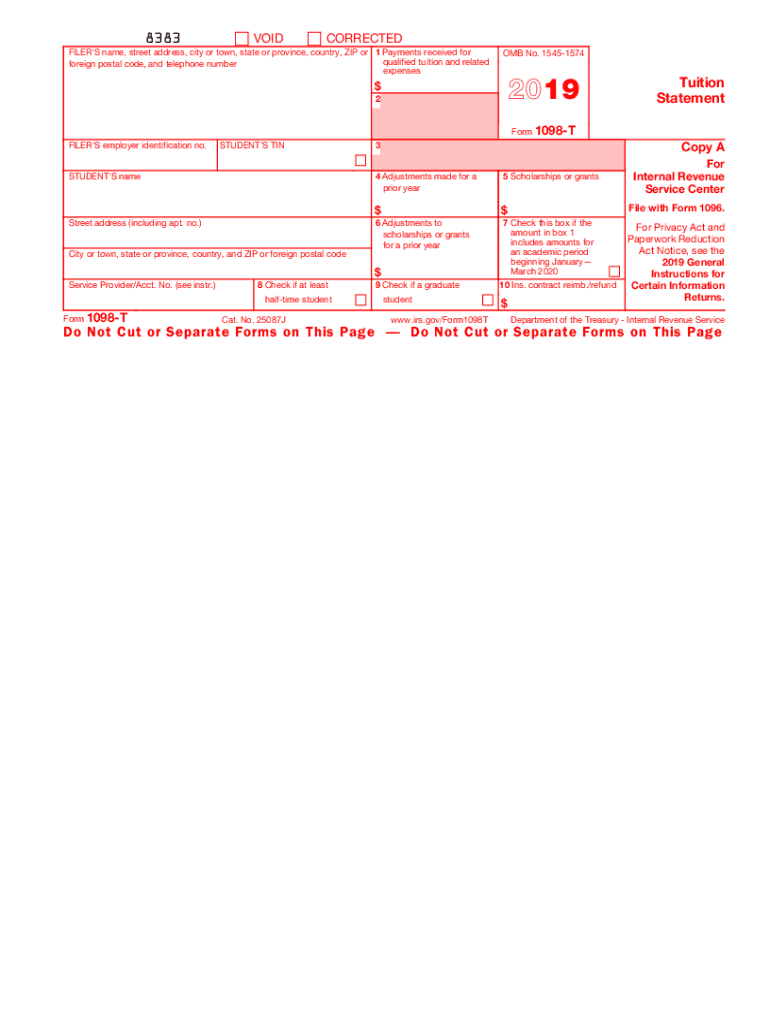

Definition and Meaning of the 1098-T Form

The 1098-T form, officially titled "Tuition Statement," is an important document used in the United States for tax purposes. It reports payments made for qualified tuition and related expenses by eligible educational institutions. This form is essential for students and their families when claiming education tax credits, such as the American Opportunity Credit and the Lifetime Learning Credit. The form is structured to provide vital information including the student’s name, tax identification number, and the total amount of qualified tuition payments made during the tax year.

The educational institutions that typically issue the 1098-T form are colleges and universities, which are required to send this form to the IRS as well as to the student by January 31 of the year following the tax year in which the payments were made. The information reported on the 1098-T can significantly impact the tax filing process, as it provides documentation necessary to establish eligibility for various tax benefits associated with higher education.

How to Use the 1098-T Form for Tax Purposes

Using the 1098-T form effectively involves several key steps. First, taxpayers should incorporate the information from the form into their tax return when applying for educational credits. The form outlines both the qualified expenses incurred and the scholarships received, which should be cross-referenced against expenses claimed on the tax return.

- Gather Documents: Collect your 1098-T form along with any other documents related to educational expenses, such as receipts for textbooks and supplies.

- Review Information: Ensure the details on the 1098-T, such as your name and Social Security number, are accurate. Mismatched information could lead to delays or complications.

- Identify Eligibility: Check if you qualify for education tax credits based on the information provided on the 1098-T.

- Complete Your Tax Return: Enter the figures from the 1098-T into the appropriate sections of your tax return to claim any eligible credits. Use IRS Form 8863 to claim the American Opportunity and Lifetime Learning credits, which require specific information from your 1098-T.

By following these steps, taxpayers can maximize their potential tax benefits associated with education expenses reported on the 1098-T form.

How to Obtain the 1098-T Form

There are several methods through which students can obtain their 1098-T forms, primarily dependent on their educational institution's processes. Most colleges and universities provide the form in electronic formats via their student portals, while others may send a paper copy by mail.

- Check Student Portals: Log into the institution’s student information system or financial aid portal. Most schools will have an electronic version available for download or viewing.

- Contact the Registrar's Office: If the form is not accessible online, reaching out directly to the registrar’s office or the financial aid department can help. They can provide information on how and when to obtain the form.

- Request a Paper Copy: If the institution issues paper forms, a request can often be made through email or phone to receive the form through the mail.

Obtaining the 1098-T form in a timely manner is essential to ensure that it can be utilized appropriately during tax preparation.

Key Elements of the 1098-T Form

Understanding the key elements of the 1098-T form is critical for students and taxpayers. The form captures various components that detail the educational expenses incurred by students. The primary sections include:

- Student Information: This section lists the student's name, address, and Social Security number.

- Qualified Tuition and Related Expenses: The form specifies the total amount of tuition payments made, as well as any applicable adjustments.

- Scholarships or Grants: Amounts received in the form of scholarships or grants are reported, which are used to offset the reported tuition expenses.

- Educational Institution Information: Details of the institution, including its name and Employer Identification Number (EIN), are provided.

This information is crucial as it determines eligibility for various tax credits and affects the overall tax liability for the individual.

Filing Deadlines for the 1098-T Form

Filing deadlines for the 1098-T form are particularly important for both students and educational institutions. Educational institutions must provide the 1098-T form to the IRS and the student by specific deadlines, which help ensure compliance and facilitate the tax filing process.

- Form Distribution Deadline: Educational institutions must send out the 1098-T forms to students by January 31 of the year following the tax year. For instance, for expenses incurred in the 2022 tax year, the forms should be issued by January 31, 2023.

- IRS Submission Deadline: Institutions must also file the 1098-T form with the IRS by February 28 (or March 31 if filing electronically) of the same year.

Taxpayers should be aware of these deadlines to ensure they receive their forms on time and can file their tax returns by the April 15 deadline without complications. Understanding these timelines can help avoid issues such as penalties for late filing or missed tax credits.

Important Terms Related to the 1098-T Form

Familiarity with key terms associated with the 1098-T form can enhance understanding of its purpose and implications in the tax filing process. Important terms include:

- Qualified Expenses: These are expenses that count toward eligibility for education tax benefits, including tuition, fees, and course-related materials.

- Tax Credits: Tax credits like the American Opportunity Credit and Lifetime Learning Credit can significantly reduce tax liability and are linked to the information reported on the 1098-T form.

- Scholarships and Grants: These funds reduce the amount a student pays out of pocket for education costs and are reported on the form.

- Tuition Statement: The 1098-T form is specifically referred to as a tuition statement, as it reports essential information on tuition payments made during the tax year.

Understanding these terms can help individuals navigate their tax filings more effectively and take full advantage of the benefits available to them.