Understanding Form 15227

Form 15227 is an application submitted to the IRS for an Identity Protection Personal Identification Number (IP PIN), aimed at protecting taxpayers from identity theft. An IP PIN is a unique six-digit number that allows individuals to verify their identity when filing taxes, thereby adding an extra layer of security.

Eligibility Requirements for Form 15227

To apply for an IP PIN using Form 15227, individuals must meet specific eligibility criteria. The primary requirements include:

- Having a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Annual adjusted gross income of $72,000 or less.

- Access to a telephone for verification purposes.

Understanding these requirements is crucial for ensuring a smooth application process. For example, if your income exceeds the threshold, you'll need to explore other options for identity protection or assistance.

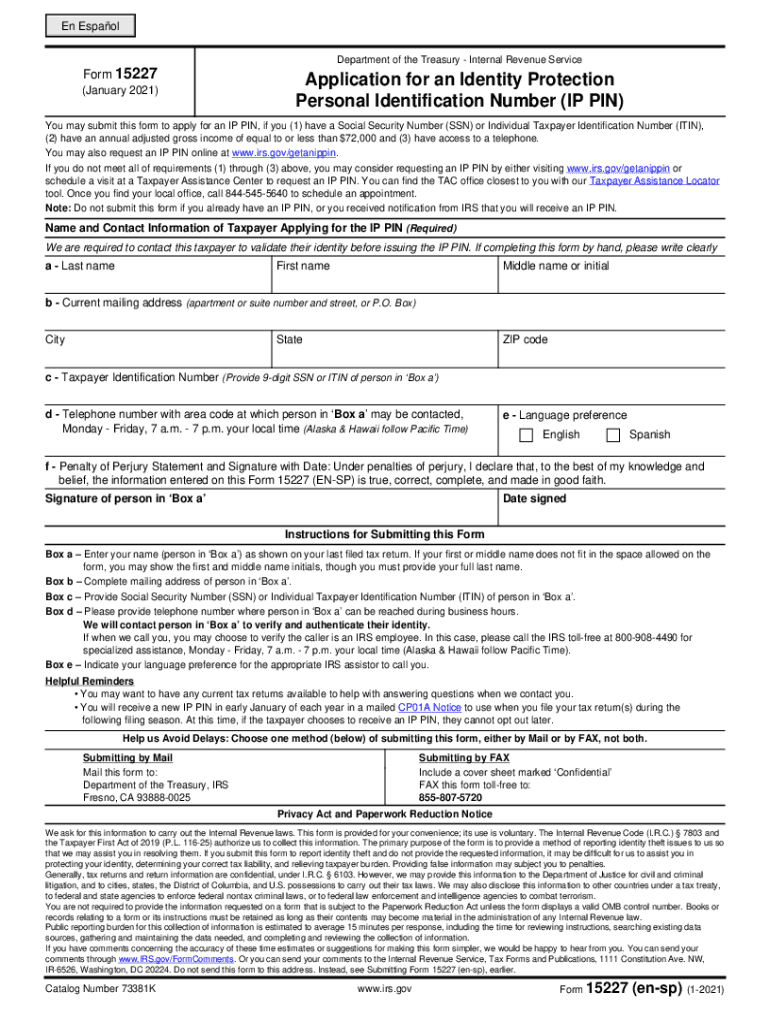

Instructions for Completing Form 15227

Completing Form 15227 involves several sections that require accurate information. Key sections include personal identification information, reasons for requesting an IP PIN, and instructions for submission.

Step-by-Step Completion

- Personal Information:

- Enter your name, address, and Social Security Number or ITIN.

- Reason for Application:

- Indicate your reason for requesting the IP PIN, whether to protect against identity theft or as a result of a notice from the IRS.

- Submission Method:

- Choose your preferred method of submission: by mail or fax.

Carefully following these steps can significantly reduce the chances of delays in processing your application.

Submission Options for Form 15227

When submitting Form 15227, consider the two primary methods: mail or fax.

-

Mail Submission:

- Address the completed form to the specified IRS address for identity protection requests. Be mindful to use a secure envelope and consider using certified mail for added security.

-

Fax Submission:

- Faxing the form may expedite the process. Ensure that the fax number provided on the form is accurate to avoid miscommunication.

Choosing the appropriate submission method can affect the speed of your application’s processing time.

Importance of Accuracy in Form 15227

Providing accurate information on Form 15227 is critical. Errors can lead to processing delays or denial of your IP PIN request.

- Common mistakes include:

- Typos in personal information.

- Incorrect income reporting.

- Failing to sign the form.

Double-checking your information and following IRS guidelines can help prevent these issues.

Follow-Up After Submission

Once you submit Form 15227, it's essential to monitor the status of your application.

- You may receive an IP PIN by mail if your application is approved, typically sent in a separate envelope to enhance security.

- If there are questions or additional information required, the IRS may contact you using the provided telephone number.

Staying informed will help ensure that you receive your IP PIN promptly, allowing you to file your taxes with peace of mind.

Implications of Not Applying for Form 15227

Failing to complete Form 15227 when eligible can expose taxpayers to the risk of identity theft. Without an IP PIN, anyone can use your SSN to file fraudulent tax returns. This not only affects your tax return but can also lead to complications in rectifying the situation once identity theft occurs.

- Protecting your personal information is a proactive step in maintaining tax security. Ignoring this process may lead to significant financial and legal challenges in the future.

Additional Resources Relating to Form 15227

For those looking for further information regarding Form 15227, the IRS provides various resources, including:

- Frequently asked questions (FAQs) specific to the IP PIN process.

- Online tools to check your application status.

- Contact information for IRS support services related to identity protection.

Utilizing these resources can provide clarity and assist in resolving any issues that may arise during the application process.