Definition & Meaning

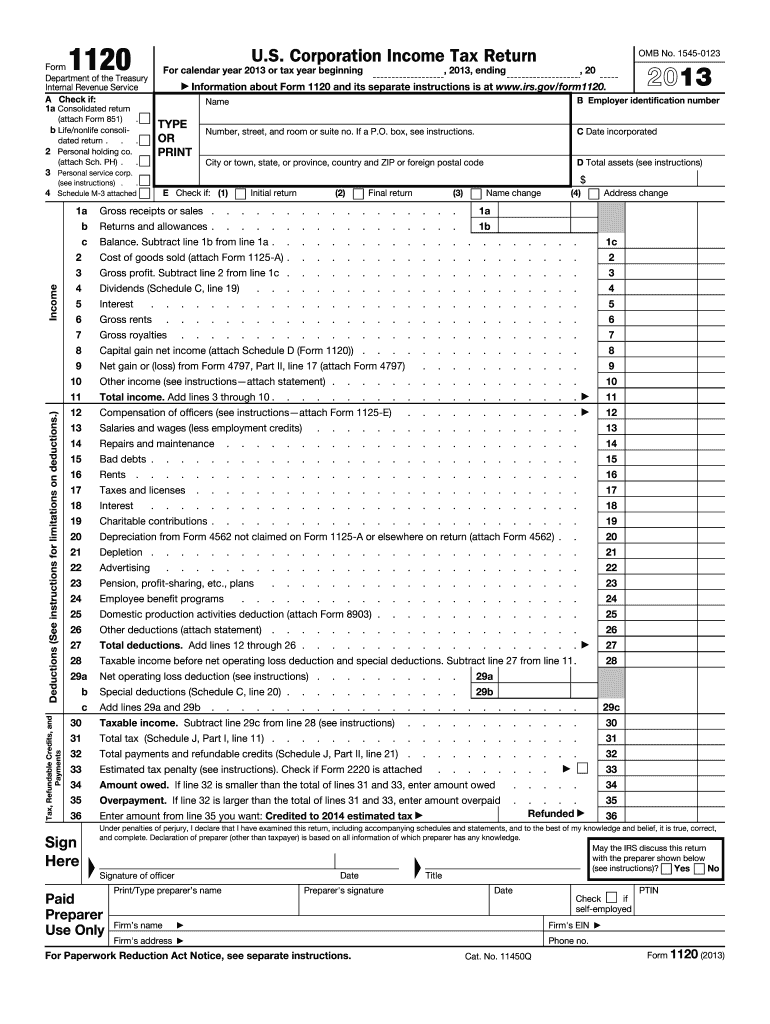

Form 1120 for the 2013 tax year is the U.S. Corporation Income Tax Return. Corporations use this form to report income, deductions, and tax liabilities to the Internal Revenue Service (IRS). It includes sections for various financial components and declarations, ensuring compliance with federal tax regulations. The form helps the IRS assess the corporation's annual income tax and ensure accurate reporting of business activities.

- Purpose of the form: Corporations report their financial activities, including income, expenses, and tax credits.

- Compliance: Adherence to IRS rules ensures legal standing and avoids penalties for incorrect filings.

How to Obtain Form

Acquiring Form 1120 for the 2013 tax year involves several methods to ensure corporations adhere to tax obligations. The IRS provides this form through various accessible channels.

-

Direct Download:

- Visit the official IRS website and search for downloadable forms.

- Navigate to the ‘Forms, Instructions & Publications’ section.

-

Mail Request:

- Contact the IRS for a mail-delivered version.

- Ensure requests include the correct form name and year.

-

Tax Software Platforms:

- Utilize software like TurboTax or QuickBooks for integrated form access.

- Benefit from tips and support provided by these platforms.

Steps to Complete the Form

Completing Form 1120 involves understanding its sections and detailed requirements. Follow these structured steps for an accurate submission:

-

Gather Required Information:

- Collect documents detailing income, deductions, and credits.

- Prepare financial statements for the fiscal year.

-

Fill Out Corporate Information:

- Include the corporation's name, address, and EIN.

- Accurately state the date of incorporation and business activity code.

-

Report Income and Deductions:

- Fill in gross receipts or sales, subtracting returns and allowances.

- State dividends received, capital gains, and other types of income.

-

Calculate Tax Liability:

- Use pages four and five for deductions and calculate the total tax using the Corporate Tax Rate Schedule.

-

Review and File:

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Who Typically Uses Form

Form 1120 is primarily utilized by U.S. corporations that must report income and expenses for tax purposes:

- C Corporations: These entities file Form 1120 to report their financial activities, distinct from individual tax reporting.

- Foreign Corporations: U.S.-based activities require completing this form, ensuring compliance with domestic tax laws.

Key Elements of Form

Form 1120 encompasses crucial financial and business components:

- Income: Reports total income, including sales and received dividends.

- Deductions: Lists allowable deductions, such as business expenses and cost of goods sold.

- Tax and Payments: Computes the corporation’s tax liability and applied payments.

Filing Deadlines / Important Dates

Adhering to IRS deadlines is crucial for smooth submission:

- Annual Filing: Generally due on the 15th day of the 3rd month after the end of the corporation's tax year.

- Extensions: Requesting an extension provides an additional six months to file, though tax payments remain due by the original deadline.

Penalties for Non-Compliance

Understanding penalties aids in avoiding unnecessary charges:

- Late Filing: A steep penalty of 5% of unpaid tax per month is imposed.

- Incorrect Reporting: Additional penalties accrue for substantial understatement of tax or filing false information.

Digital vs. Paper Version

Corporations can choose between digital or paper submissions:

-

Digital Filing:

- Offers faster processing and immediate confirmation of receipt.

- Supported by platforms compatible with IRS systems.

-

Paper Filing:

- Traditional method for those preferring physical submission.

- Ensure delivery tracking to confirm receipt by the IRS.

Software Compatibility

Leveraging software programs can streamline the filing process:

- TurboTax & QuickBooks: Offer electronic filing solutions and built-in audit support.

- DocHub Integration: Facilitates editing and managing forms digitally before submission to IRS systems.

Understanding these key aspects of Form ensures businesses fulfill legal tax obligations comprehensively, safeguarding against potential penalties and maintaining fiscal responsibility.