Definition and Meaning of a Liability Letter for Damages

A liability letter for damages serves as a formal document that outlines the obligations of parties involved in a transaction, particularly where one party assumes financial responsibility for damages that may occur. This letter typically includes the terms under which one party may be held accountable for any loss or damage, protecting the interests of the other party.

- Purpose: The primary purpose of this letter is to clarify liability, ensuring all parties understand their responsibilities. In contexts such as rental agreements or business partnerships, this can significantly mitigate legal risks.

- Common Scenarios: Liability letters are often utilized in lease agreements, service contracts, and event planning, wherein one entity (e.g., a tenant or organizer) agrees to assume responsibility for potential damages incurred during the engagement or use of a property.

Key Components of a Liability Letter

Understanding the essential components of a liability letter is vital for effective drafting. A comprehensive liability letter should typically include:

- Identification of Parties: Names and addresses of the parties involved help establish the agreement's context.

- Scope of Responsibility: Clearly defined terms outlining what damages or losses the responsible party must cover.

- Limitations and Exclusions: Any limitations concerning what damages are not covered. For example, exclusions may involve damages due to acts of God, negligence of the non-liable party, or misconduct of third parties.

- Signatures: Both parties should sign the letter to indicate acceptance of the terms, making it a binding agreement.

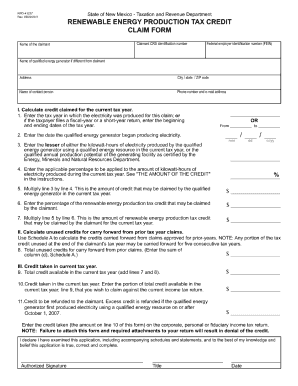

How to Draft a Liability Letter for Damages

Creating a liability letter requires careful attention to detail to ensure legal effectiveness and clarity. The following steps provide a structured approach to drafting this document.

-

Start with a Professional Header:

- Include the date and contact information for both parties.

- Clearly title the document "Letter of Liability for Damages."

-

Introduce the Parties Involved:

- Define all parties by their legal names and titles. It is essential to specify who is taking on liability.

-

Detail the Liability Agreement:

- Elaborate on the specific responsibilities undertaken by the liable party. Include precise language discussing what damages are covered.

-

Add Limitations and Conditions:

- Include any stipulations under which liability may be limited or excluded. This can prevent misunderstandings regarding responsibility.

-

Conclude with Signatures:

- Incorporate a space for signatures and dates to finalize the document legally.

