Definition and Meaning of 15 G EPFO

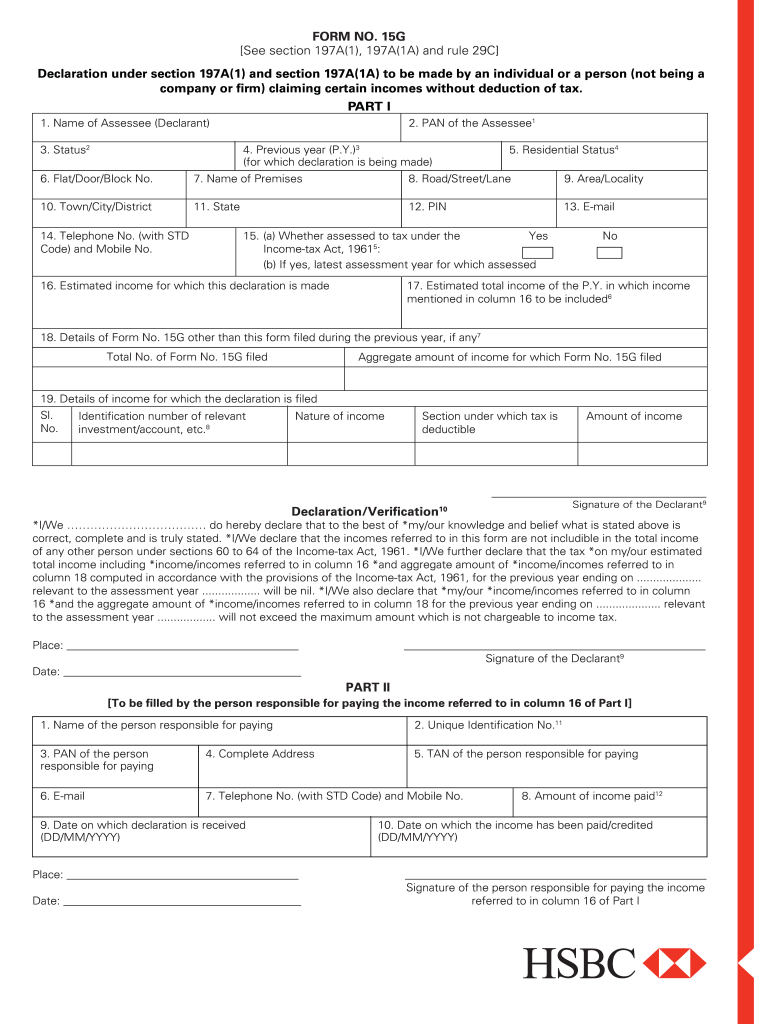

Form 15G is a crucial declaration for individuals or non-corporate entities seeking to receive certain incomes without the imposition of tax deductions under sections 197A(1) and 197A(1A) of the Income-tax Act, 1961. This form is mainly utilized when claiming tax exemptions on interest income, particularly from Provident Fund (PF) withdrawals. It is essential for individuals to understand that the use of this form is exclusive to those whose total income is below the taxable limit, ensuring compliance with Indian tax regulations.

This form requires specific personal details from the declarant, including name, address, and PAN (Permanent Account Number), alongside an estimation of the person's income for the financial year. The declaration further necessitates the verification of one's tax status, confirming that the individual is eligible for tax exemption under the applicable laws.

Key Elements of Form 15G EPFO

- Personal Information: Name, address, and PAN of the declarant.

- Income Declaration: Estimation of total income accrued during the financial year.

- Verification: A signature or declaration ensuring the accuracy of the provided information.

- Tax Status: A confirmation that the total income is below the taxable threshold.

Understanding the fundamental aspects of Form 15G is vital for individuals aiming to withdraw their Provident Fund without incurring tax deductions.

Steps to Complete the 15 G EPFO

Completing Form 15G for EPFO is a systematic process that ensures correct submission for tax exemption. Adhering to the following steps facilitates a smooth experience in obtaining the necessary approvals:

- Gather Required Information: Collect personal details, including PAN, and calculate your estimated income for the financial year.

- Download the Form: Access the official EPFO website or related resources to obtain the latest version of Form 15G.

- Fill Out the Form: Accurately complete all sections:

- Personal Information: Enter your name, address, and PAN.

- Income Details: Estimate your income, ensuring it falls below the taxable limit.

- Declaration: Verify and sign the statement.

- Submission of Form: Submit the completed form to your employer or relevant EPFO office. This can often be done online through the EPFO’s portal.

- Track Submission Status: Keep a record of your submission and follow up if necessary, ensuring the form has been processed properly.

Following these steps helps ensure compliance and allows for a seamless withdrawal of provident fund without tax liabilities.

Who Typically Uses the 15 G EPFO

Form 15G EPFO is generally utilized by a wide range of individuals who meet specific criteria. The typical users include:

- Employees: Those who have resigned or retired and wish to withdraw their Provident Fund without tax deductions.

- Individuals with Minimal Income: People whose total annual income is below the taxable threshold can benefit from this form.

- Non-Corporate Entities: Small businesses operating as sole proprietorships that may deal with income that doesn't require tax deduction at the source.

By identifying the primary user base, it becomes easier to understand how Form 15G meets the needs of those who rely on tax relief when accessing their savings.

Important Terms Related to 15 G EPFO

Familiarity with essential terminology surrounding Form 15G helps demystify the process and ensures proper understanding. Some of the key terms include:

- Tax Deducted at Source (TDS): A percentage of income that is withheld by the payer and paid to the government as advance tax.

- Income Tax Act, 1961: The primary legislation governing income tax in India, defining regulations applicable to taxpayers.

- Permanent Account Number (PAN): A unique identification number assigned to individuals and entities by the Income Tax Department for tax purposes.

- Tax Exemption: A provision that allows individuals to reduce their taxable income, thereby lowering the total tax owed.

Understanding these terms is crucial for anyone navigating the process of tax declarations and withdrawals using Form 15G.

Legal Use of the 15 G EPFO

The legal framework governing Form 15G is anchored in Indian tax law, particularly within the Income Tax Act, 1961. Understanding the legal dimensions of using this form is essential for compliance:

- Scope of Use: Form 15G can only be submitted when the total income for the financial year is below the taxable limit. Individuals must ensure accurate income estimation to avoid penalties.

- Legal Validation: Completing Form 15G provides a declaration that protects individuals from undue tax deductions. Any false declarations can lead to legal consequences under tax regulations.

- Document Retention: It is advisable to keep a copy of the submitted form for record-keeping and reference in case of future inquiries by tax authorities.

Being informed about the legal use of Form 15G enables individuals to utilize it confidently, ensuring adherence to tax regulations.