Definition and Purpose of the Tax-Free Exchange Package - Tennessee

The Tax-Free Exchange Package in Tennessee is a comprehensive tool designed for real estate sellers aiming to engage in tax-free exchanges. This package plays a critical role in facilitating these transactions by allowing participants to defer capital gains taxes and avoid depreciation recapture. Primarily provided by U.S. Legal Forms, Inc., it consists of a collection of essential forms and detailed guidance. The primary function of this package is to streamline the process of exchanging like-kind properties, thereby preserving the seller's financial interests and ensuring compliance with the IRS's legal requirements.

How to Use the Tax-Free Exchange Package

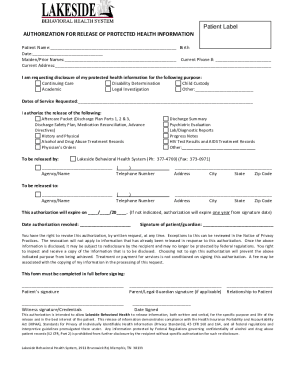

Using the Tax-Free Exchange Package requires a clear understanding of its forms and procedures. Sellers begin by reviewing the documents provided, including the Exchange Agreement and Like-Kind Exchanges form. Each document outlines specific steps and requirements, guiding users through the intricacies of initiating and completing a tax-free exchange. It is crucial for sellers to adhere to the instructions carefully, such as designating replacement properties within the stipulated timeframes. The comprehensive tips included in the package ensure that users are not only compliant but also optimize the benefits of tax deferral.

Steps to Complete the Tax-Free Exchange Package

-

Review the Exchange Agreement: Familiarize yourself with the terms and conditions set forth in the Exchange Agreement. This document outlines the fundamental aspects of the exchange process and sets the stage for subsequent actions.

-

Identify Replacement Properties: According to IRS guidelines, replacement properties must be identified within 45 days from the sale of the original property. Use the forms provided to list potential properties and submit them accordingly.

-

Complete Like-Kind Exchanges Form: This form is essential for outlining the details of the properties involved in the exchange. Ensure all information is accurate and comprehensive to prevent future complications.

-

Defer Capital Gains Taxes: Utilize the package to ensure the deferral of capital gains taxes is properly documented according to legal standards, maximizing the financial benefits.

-

Submit Required Documentation: Once all forms are completed and verified, submit them through the channel specified in the package, whether online, by mail, or in person, to finalize the exchange.

Important Terms Related to the Tax-Free Exchange Package

-

Like-Kind Property: Under IRS guidelines, this describes real estate that is similar in nature, character, and class, allowing for tax deferral in exchanges.

-

Replacement Property: The new property acquired in an exchange, which must adhere to specific identification and acquisition timeframes.

-

Capital Gains Tax: A tax on the profit from the sale of property or investment, which can be deferred during a tax-free exchange.

-

Depreciation Recapture: The process by which the IRS reclaims depreciation deductions claimed on the exchanged property, avoided through the tax-free exchange process.

-

Identification Period: A 45-day period post-sale to officially identify replacement properties in the exchange.

Legal Use of the Tax-Free Exchange Package

The Tax-Free Exchange Package is not just a set of documents; it's crafted to ensure legal compliance in the process of property exchanges. By using the forms within this package, sellers align with the IRS guidelines under Section 1031 of the Internal Revenue Code (IRC). Each document within the package is designed to minimize the risk of legal complications and penalties by ensuring all aspects of the exchange comply with federal and Tennessee state laws. While the package itself provides a solid foundation, consulting a tax professional for advice tailored to specific situations is recommended.

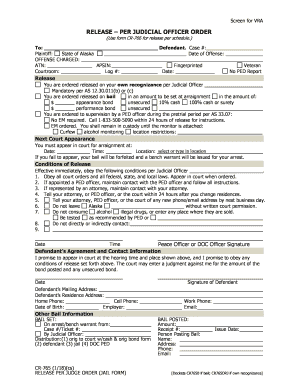

State-Specific Rules for Tennessee

While the general guidelines for tax-free exchanges are governed by federal law, Tennessee may have distinct considerations. These include state-specific tax incentives or requirements that could impact the exchange process. For instance, variations in state tax law or additional forms might be necessary to accommodate the nuances of property transactions in Tennessee. Sellers should familiarize themselves with these elements to ensure full compliance and optimize their financial and legal outcomes.

Examples of Using the Tax-Free Exchange Package

Consider a real estate investor in Tennessee looking to exchange an office building for another commercial property. Using the Tax-Free Exchange Package, the investor can defer capital gains taxes by ensuring the new property qualifies as like-kind. Carefully completing the forms and adhering to the identification and acquisition timelines can exemplify the correct use of the package. This allows the investor to leverage their equity without immediate tax implications, providing capital for further investments.

Eligibility Criteria for Utilizing the Package

Eligibility for utilizing the Tax-Free Exchange Package involves several criteria. Sellers must own investment or business-use property in Tennessee for the exchange to qualify. The replacement property must also be held for similar investment purposes. It is essential that the transaction is structured in compliance with IRC Section 1031 stipulations to maintain eligibility. Understanding these criteria ensures sellers can fully benefit from the deferred tax advantages offered by the tax-free exchange.