Definition and Meaning of the NJ Inheritance Waiver Tax Form 01 PDF

The NJ Inheritance Waiver Tax Form 01, often referred to simply as the Form 01, is an official document issued by the New Jersey Division of Taxation. This form is specifically designed for individuals dealing with the transfer of assets from a deceased person's estate when the final inheritance tax return cannot be filed immediately. By submitting this form, individuals can secure consents that allow for the transfer of the decedent's assets lawfully and efficiently.

The form captures critical information regarding the decedent's estate, such as the gross value of the estate, applicable deductions, and detailed descriptions of how assets are to be transferred. This preliminary step is essential for ensuring that legal and tax obligations are met while providing a framework for further detailed tax filing, which is required subsequently.

Key Components of the Form

- Estate Information: Sections for detailing the decedent's estate value and specific asset information.

- Tax Waivers: Requests for necessary tax waivers to facilitate asset transfers without penalty.

- Compliance Assurance: A certification that a final return will be filed at a later date to comply with state tax law.

How to Obtain the NJ Inheritance Waiver Tax Form 01 PDF

To acquire the NJ Inheritance Waiver Tax Form 01 PDF, individuals can visit the New Jersey Division of Taxation's official website, where the form is available for download. Following these steps will help you access the document:

- Visit the New Jersey Division of Taxation Website: Navigate to the official site of the New Jersey Division of Taxation.

- Search for Forms: Look for the section dedicated to forms and publications, which typically includes inheritance tax documents.

- Download the Form: Locate the nj inheritance waiver tax form 01 pdf in the list of available forms and download it directly to your device.

- Printer-Friendly Version: Ensure the version you download is formatted for easy printing, allowing you to complete it by hand if needed.

Having the form downloaded will facilitate easier accessibility for completing and submitting it when necessary.

Steps to Complete the NJ Inheritance Waiver Tax Form 01 PDF

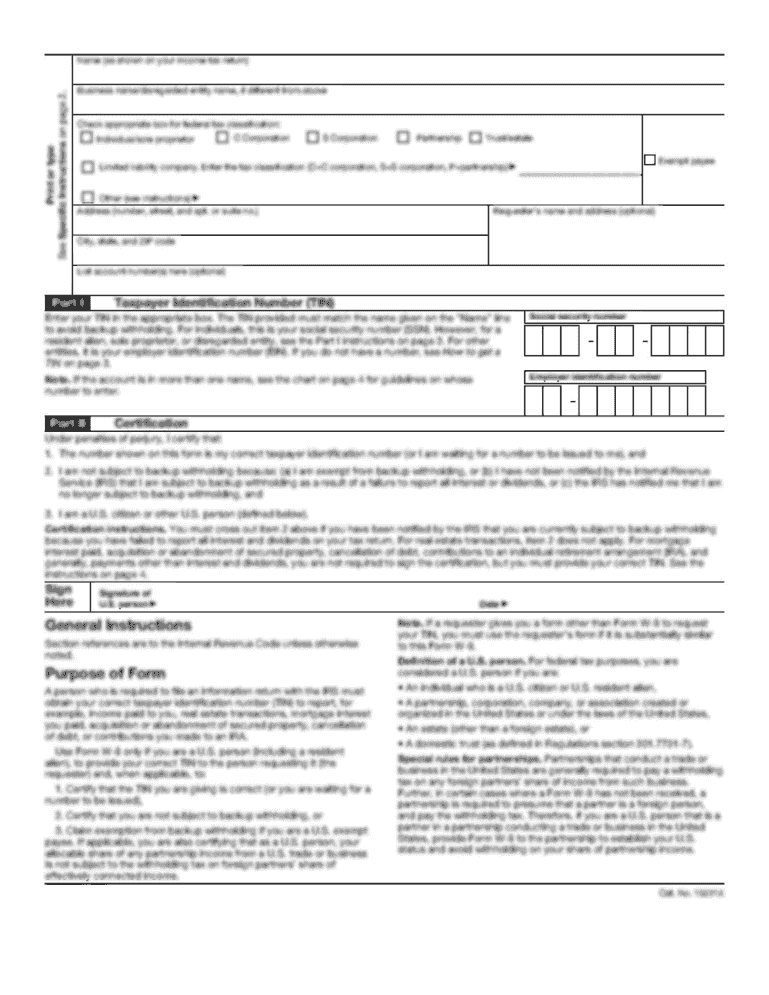

Filling out the NJ Inheritance Waiver Tax Form 01 PDF involves several important steps to ensure all information is accurately represented. Follow these guidelines to complete the form without complications:

- Read Instructions Carefully: Before beginning, carefully read any accompanying instructions provided with the form to understand its requirements.

- Input Decedent Information: Fill in the name, date of death, and Social Security number of the decedent. This foundational information is crucial for identification purposes.

- Detail Estate Assets:

- List all assets included in the estate.

- Provide the gross value of the estate, taking deductions into account.

- Include specific notes on both liquid and real assets.

- Waiver Requests: Clearly identify which tax waivers are being requested related to specific assets to facilitate their transfer.

- Certifications: Certify the information by signing and dating the form at the bottom, ensuring that all provided data is accurate and reflects the estate's status.

Completing the form accurately is vital for meeting tax obligations and ensuring compliance with New Jersey estate law.

Important Terms Related to the NJ Inheritance Waiver Tax Form 01 PDF

Understanding key terminology associated with the NJ Inheritance Waiver Tax Form 01 is essential for all parties involved in the inheritance process. Key terms include:

- Decedent: The individual who has passed away and whose estate is being managed.

- Gross Estate Value: The total value of all assets belonging to the decedent before any deductions or liabilities are considered.

- Deductions: Expenses that can be subtracted from the gross estate value, such as debts or funeral costs.

- Tax Waiver: A request for forgiveness of inheritance tax obligations related to transferred assets.

- Final Return: The comprehensive report that must eventually be filed to assess the total taxes owed on the estate.

Having clarity on these terms can mitigate confusion and enhance comprehension throughout the inheritance process.

Who Typically Uses the NJ Inheritance Waiver Tax Form 01 PDF

The NJ Inheritance Waiver Tax Form 01 PDF is primarily utilized by the following groups:

- Executors and Administrators: Individuals responsible for managing the estate and ensuring all assets are transferred legally.

- Heirs or Beneficiaries: Those receiving assets from the estate who may need to verify their entitlements and request waivers where applicable.

- Legal Representatives: Attorneys handling estate matters who require this form to facilitate the inheritance process for their clients.

- Tax Professionals: Accountants or tax advisors assisting clients in meeting New Jersey’s inheritance tax obligations.

Utilizing this form correctly is critical for ensuring the legal transfer of assets while complying with state regulations.

Filing Deadlines and Important Dates for the NJ Inheritance Waiver Tax Form 01 PDF

Timely filing of the NJ Inheritance Waiver Tax Form 01 is crucial for compliance with state requirements. Understanding filing deadlines ensures that executors and beneficiaries meet all obligations without incurring penalties. Important dates to consider include:

- Date of Death: The filing process should begin as soon as possible following the decedent's passing to facilitate timely asset transfers.

- Final Tax Return Due Date: The final inheritance tax return must be filed within eight months after the decedent's death. The waiver form may need to be filed before this timeline to request timely asset transfers.

- Waiver Processing Time: Allow sufficient time for the state to process the waiver request; factor in potential delays when planning asset transfers.

Adhering to these deadlines helps avoid unnecessary complications with asset transfers and ensures compliance with New Jersey tax laws.