Definition and Meaning of Deed Trust Form PDF

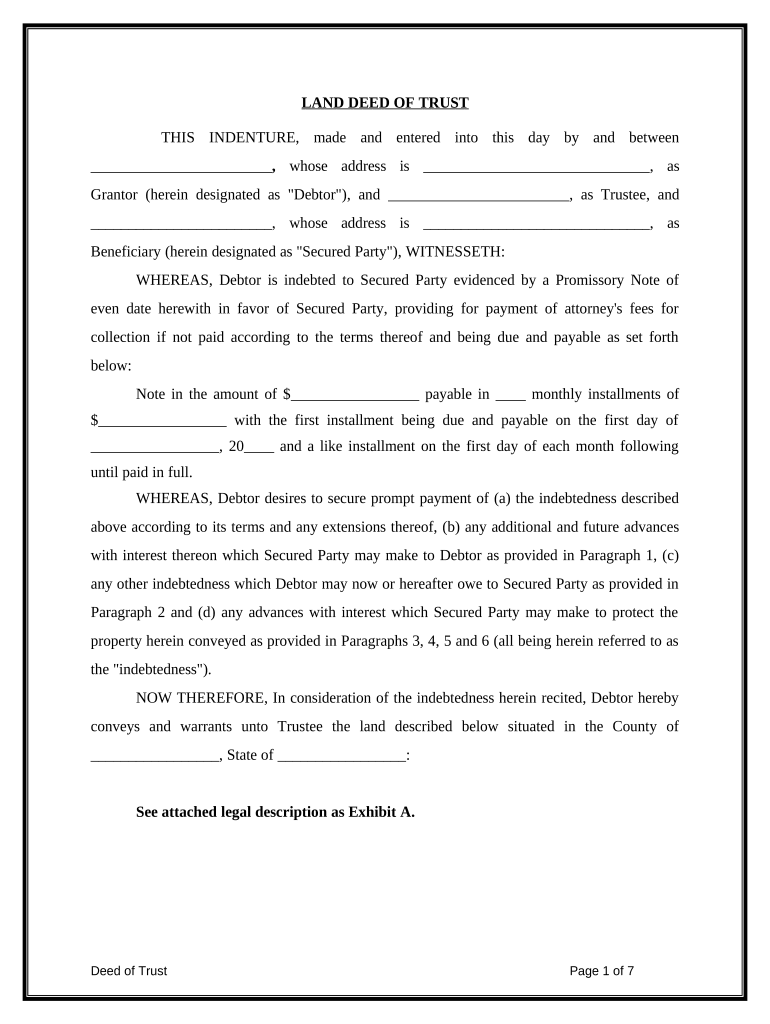

A deed of trust is a legally binding document that involves three parties: the borrower (or Debtor), the lender (or Secured Party), and the third-party Trustee. This form secures a loan with real estate, whereby the borrower transfers the property title to the Trustee, who holds it until the loan is repaid. The deed outlines the obligations of the borrower, including:

- Repayment of the loan

- Maintenance of property insurance

- Payment of property taxes

- Keeping the property in good condition

If the borrower defaults, the deed of trust grants the Secured Party the right to sell the property to recover the owed amount.

Key Elements of the Deed Trust Form PDF

Understanding the key elements of the deed trust form is essential for effective use. Here are the fundamental components:

- Parties Involved: Clear identification of the Debtor, Trustee, and Secured Party with full names and addresses.

- Loan Amount: The exact amount borrowed by the Debtor needs to be stated.

- Property Description: A detailed description of the property being secured, including its address and legal description.

- Terms and Conditions: Specific terms under which the loan will be repaid, including interest rate, payment schedule, and penalties for late payments.

- Default Provisions: Conditions under which the Secured Party may initiate foreclosure in case of default.

- State Governing Law: A clause indicating which state laws govern the deed of trust, crucial for legal enforcement.

Steps to Complete the Deed Trust Form PDF

Filling out a deed trust form PDF requires attention and precision. Here are the steps to effectively complete the form:

- Gather Necessary Information: Collect information about the borrower, lender, property, and loan terms.

- Fill in the Parties' Information: Start by entering the full names and addresses of the Debtor, Trustee, and Secured Party.

- Specify Loan Details: Clearly state the loan amount, interest rate, and repayment terms.

- Describe the Property: Include an accurate and complete description of the secured property.

- Include Default Terms: Detail the actions that can be taken in case of default and other important stipulations.

- Review for Accuracy: Carefully review the completed form to ensure accuracy and completeness.

- Sign the Document: All involved parties must sign the document in the designated areas for it to be legally binding.

- Notarization: Although not always required, notarizing the document can enhance its legal validity.

Who Typically Uses the Deed Trust Form PDF

The deed trust form is primarily utilized by various parties involved in real estate transactions, including:

- Homebuyers: Individuals securing a mortgage for purchasing a home.

- Lenders: Banks or financial institutions providing loans and requiring a secured interest in real estate.

- Real Estate Investors: Investors financing property purchases or refinancing existing loans.

- Trustees: Individuals or entities appointed to manage the trust and ensure compliance with its terms.

Legal Use of the Deed Trust Form PDF

In the United States, the deed of trust serves as a legally recognized mechanism for securing loans against real property. The legal framework surrounding this form ensures that:

- It complies with state-specific laws.

- It outlines the responsibilities of all parties, protecting borrowers from unfair practices.

- It provides a clear legal route for lenders to recoup their investments in the event of default.

Understanding the legal implications is crucial for all parties involved to prevent disputes and ensure enforceability.

Important Terms Related to Deed Trust Form PDF

Familiarity with critical terminology related to the deed of trust can aid in understanding its implications:

- Trustee: The neutral third party responsible for holding the title until the loan is paid off.

- Secured Party: The lender who has a financial claim to the property.

- Default: The failure to meet the obligations outlined in the deed, such as timely loan repayments.

- Foreclosure: The legal process through which the Secured Party obtains ownership of the property due to default.

- Equity: The difference between the market value of the property and the amount owed on the loan.

Examples of Using the Deed Trust Form PDF

The deed trust form can be applied in various scenarios:

- First-Time Home Purchase: A first-time buyer uses the deed of trust to secure a mortgage, with a bank as the lender holding the trust.

- Investment Property Financing: An individual securing a loan for a rental property can use this form to formalize the financing arrangement with the lender.

- Refinancing: Homeowners looking to refinance an existing mortgage may utilize a deed of trust to secure new loan terms.

Understanding these real-world applications demonstrates the versatility and necessity of the deed trust form in various financing situations.

State-Specific Rules for the Deed Trust Form PDF

Every state has unique regulations governing the use of deeds of trust. When utilizing a deed trust form PDF, it is vital to comply with local laws, as each state may have particular requirements, such as:

- Witness or Notary Requirements: Some states mandate that deeds of trust must be signed in front of a notary public.

- Filing with State or County Recorder: Certain jurisdictions require the deed to be filed with the local land records office to ensure its legal enforceability.

- Foreclosure Processes: States have different processes for non-judicial and judicial foreclosures, impacting how the deed of trust can be enforced.

Researching local laws and consulting with a legal professional is advisable to ensure compliance and validity.