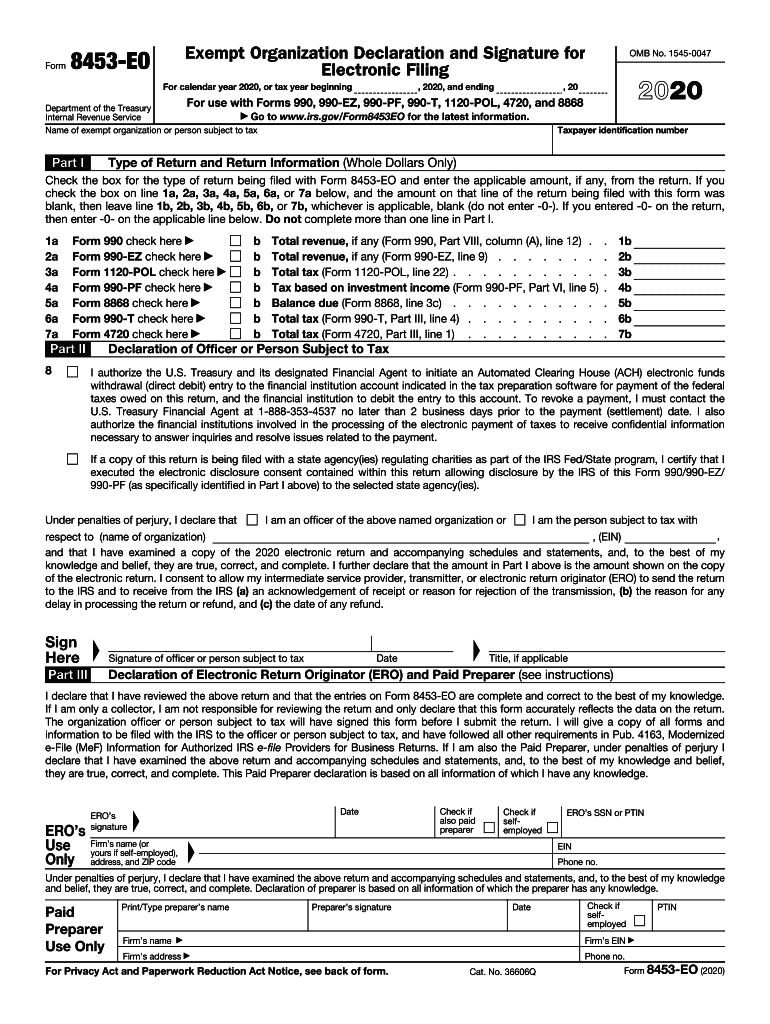

Definition and Meaning

IRS Form 8453, officially known as the U.S. Individual Income Tax Transmittal for an IRS e-file Return, is a document used to transmit paper documents that are not included as electronic files for an electronically filed tax return. This form serves as a cover sheet and is primarily utilized to send written material required for IRS verification, such as certain declaration statements or disclosure agreements, that cannot be attached electronically. Its primary function is to facilitate the accurate and complete submission of the necessary paper documents that accompany electronic filings.

How to Use IRS Form 8453

The use of IRS Form 8453 is fairly straightforward but crucial for the proper submission of additional documentation when filing an electronically transmitted tax return. Taxpayers must first complete their electronic filing process using a tax software or through a tax professional. Subsequently, any paper documents that cannot be attached electronically should be printed, signed if necessary, and sent along with Form 8453. These items might include specific declarations, powers of attorney, or other IRS forms that are required but were not part of the digital submission.

How to Obtain IRS Form 8453

IRS Form 8453 can be obtained directly from the IRS website. Taxpayers can download it in PDF format and print it for use. The form is also available through most tax preparation software as part of the e-filing setup process. Tax professionals typically offer this form to their clients if additional documentation is necessary for their electronically filed returns. It is essential to ensure the latest version of the form is being used, as tax forms can change from year to year based on updated IRS regulations.

Steps to Complete IRS Form 8453

- Complete the Header: Fill in your name, social security number, and address at the top of the form.

- Include Required Documentation: Attach the paper documents that need to be submitted in conjunction with your e-filed tax return. These could include written declarations or other necessary IRS forms.

- Sign and Date: Ensure the form is signed and dated by the taxpayer or an authorized representative if it includes such a requirement.

- Double-Check Accuracy: Verify that all information on the form and attached documents is accurate and complete to avoid processing delays.

- Mail to the IRS: Once all steps are completed, mail the form and attached documents to the address specified in the e-filing instructions or on the IRS website.

Key Elements of IRS Form 8453

- Taxpayer Information: Includes fields for the taxpayer's name, social security number, address, and tax year.

- Document Checklist: A section to check off and list the documents being attached with the form.

- Declaration and Signature Fields: Areas designated for signatures, which are critical for validating the accompanying documents and confirming their authenticity.

IRS Guidelines on IRS Form 8453

The IRS provides specific guidelines to ensure the correct usage of Form 8453. It is primarily used for transmitting supporting documents not eligible for electronic attachment. The IRS highlights the importance of submitting all necessary documents to accompany e-filed returns, which helps avoid penalties related to insufficient filing. Reliance solely on electronic submissions that omit critical paper documentation can result in processing delays or audit triggers.

Filing Deadlines and Important Dates

Form 8453 should be submitted to the IRS shortly after electronic filing of the tax return to ensure timely processing. Although there is no explicit deadline distinct from those associated with the e-filing process, the form and accompanying documents should be mailed no later than three business days after receiving IRS acceptance of the electronically filed tax return. It aligns with typical tax return deadlines, including extensions, which are generally set for April 15 and October 15 for extended returns.

Form Submission Methods

Form 8453 is specifically designed to support paper submissions as a supplement to electronic filings. Therefore, the form and its attachments must be mailed to the IRS. There is currently no method for submitting IRS Form 8453 and its contents online or in person. The physical address for mailing depends on whether a payment is included and is provided in the instructions upon completion of the electronic filing process.

Penalties for Non-Compliance

Failing to submit IRS Form 8453 when required can lead to significant issues, including delayed processing of the tax return, rejection of the electronic filing, or even penalties. The absence of necessary documents can result in the IRS questioning the completeness or accuracy of a return, which might trigger an audit. Ensuring all required paper documents are sent with Form 8453 helps avoid these potential pitfalls and maintain compliance with IRS requirements.