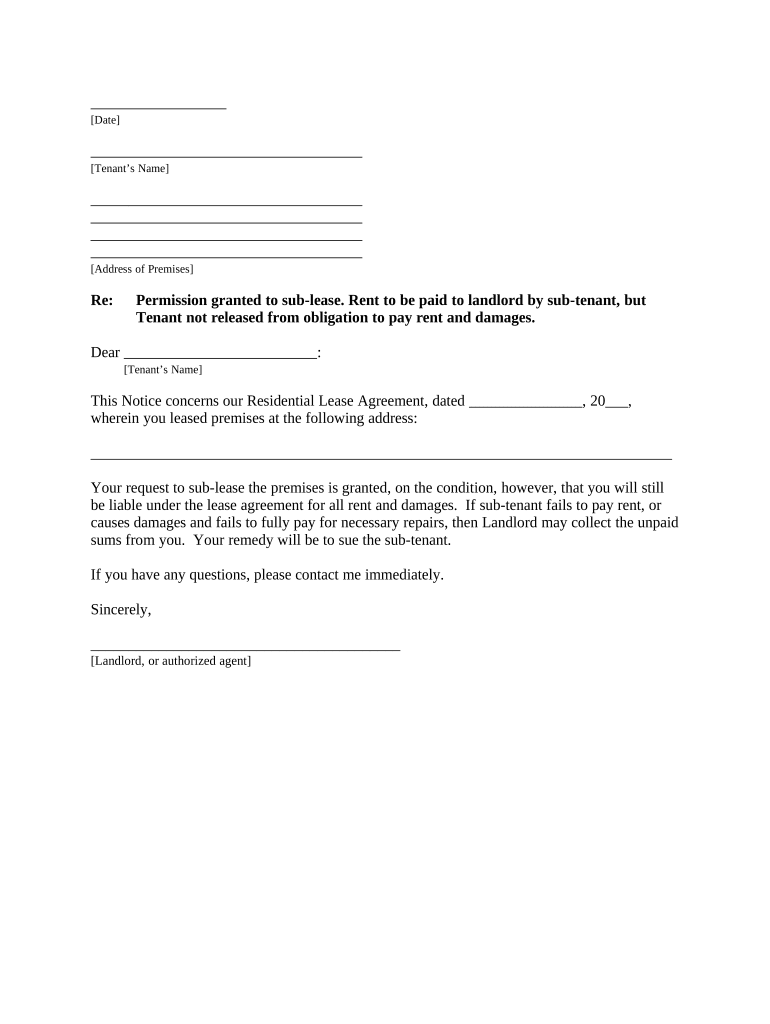

Example of a Liability Letter Structure

-

[Date]

-

[Your Name]

[Your Address]

[City, State, ZIP Code] -

[Recipient's Name]

[Recipient's Address]

[City, State, ZIP Code]

Sample Liability Letter for Damages

"This letter serves to confirm the agreement between [Liable Party] and [Non-Liable Party] regarding responsibility for damages incurred during [specific event or rental date]. [Liable Party] agrees to assume full responsibility for damages, including, but not limited to, property damage, and loss due to unforeseen circumstances, with the exception of damages caused by [specific exclusions]."

Common Uses and Scenarios for Liability Letters

Liability letters are versatile documents used across various industries and circumstances. Below are scenarios where these letters prove beneficial:

- Rental Agreements: When a tenant sub-leases property, they often remain ultimately liable for damages caused by their sub-tenants, necessitating a letter to outline liabilities.

- Event Planning: Organizers often require vendors to sign liability letters to affirm that they will cover any damages incurred during the event.

- Construction Contracts: Contractors may provide liability letters to protect against damages that may occur on the job site, agreeing to shoulder the costs.

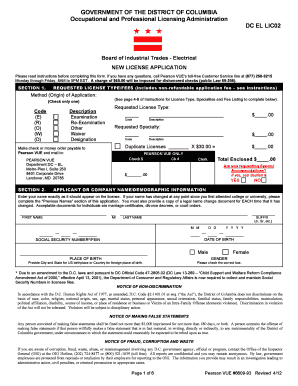

Legal Validity of Liability Letters

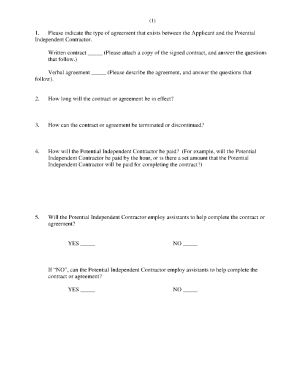

For a liability letter to be legally binding in the United States, it must adhere to specific requirements:

- Written Document: Oral agreements may lack enforceability; therefore, a written document is crucial.

- Clarity and Precision: Terms must be clear enough that both parties understand their responsibilities, minimizing disputes.

- Voluntary Agreement: Both parties should willingly agree to the terms without coercion or undue pressure.

Factors Influencing Legal Acceptance

- Jurisdictional Variations: Laws vary by state; hence, it is critical to understand local statutes affecting liability.

- Contractual Language: The inclusion of precise legal jargon can enhance the enforceability of the agreement while ensuring it adheres to relevant statutes.

- Utilization of Legal Counsel: Engaging with legal professionals during the drafting phase can strengthen the document's validity by ensuring compliance with applicable laws.

Example Scenarios Illustrating Liability Letters in Use

- Lease Agreements: A tenant may sign a letter of liability for damages specifying that if any damage occurs to the property during their lease, they will cover repair costs, thus protecting the landlord's interests.

- Service Industry: A photographer may require a liability letter from clients before shooting at specific venues, stating clients will assume responsibility for any damages or liabilities arising at the venue.

- Corporate Events: Corporations may use liability letters with vendors, ensuring that if equipment is damaged during the event, the vendor will bear the costs, thus protecting the corporation.

By carefully drafting and utilizing liability letters, parties can navigate potential legal issues related to damages, ensuring clarity and protection in agreements.