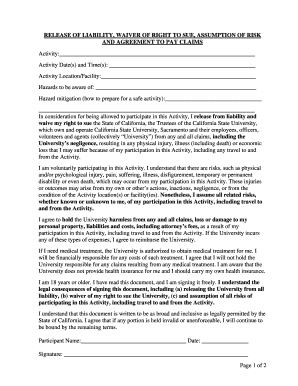

Definition and Meaning of Authorization Letter for Refund

An authorization letter for refund is a formal document that grants permission to an individual or entity to handle a monetary return on behalf of another. This type of letter is commonly used in various contexts, such as consumer transactions involving refunds for goods or services, tax refunds, and tuition reimbursement requests. The purpose of the letter is to verify that the person requesting the refund has the authority to do so, thus ensuring compliance and mitigating the risk of fraud.

- Use Cases:

- Requesting a refund from a retailer for a defective product.

- A parent authorizing a school to refund tuition fees for a child.

- An employee authorizing a company to process a reimbursement for expenses.

Understanding the specific terms outlined in the authorization letter is crucial for all parties involved, as it delineates the rights and responsibilities concerning the refund process.

How to Use the Authorization Letter for Refund

Using an authorization letter for refund involves several steps that ensure the document is both effective and compliant with necessary regulations. Proper execution increases the likelihood of a smooth refund process.

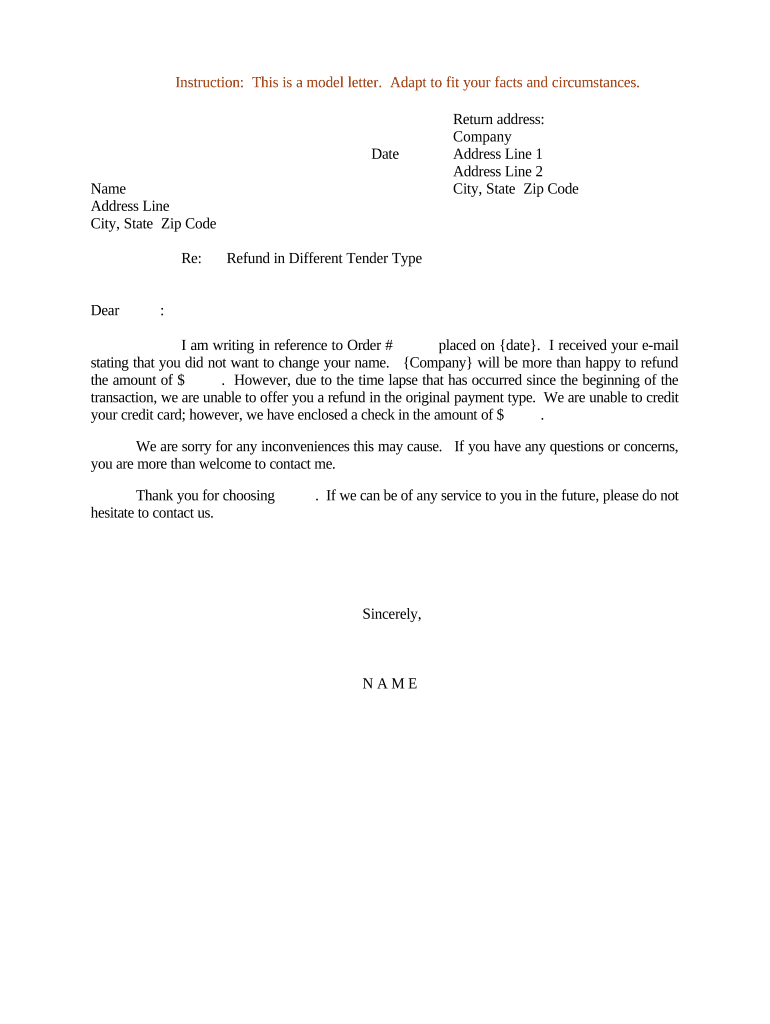

- Identify the Required Format: Ensure that the letter follows a professional structure, typically including the sender's and recipient's information, date, subject line, and body text.

- Include Necessary Information: Clearly state the purpose of the letter, the amount to be refunded, and provide pertinent details such as a receipt number or previous transaction date.

- Signature and Date: The letter should be signed by the authorized individual(s) and dated to validate the request. It may also be beneficial to include contact information for follow-up.

Consider the context; for instance, if the letter is for a tax refund, adhere to IRS guidelines regarding authorization letters.

Key Elements of the Authorization Letter for Refund

Several key elements must be included in an authorization letter for refund to ensure it effectively communicates the necessary information and requirements.

- Sender Information: Full name, address, phone number, and email of the individual requesting the refund.

- Recipient Information: Full name of the institution or individual who will process the refund.

- Authorization Statement: A clear statement indicating who is authorized to act on behalf of the sender.

- Description of the Refund Request: Detailed information about the refund, including the reason, dollar amount, and transaction details.

- Signature and Date: To validate the request, the letter must be signed and dated by the requester, confirming their intent and authority.

By ensuring these elements are present, the letter can effectively communicate its purpose, reducing ambiguity for all involved parties.

Examples of Using the Authorization Letter for Refund

Various scenarios illustrate the practical use of an authorization letter for refund, demonstrating its versatility across different situations.

Retail Refunds

A customer who purchased an electronics item that malfunctioned can write a letter to authorize a friend to obtain a refund. The letter would include:

- Product details, such as model and serial number.

- Original purchase receipt number.

- A statement authorizing the friend to receive the refund.

Tax Refunds

Taxpayers may need to authorize a tax professional to obtain their tax refund on their behalf, especially if they are unable to visit the IRS office in person. The letter should outline:

- Taxpayer details, including Social Security number.

- Tax period for which the refund is requested.

- Professional's details and clear authorization to act.

Tuition Reimbursement

Parents requesting tuition refunds from educational institutions often use this letter. Key details to include are:

- Student's name and identification number.

- Reason for the refund request.

- Signature of the parents or guardians authorizing the institution to process the refund.

Steps to Complete the Authorization Letter for Refund

Completing the authorization letter for refund requires careful attention to detail to meet all necessary requirements and facilitate a seamless refund process.

- Draft the Letter: Use a standard business letter format, including sender and recipient details.

- State Intent: Clearly communicate the purpose of the letter, specifying it’s an authorization for a refund.

- Detail the Amount and Transaction: Provide complete details about the transaction, such as date, amount, and reason for the refund.

- Authorize the Representative: Explicitly state who is authorized to claim the refund on your behalf. Include their contact information for verification.

- Review for Accuracy: Check all details for correctness to avoid delays in processing.

- Sign and Date: Ensure the letter is signed and dated, adding legitimacy.

Following these steps will streamline the refund process and reduce the likelihood of complications.

By comprehensively addressing the various facets of an authorization letter for refund, individuals can confidently navigate this crucial aspect of financial transactions.