Understanding the LLC Resolution Form

The LLC resolution form is a crucial document for limited liability companies that formalizes decisions made during member meetings. It serves as a written record of the company's key decisions, such as the appointment or removal of managers, approval of contracts, or changes in company policies. Using this form ensures clarity and compliance with state laws, providing legal backing for actions taken by the LLC's members.

Purpose of the LLC Resolution Form

An LLC resolution form captures essential decisions made by the company's members. Its primary purposes include:

- Documenting Key Decisions: Records decisions made during meetings, ensuring that all members are on the same page.

- Legal Protection: Acts as evidence in case of disputes or audits, proving that decisions were made according to proper procedures.

- Facilitating Smooth Operations: Provides a clear process for implementing changes, avoiding confusion among members.

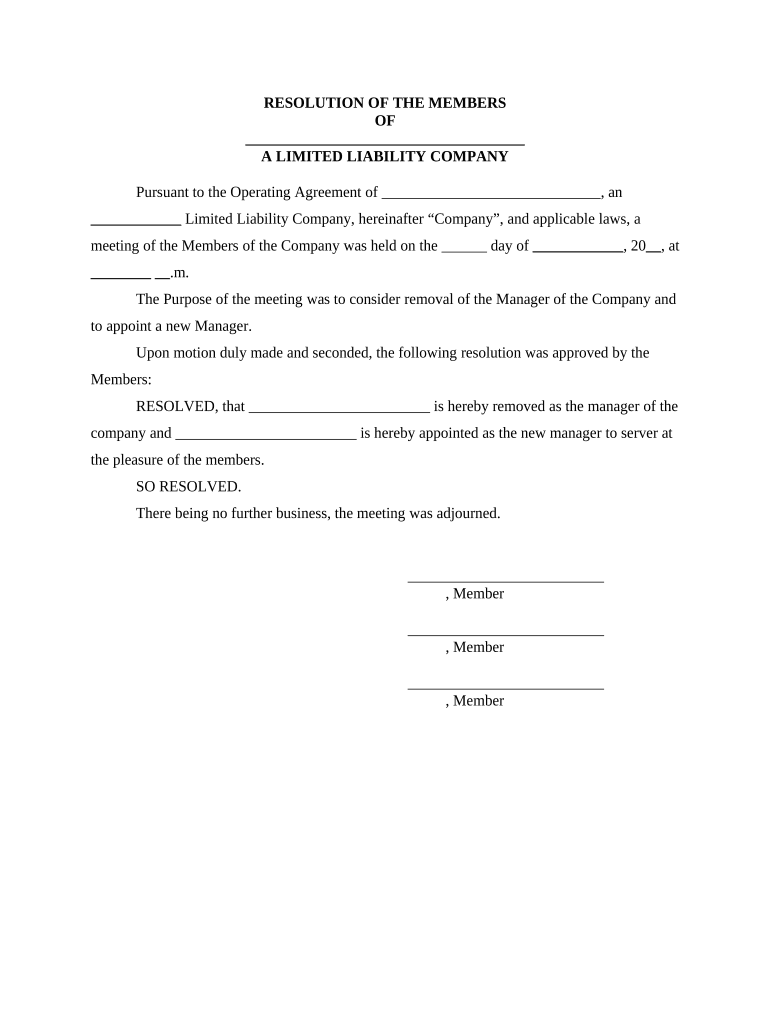

Components of an LLC Resolution Form

The structure of an LLC resolution form can vary, but common key elements typically include:

- Title: Clearly states that it is a resolution of the LLC.

- Date: Indicates when the resolution was adopted.

- Members Involved: Lists all members present during the decision-making process.

- Resolution Details: Provides a detailed description of the proposed action (e.g., appointing a new manager).

- Approval Signatures: Includes signatures of members to validate the resolution.

How to Complete an LLC Resolution Form

Completing an LLC resolution form involves several steps:

-

Gather Required Information: Collect details about the meeting date, the names of attending members, and the specifics of the resolution being proposed.

-

Draft the Resolution: Write out the resolution in clear language, detailing what decision is being made and any relevant background information.

-

Review with Members: Before finalizing, share the draft with all members to ensure agreement and clarity on the proposed resolution.

-

Adoption and Signing: Conduct a vote among members for approval. Once agreed upon, have all relevant members sign the document.

-

Store the Resolution: Save the document in a secure location as part of your company's records for future reference.

Sample Situations Requiring an LLC Resolution

Various scenarios may require the completion of an LLC resolution form, including:

- Managerial Changes: When an LLC member is added or removed from management roles.

- Financial Decisions: Approving significant purchases or changes in banking arrangements.

- Policy Adjustments: Implementing new operational policies or amendments to existing ones.

Types of LLC Resolutions

Different types of resolutions can be documented using an LLC resolution form, such as:

- Ordinary Resolutions: General decisions made during meetings that require a simple majority for approval.

- Special Resolutions: More significant decisions that may need a higher threshold for approval, often requiring two-thirds of the members.

Legal Implications of LLC Resolutions

It is critical to understand the legal implications surrounding the LLC resolution form:

- Legal Compliance: Each state has laws governing LLC operations, making adherence to these resolutions vital for legal protection.

- Liability Protection: Properly documented resolutions help shield members from personal liability associated with company decisions.

Best Practices for Using an LLC Resolution Form

Consider the following best practices to ensure effective use of the LLC resolution form:

- Regular Meetings: Hold regular meetings to review company policies and document decisions that arise.

- Consistent Documentation: Always use the formal resolution form for major decisions to maintain consistency and clarity.

- Consult Legal Counsel: When needed, consult with legal professionals to ensure the resolution aligns with state laws and company bylaws.

Conclusion

By understanding and utilizing the LLC resolution form, members of a limited liability company can ensure their decisions are documented, legally sound, and reflective of the company's operational needs. This not only promotes organized internal governance but also provides a safeguard against potential legal issues.