Definition and Meaning of Employees Pension Scheme 1995 Form 10D 2010

The Employees Pension Scheme (EPS) 1995 Form 10D is an important document for individuals seeking to claim their pension benefits under the Employees’ Provident Fund Organization (EPFO) in India. The scheme, established to secure financial stability for employees post-retirement, particularly underlines the benefits available to those who are eligible following cessation of service. Form 10D is specifically designed for members who wish to apply for the monthly pension that is provided under this scheme after fulfilling certain criteria.

Key Features

- Eligibility for Monthly Pension: Form 10D is applicable for individuals who have completed at least ten years of service, as mentioned in the Employee Pension Scheme regulations.

- Dependent Benefits: This form is crucial for dependents of deceased members, allowing them to claim pension benefits.

- Application Process: The form facilitates the request for pension benefits and requires detailed personal information, employment history, and banking details.

Understanding the importance of Form 10D is essential for ensuring that individuals receive the financial support they are entitled to during their retirement years or in the event of an employee’s demise.

Steps to Complete the Employees Pension Scheme 1995 Form 10D 2010

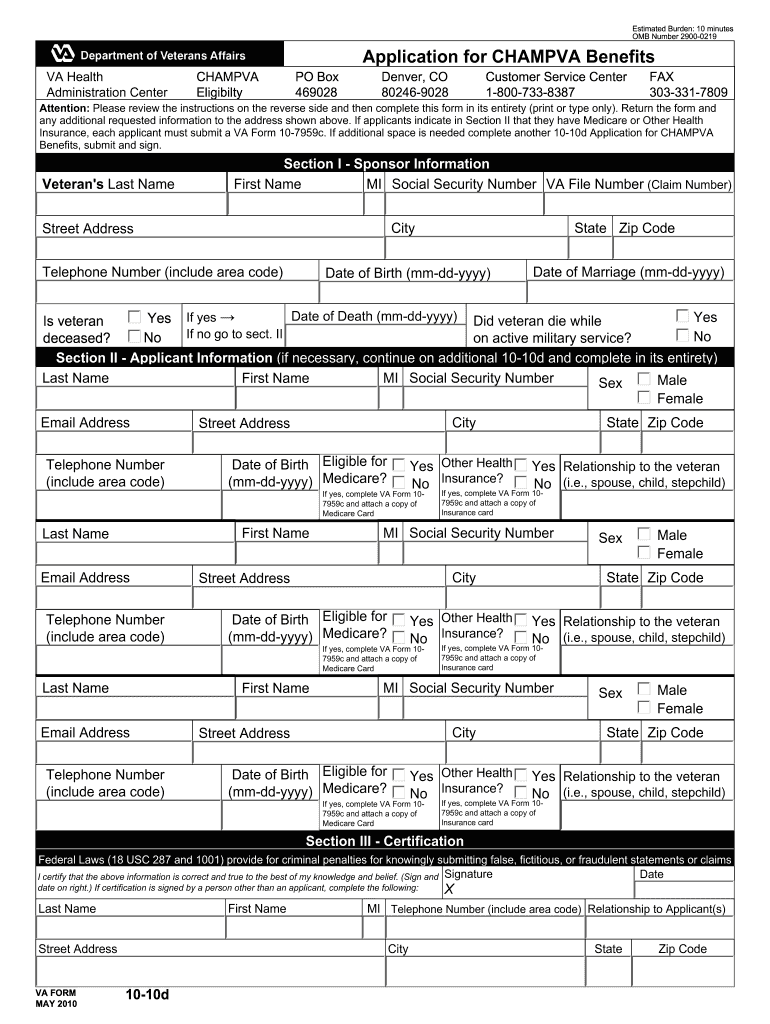

Filling out the Employees Pension Scheme 1995 Form 10D requires meticulous attention to detail to ensure all information is accurately provided. Here are the steps to complete the form effectively:

- Download the Form: Obtain the latest version of the form from designated sources, such as the EPFO website or local EPF offices.

- Personal Information: Fill in your personal details, including name, address, and contact information. This section includes critical identifiers such as the Universal Account Number (UAN).

- Employment Details: Clearly state your employment history. Include the name of the establishment, EPF Account number, and the period of employment.

- Pension Details: Specify the reason for claiming the pension, whether for yourself or as a dependent. Include the details pertaining to the deceased member if applicable.

- Bank Details: Mention your bank account information accurately, including account number and IFSC code for pension disbursal.

- Documentation: Attach required documents such as identity proof, employment proof, and nominee details.

- Submission: Ensure the completed form is signed and submit it to the respective EPFO office or through digital channels.

Carefully following these steps ensures a smoother application process and expedites the review and disbursement of pension benefits.

Important Terms Related to Employees Pension Scheme 1995 Form 10D 2010

Understanding key terminologies associated with the Employees Pension Scheme 1995 Form 10D can help applicants navigate the process more effectively. Here are some essential terms to be aware of:

- Universal Account Number (UAN): A unique number assigned to employees for tracking their EPF contributions and pension history.

- Pension Fund: A fund established to provide monthly financial support to retirees or dependents of deceased members.

- Member Contribution: The amount contributed by the employee towards their pension scheme over their period of employment.

- Employer Contribution: The additional amount the employer contributes to the employee’s pension scheme, which also includes the Government's contribution.

- Nominee: An individual designated to receive benefits in the event of the primary member's demise.

Familiarity with these terms can enhance understanding and make the navigation of processes related to Form 10D much more effective.

Examples of Using Employees Pension Scheme 1995 Form 10D 2010

Practical examples illustrate how Form 10D can be used in various scenarios, ensuring proper pension claim processing for eligible individuals. Here are a few situations:

- Retiree Claiming Pension: An employee who has served 20 years and is retiring at the age of 60 may use Form 10D to claim their monthly pension. They would fill out the necessary employment details, attach relevant identification, and submit the application for processing.

- Survivor Claim: If a member of the pension scheme passes away after serving for fifteen years, their spouse or children can use Form 10D to claim survivor benefits. This requires them to provide proof of the member’s death along with their personal details and relationship to the deceased.

- Change in Employment Status: An employee who has recently changed jobs and wishes to transfer their pension benefits to the new employer may also need to complete Form 10D to facilitate the transition and ensure that their contributions are carried over properly.

These examples provide clarity on the application of Form 10D in real-life situations, showcasing its significance in managing pension claims.

Filing Deadlines and Important Dates for Employees Pension Scheme 1995 Form 10D 2010

Awareness of filing deadlines and important dates can significantly enhance the effectiveness of the pension claim process. Here’s an outline of these crucial timelines:

Important Dates

- Claim Submission Deadline: It is advisable to submit Form 10D as soon as retirement or the event necessitating the claim occurs. While there may not be a hard deadline for submissions, delays can affect the disbursement of benefits.

- Processing Time: Typically, pension claims filed through Form 10D may take between two to three months for processing. Monitor the progress after submission.

- Annual Review of Pension Plan: Each year, beneficiaries should keep track of any changes in policies or procedures associated with their pension to avoid discrepancies.

Being mindful of these timelines can help applicants ensure their pension claims are processed in a timely manner, minimizing any potential disruptions to their financial security.