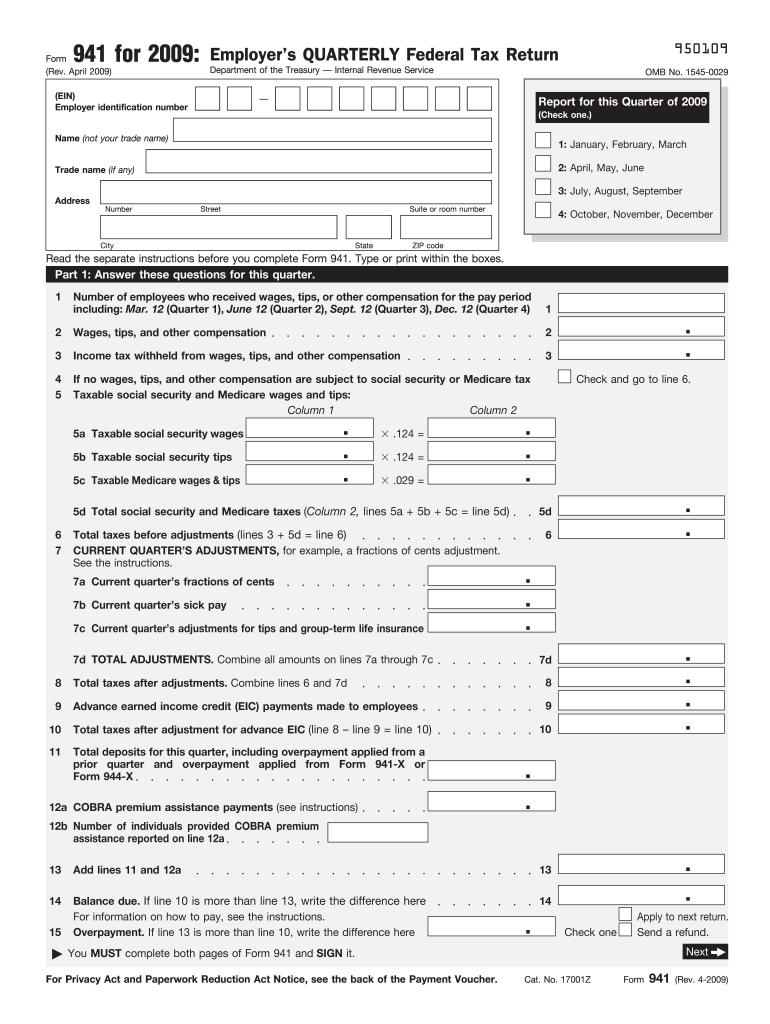

Definition and Purpose of the 2009 Form 941

The 2009 Form 941, officially known as the Employer's Quarterly Federal Tax Return, is a crucial document for employers in the United States. It is used to report quarterly payroll taxes, including wages, tips, and other forms of compensation paid to employees. This form also captures the federal income tax withheld from employees' pay, as well as the employer and employee portions of Social Security and Medicare taxes. The accurate completion of this form is essential for compliance with federal tax laws, as it informs the IRS about an employer's tax liabilities.

Key Components of the 2009 Form 941

- Employer Identification: Employers must provide their legal name, trade name (if different), address, and Employer Identification Number (EIN). This information is vital for the IRS to match the form with the correct employer account.

- Wages and Taxes: The form includes sections for reporting total wages paid, tips received, and other compensation. Employers must also calculate and report the federal income tax withheld and the respective Social Security and Medicare taxes.

- Tax Credits: Employers can report any eligible tax credits that reduce their overall tax liabilities, such as the Credit for Qualified Sick and Family Leave Wages.

Steps to Complete the 2009 Form 941

Completing the 2009 Form 941 requires careful attention to detail to ensure accurate reporting of taxes owed.

- Gather Necessary Information: Collect payroll records, including total wages, the number of employees, tips, and any tax liabilities from the previous quarter.

- Enter Employer Information: Fill in the employer's legal name, EIN, and address at the top of the form.

- Report Employee Wages: In the designated sections, report the total wages, tips, and other compensation paid during the quarter.

- Calculate Taxes: Based on reported wages, calculate federal income tax withheld, as well as the total Social Security and Medicare taxes owed. Ensure accurate calculations to avoid penalties.

- Tax Payments: If applicable, report any tax payments made since the last filing. This ensures that the IRS has an accurate record of payments.

- Review and Sign: Verify all entries for accuracy. Then, sign and date the form before submission.

By meticulously following these steps, employers can accurately report their payroll tax obligations, minimizing the risk of errors.

How to Obtain the 2009 Form 941

Employers can access the 2009 Form 941 from various sources to ensure they are using the correct version.

- IRS Website: The easiest way to obtain Form 941 is by downloading it directly from the IRS official website. The form is available as a PDF, allowing for printing and manual completion.

- Tax Preparation Software: Many tax preparation software programs, including TurboTax and QuickBooks, automatically include Form 941 as part of their tax filing features, streamlining the process for users.

- Professional Tax Preparers: Employers can also request the form from professional tax preparers or certified public accountants (CPAs) who can assist with compliance and filing.

Filing Deadlines for the 2009 Form 941

Filing deadlines for the 2009 Form 941 are critical to maintain compliance with federal tax regulations. Employers must submit the form by the last day of the month following the end of each quarter:

- Quarter 1: January 1 - March 31, due by April 30, 2009

- Quarter 2: April 1 - June 30, due by July 31, 2009

- Quarter 3: July 1 - September 30, due by October 31, 2009

- Quarter 4: October 1 - December 31, due by January 31, 2010

Failure to file by these deadlines can result in penalties.

Important Terms Related to the 2009 Form 941

Understanding key terms associated with the 2009 Form 941 aids in the accurate completion and comprehension of the form:

- FICA: Refers to the Federal Insurance Contributions Act, which mandates the collection of Social Security and Medicare taxes.

- Withholding Tax: The portion of an employee's wages that an employer officially deducts for federal income tax.

- Payroll Tax: Taxes imposed on employers and employees, calculated as a percentage of the salaries that employers pay their staff. This includes Social Security and Medicare taxes.

Each of these terms is integral to proper reporting and compliance, ensuring that employers and their employees understand their tax obligations.

Legal Use of the 2009 Form 941

The 2009 Form 941 serves a legal purpose in establishing an employer's compliance with IRS reporting and payment obligations. Under U.S. tax law, employers are required to:

- Accurately report wages, tips, and other compensations to the IRS.

- Pay federal taxes associated with employee wages, including income tax withholding and FICA taxes.

- Retain completed copies of Form 941 for at least four years after the date of filing for recordkeeping and possible audits.

Employers who fail to meet these legal requirements may face significant penalties, including fines and increased scrutiny from tax authorities.

Through understanding and adhering to the guidelines of the 2009 Form 941, employers can ensure their compliance with federal tax regulations.