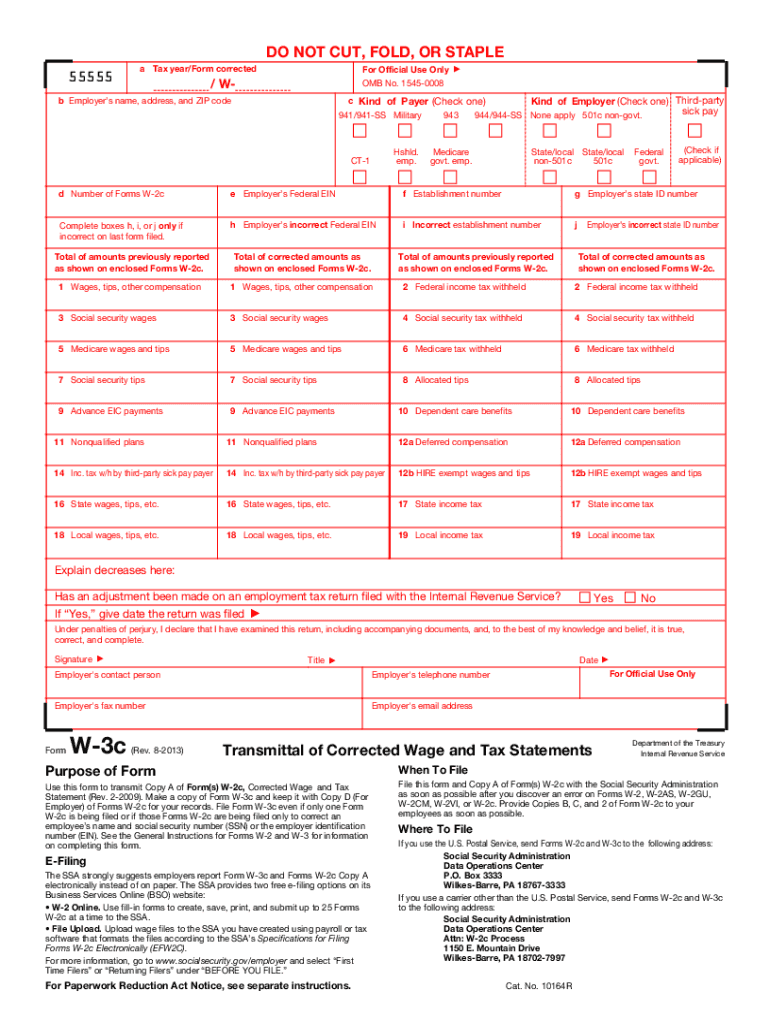

Successfully completing the 2013 W-3C involves several precise steps to ensure accuracy and compliance. Here is a step-by-step breakdown of how to complete the form:

- Identify the Employer Information: Fill in the employer's name, address, and Employer Identification Number (EIN) at the top of the form.

- Report the Corrected Information:

- Include total corrected wages, Social Security tips, and other tax-related information that needs correction.

- Use the amounts from the corrected W-2c forms.

- Fill in the Reason for Correction: Indicate the specific reasons for corrections, such as adjusting an incorrect Social Security number or reporting additional income.

- Total Amounts: Ensure the totals provided on the W-3C match those submitted on the corresponding W-2c forms.

- Sign and Date the Form: The form must be signed by someone authorized to represent the employer, affirming that the information is accurate and reflects the corrections needed.

Common Mistakes to Avoid

- Incomplete Information: Failing to provide all required details, such as the EIN or accurate corrected amounts.

- Mismatched Totals: Ensure that the totals on the W-3C align exactly with the combined figures from the W-2c forms submitted.

- Late Filings: Submit the W-3C as soon as the corrections are identified and made to avoid potential penalties.

Who Typically Uses the 2013 W-3C Form

The 2013 W-3C form is primarily used by employers who find it necessary to correct wage reporting to the SSA. However, there are specific scenarios and stakeholders who frequently utilize this document:

Users of the W-3C Form

- Small to Large Businesses: Employers of all sizes that issue W-2 forms and must rectify errors or discrepancies.

- Payroll Administrators: Individuals responsible for overseeing employee payroll and ensuring accurate reporting to federal agencies.

- Accountants and Tax Professionals: Professional preparers who manage payroll reporting and compliance on behalf of clients may use the W-3C to ensure accurate submissions.

Legal Use of the 2013 W-3C Form

The legal standing of the 2013 W-3C form is backed by regulations set forth by the IRS. This form must be filed in accordance with federal laws to ensure that all wage corrections made through W-2c forms are officially recognized.

Legal Considerations

- Compliance with IRS Regulations: Filing the W-3C is required under IRS law when corrections are necessary, and noncompliance can result in penalties.

- Protection for Employees: Timely filing ensures that employee records with the SSA are accurate, thus safeguarding their rights to future benefits.

- Record-Keeping Obligations: Employers must retain copies of submitted W-3C forms for at least four years, providing evidence of their corrections in case of audits.

Filing Deadlines for the 2013 W-3C Form

Filing deadlines for the 2013 W-3C form are crucial for employers to be aware of, ensuring timely submission and compliance. The general deadline for submitting the W-3C with the SSA is typically set to be completed by:

- Paper Filings: January 31 of the year following the tax year of the corrections.

- Electronic Filings: The same January 31 deadline applies, but electronic submissions are generally encouraged for faster processing.

Consequences of Late Filings

- Penalties: Employers may incur fines for late filing, which can vary based on how late the submission is.

- Employee Impacts: Late filings can lead to inaccurate records for employees, affecting their potential benefits and tax liabilities.

Key Elements of the 2013 W-3C Form

Understanding the key elements of the 2013 W-3C form is fundamental for ensuring compliance and accurate reporting. Each section of the form contains specific information that must be provided clearly.

Critical Components

- Employer Identification: Complete and accurate information about the employer, including name and EIN.

- Corrected Data Summary: Detailed summary of the corrections being reported, ensuring that all figures match the related W-2c forms.

- Certification Details: Ensures the information is verified and correctly represented by an authorized party.

Careful attention to these elements will enhance the accuracy of form submission and confirm compliance with IRS requirements.