Definition and Meaning of the Letter

A letter informing a debt collector of unfair practices is a formal document that communicates an alleged violation regarding debt collection methods. Specifically, when a debt collector chooses to contact a consumer regarding a debt via postcard—which is prohibited under Section 808 of the Fair Debt Collection Practices Act. This type of communication may expose personal financial information in a way that is public or easily accessible to others. The sender of the letter typically details the specific incident of unfair practice and asserts the intention to pursue legal remedies if such behavior continues.

Key Elements of the Letter

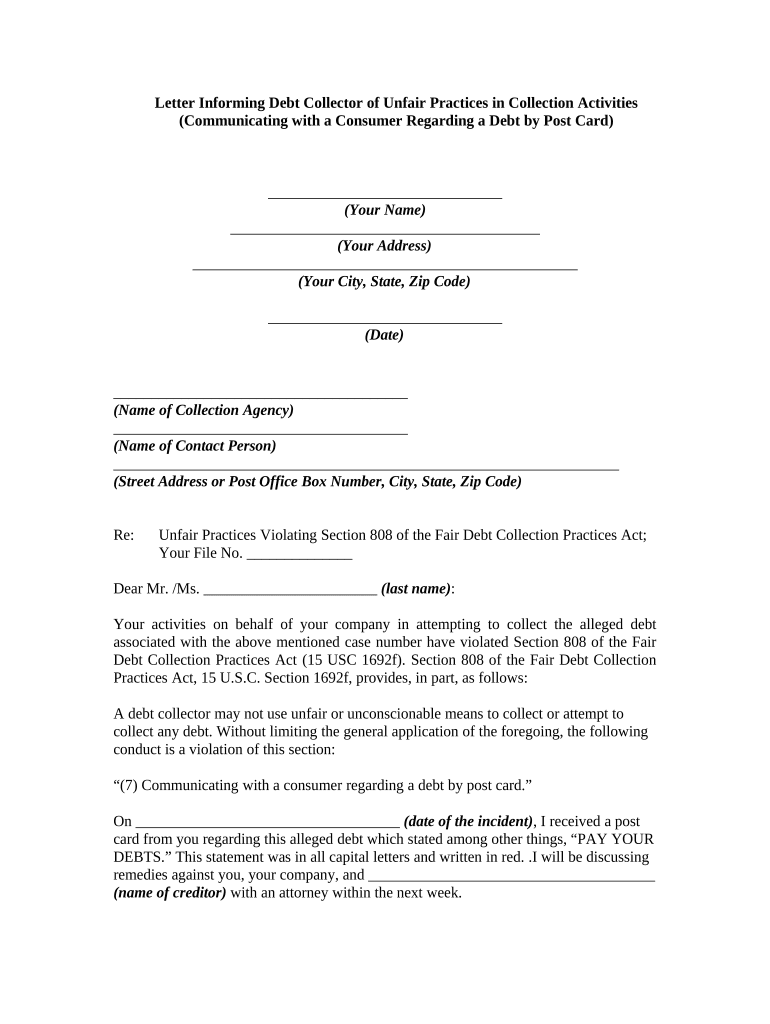

When drafting this letter, several critical elements must be included to ensure clarity and legal weight:

- Sender and Recipient Information: Clearly state your name and address, as well as the name and address of the debt collector.

- Subject Line: Specify the subject of the letter, highlighting it's about unfair collection practices.

- Details of the Incident: Describe the postcard communication, including the date received and the specific content that you find objectionable.

- Legal Basis: Reference the Fair Debt Collection Practices Act, specifying 15 U.S.C. 1692c, which prohibits unfair collection practices such as contacting consumers in a way that breaches their privacy.

- Request for Action: Clearly indicate what you expect from the debt collector, such as ceasing contact or rectifying the method of communication.

- Signature and Date: End the letter with your signature and the date of writing for documentation purposes.

Legal Use of the Letter

This letter serves as an official notification to the debt collector about their potential violation of federal law. It outlines the sender's legal rights as stipulated under the Fair Debt Collection Practices Act. By being explicit about the unfair practices employed and the relevant statute, you create a well-documented case that can be utilized if legal action becomes necessary. Furthermore, it is wise to keep copies of this correspondence as they may be valuable for any future legal proceedings or discussions with regulatory authorities.

Steps to Complete the Letter

To effectively complete the letter informing a debt collector of unfair practices, follow these steps:

- Gather Necessary Information: Collect all relevant details about the debt and any correspondence received from the debt collector.

- Draft the Letter: Use the key elements outlined to structure the letter properly.

- Review Legal Implications: Ensure that your references to the Fair Debt Collection Practices Act are accurate and cite specific sections, such as 15 U.S.C. 1692c.

- Include Evidence: If possible, attach a copy of the postcard or any related documents to support your claims.

- Send the Letter: Ensure to send the letter via certified mail to have proof of delivery and receive a tracking number for your records.

Examples of Unfair Practices

Here are common examples of unfair practices that could warrant the use of this letter:

- Postcard Communication: Sending a postcard that includes identifiable information about the individual's debt, potentially disclosing it to third parties.

- Harassment: Repeated calls or messages at odd hours, causing distress to the consumer.

- Threats of Legal Action: Sending communication threatening legal action without actual intent or ability to pursue it.

- Misleading Claims: Making false representations about the amount owed or the consequences of non-payment.

Importance of Compliance

Debt collectors must adhere to legal guidelines outlined in the Fair Debt Collection Practices Act to maintain ethical standards in their collection efforts. Your letter serves not only to inform them of their unfair practices but also to promote compliance with the law. Non-compliance could lead to significant penalties for the debt collector, including fines and repercussions through federal agencies, thereby emphasizing the necessity for ethical practices in debt collection.

Why Consumers Should Take Action

Taking action against unfair debt collection practices is crucial for several reasons:

- Protection of Privacy: Safeguarding personal financial information and preventing the public disclosure of such sensitive matters.

- Upholding Rights: Ensuring that rights as a consumer are respected and that communication methods align with legal standards.

- Financial Well-being: Reducing stress and anxiety associated with aggressive or inappropriate debt collection methods.

- Influencing Change: By addressing unfair practices, consumers can contribute to more significant reform in the debt collection industry.

State-Specific Rules for Debt Collection

It is essential to be aware of state-specific rules that may apply in addition to federal laws. Each state may have additional regulations governing debt collection practices. For example:

- California: May require further disclosures about the nature of the debt.

- New York: Offers stricter guidelines on how and when collectors can contact consumers.

- Texas: Provides clear avenues for dispute and defense against harassment.

Understanding these nuances not only enhances the effectiveness of your communication but also aligns your concerns with applicable local regulations, creating a more robust case against any possible unfair practices.