Definition and Meaning of the W-2 Form

The W-2 form, officially known as the Wage and Tax Statement, is a crucial document for employees in the United States. It is issued annually by employers to report an employee's wages, tips, and other compensation, along with the taxes withheld from these earnings. The W-2 form is primarily used for federal income tax reporting, and it consolidates essential earnings and tax information, making it easier for employees to accurately file their tax returns.

Purpose of the W-2 Form

The principal purpose of the W-2 form includes:

- Income Reporting: Provides a summary of an employee’s total earnings throughout the year, including wages, bonuses, and tips.

- Tax Withholding: Indicates the total amount of federal, state, and other applicable taxes withheld.

- Tax Returns: Serves as a central document for employees when filling out their tax returns, ensuring compliance with IRS tax law.

Importance for Employees

For employees, the W-2 form is vital because:

- It ensures compliance with federal and state tax obligations.

- It acts as proof of income, valuable for applying for loans or other financial services.

How to Obtain the W-2 Form PDF

Obtaining the W-2 form is straightforward. Employers are required to provide this form to employees by January 31 of each year. Here are several methods through which employees can obtain their W-2 forms in PDF format.

Employer Issuance

- Direct Delivery: Most employers will provide a printed version directly to employees. However, many also offer digital versions.

- Online Employee Portal: Employers may have secure online portals where employees can log in, view, and download their W-2 forms as PDFs.

Requesting from Employers

If an employee does not receive their W-2 by the deadline, they should:

- Contact their employer's payroll or human resources department to request a copy.

- Verify their mailing address to ensure it is up-to-date.

IRS Resources

If the employer cannot be contacted, an employee can reach out to the IRS for assistance:

- Call the IRS: Employees can call the IRS at their designated customer service line to inquire about obtaining a copy of their W-2.

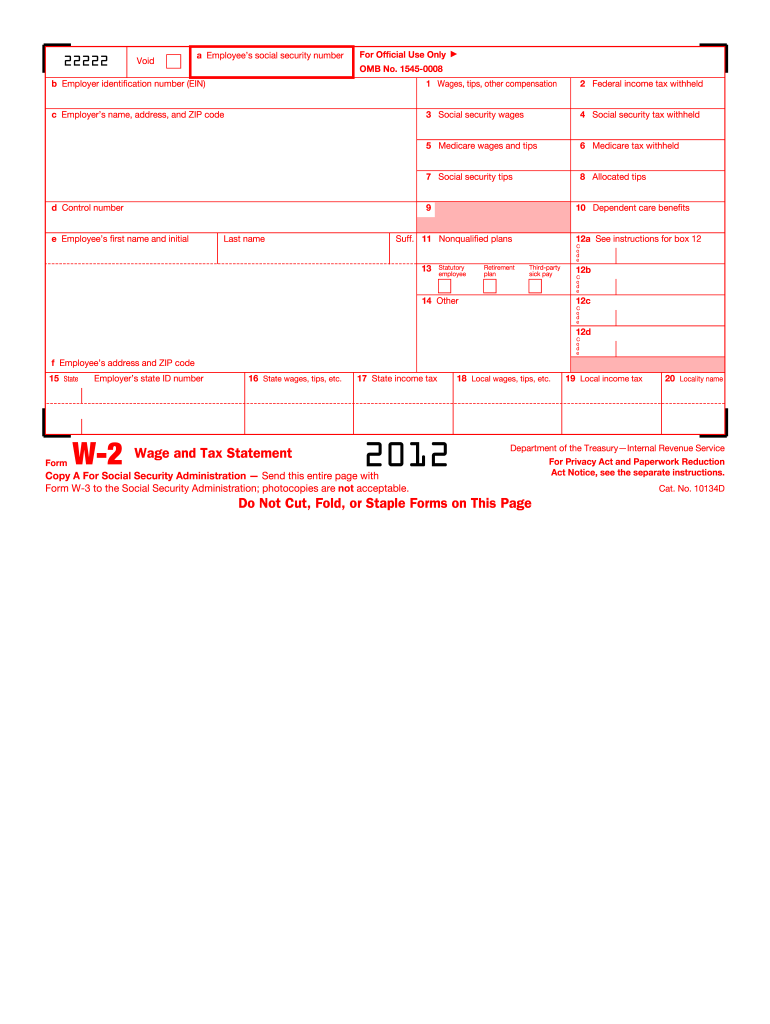

Steps to Complete the W-2 Form PDF

Filling out the W-2 form accurately is essential for correct tax reporting. Here are detailed steps employees should follow when completing the W-2.

Gathering Necessary Information

Before completing the form, gather the following:

- Employee's Social Security number (SSN).

- Employer's identification (EIN).

- Detailed earnings information including salary, bonuses, and tips.

Filling Out the Form

- Employee Information: Input personal details including name, address, and SSN.

- Employer Information: Enter the employer’s name, address, and EIN.

- Wages and Tips:

- Report total wages, tips, and other compensation in Box 1.

- Tax Withholding: Fill in the total federal income tax withheld in Box 2.

- State Information: If applicable, complete the state and local tax fields, including state wages and taxes withheld.

Review and Distribute

After completing the W-2, review the information for accuracy, then distribute copies as required:

- Copy A: Submit to the Social Security Administration (SSA).

- Copy B: Provide to the employee for their tax return.

- Copy C: Retain for employer records.

Important Terms Related to the W-2 Form

Understanding key terminology associated with the W-2 form can help clarify the tax reporting process.

- Employer Identification Number (EIN): A unique nine-digit number assigned by the IRS to businesses for tax purposes.

- Tax Withholding: The process of deducting a specified amount of money from an employee's wages to cover federal and state income taxes.

- Social Security Tax: A payroll tax that funds the Social Security program, reported on the W-2 under designated boxes.

These terms are fundamental to understanding the implications of filing the W-2 and how it impacts individual tax obligations.

Filing Deadlines and Important Dates

Adhering to deadlines is key to avoid penalties. Important dates regarding the W-2 form include:

- January 31: Employers must provide W-2 forms to employees by this date.

- January 31: Employers must also submit copies of all W-2 forms to the Social Security Administration.

Consequences of Missing Deadlines

Missing these deadlines can result in:

- Penalties from the IRS for late filing.

- Increased tax liabilities due to inaccurate reporting if the deadline is not met.

Understanding and adhering to these dates are crucial for compliance.

Legal Use of the W-2 Form PDF

The W-2 form holds legal significance as it is a required document for reporting income and taxes to the IRS.

Compliance and Fines

- IRS Regulations: Employers must comply with IRS regulations when issuing W-2 forms. Failure to do so can result in fines.

- Accurate Reporting: Employees rely on the accuracy of W-2 forms to file their taxes correctly; incorrect information can lead to audits or penalties.

Utilizing the W-2 Form

- Audit Trail: The W-2 provides a documented trail of income and taxes paid, protecting both employees and employers during audits.

Understanding the legal implications surrounding the W-2 form is essential for all parties involved.