Definition & Meaning of IRS Form 433-D

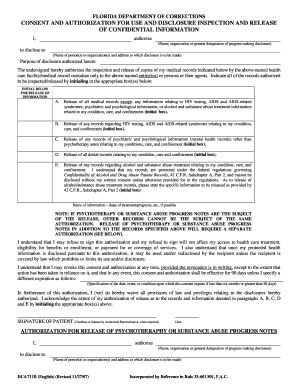

IRS Form 433-D is an Installment Agreement that allows taxpayers to set up a structured payment plan to settle federal taxes owed to the Internal Revenue Service (IRS). This form is particularly essential for individuals or businesses that cannot pay their tax liability in one lump sum due to financial constraints. By submitting Form 433-D, taxpayers can formalize their commitment to pay down their tax debt over time, making it more manageable.

The form includes various sections designed to capture the taxpayer’s personal and financial information. This includes details such as the taxpayer's name, Social Security Number, amount owed, payment terms, and whether payments will be made via automatic debit from a bank account. Completing this form correctly ensures compliance with IRS regulations and sets clear expectations regarding the payment plan's duration and amounts.

Steps to Complete the IRS Form 433-D

Completing IRS Form 433-D requires careful attention to detail to ensure that all information is accurate. Here are the steps typically involved in the completion process:

-

Gather Required Information: Collect financial documents that reflect income, expenses, assets, and liabilities. This may include bank statements, pay stubs, and information on any other financial obligations.

-

Fill Out Personal Information: In the initial section, provide your name, address, and Social Security Number. If filing jointly, ensure to include the spouse’s details as well.

-

Indicate the Amount Owed: Clearly state the total amount due in taxes, including any penalties or interest.

-

Specify Payment Terms: Determine the terms of your installment agreement, such as the monthly payment amount and the duration of repayments.

-

Select Payment Method: Indicate whether you will make payments through direct debit or another method. If opting for direct debit, include the bank account information.

-

Review and Sign: Before submission, thoroughly review the completed form for accuracy. Finally, sign and date the form to validate the information provided.

-

Submit the Form: Follow the chosen submission method, which could include mailing the form or filing it online if applicable.

Tips for Accuracy

- Double-check all figures, especially in regard to your income and liabilities.

- Ensure that the payment amounts align with what you can realistically afford to pay monthly.

- Consult IRS guidelines or a tax professional if uncertain about any details.

How to Obtain the IRS Form 433-D

Obtaining IRS Form 433-D is straightforward and can be completed through a few different methods:

-

Download from the IRS Website: The form is available for download from the IRS website in PDF format. This allows you to print it and fill it out by hand or electronically complete it if preferred.

-

Request by Mail: Taxpayers may also request a physical copy of Form 433-D by contacting the IRS directly through their customer service. This may take longer, so it is recommended for those who prefer paper forms.

-

Access through Tax Software: Many tax preparation software programs, like TurboTax or H&R Block, offer integrated access to IRS forms, including Form 433-D. This can streamline the process for users already utilizing these services.

-

IRS Office Visits: For personalized assistance, taxpayers can visit local IRS offices where representatives can provide the form and answer questions related to its completion.

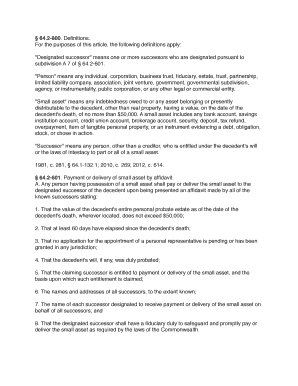

Important Terms Related to IRS Form 433-D

Understanding key terminology is crucial when completing IRS Form 433-D. Here are some essential terms:

-

Installment Agreement: A formal agreement allowing taxpayers to pay off their tax debt in regular installments over a specified period.

-

Direct Debit: A payment method that automatically withdraws the agreed-upon installment amount from the taxpayer’s bank account each month.

-

Liabilities: The total amount of financial obligations owed by the taxpayer, including other debts aside from tax liabilities.

-

Financial Disclosure: The requirement to provide information about income, expenses, and assets on the form to determine the taxpayer’s ability to pay.

-

IRS Collection Process: The procedure followed by the IRS to recover outstanding tax liabilities, which may include various collection actions if an agreement is not in place or adhered to.

Who Typically Uses IRS Form 433-D

IRS Form 433-D is commonly used by taxpayers in the following situations:

-

Individuals Facing Financial Hardship: Taxpayers who find themselves unable to meet their tax obligations due to unexpected financial difficulties, such as job loss or medical emergencies.

-

Small Business Owners: Business owners who may be struggling to manage cash flow and are unable to pay their tax liabilities can take advantage of this installment plan.

-

Self-Employed Individuals: Freelancers and independent contractors who may experience variable income streams and need structured payments to handle their tax obligations.

-

Taxpayers with Disputed Taxes: Those negotiating with the IRS concerning the amount owed may use Form 433-D to secure a payment plan while discussions are ongoing.

Understanding the demographics of individuals commonly utilizing this form can aid in its effective application and completion.

Submission Methods for IRS Form 433-D

There are multiple methods available for submitting IRS Form 433-D, making it flexible for taxpayers based on their preferences:

-

Online Submission: Certain taxpayers may have the option to submit Form 433-D electronically through secure IRS portals, offering convenience and faster processing times.

-

Mail Submission: Send the completed paper form to the appropriate IRS mailing address specified for installment agreements. Ensure to verify the correct address based on your geographic location.

-

In-Person Submission: Taxpayers can schedule an appointment at a local IRS office to submit the form directly, ideal for those seeking personal assistance.

Important Considerations

- When mailing the form, consider using a traceable mail service to confirm receipt by the IRS.

- Always retain a copy of the submitted form for personal records.

Understanding each submission method helps taxpayers choose the one best suited to their circumstances.