Understanding the Green Dot Dispute Form

The Green Dot dispute form is a critical document for cardholders who need to formally dispute unauthorized charges on their accounts. This form ensures that the cardholder's claims are documented and processed appropriately by Green Dot Corporation. Users must include personal information, transaction details, and specific reasons for the dispute. Submitting a complete form helps facilitate a prompt response from the Green Dot dispute department.

Key Elements of the Green Dot Dispute Form

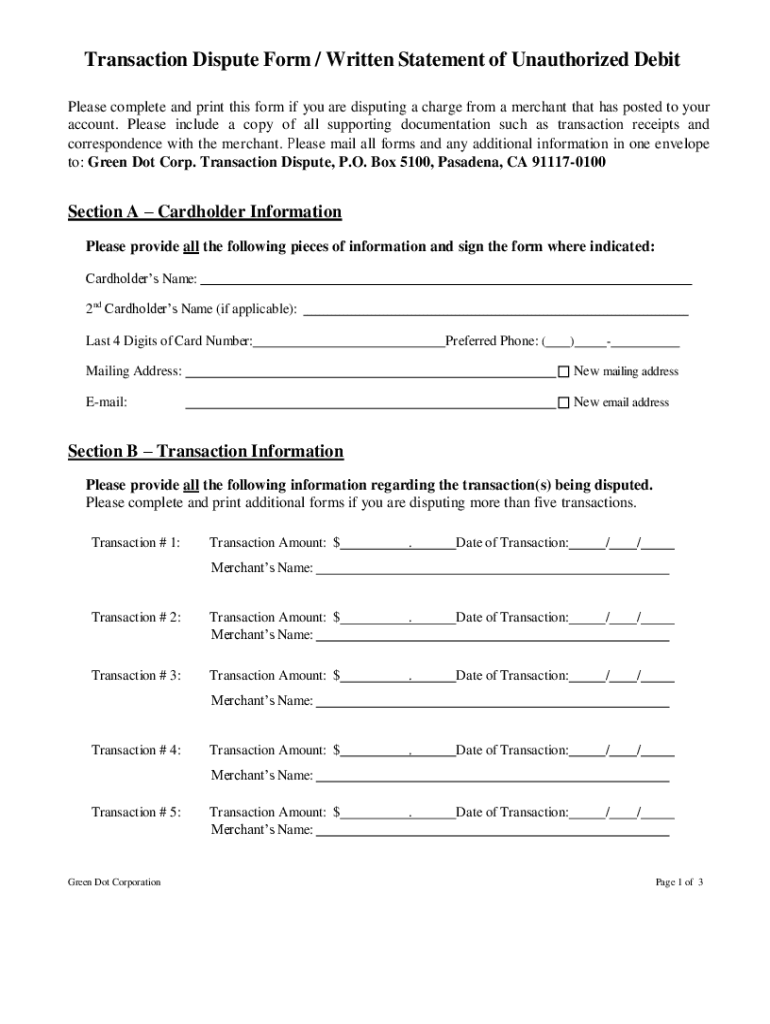

The Green Dot dispute form contains several essential components that enable effective dispute resolution. Key elements include:

- Personal Information: Cardholders must provide their name, address, and account number.

- Transaction Details: Specific information about the disputed transactions, including the date, amount, and merchant, must be included.

- Reasons for Dispute: Cardholders should clearly articulate the reasons for disputing each charge, such as unauthorized transactions or billing errors.

- Supporting Documentation: Attach any relevant evidence, like bank statements or receipts, to substantiate the dispute.

These elements ensure that Green Dot can thoroughly assess the dispute and respond in a timely manner, potentially providing provisional credit as part of the process.

Steps to Complete the Green Dot Dispute Form

Filing a dispute using the Green Dot dispute form involves several important steps to ensure that the process runs smoothly:

- Obtain the Form: Access the Green Dot dispute form through the official Green Dot website or customer support.

- Fill in Personal Information: Enter your full name, account number, address, and contact information.

- Detail Transactions: List all disputed transactions, including the date, merchant name, and specific amounts.

- Explain Your Dispute: Carefully write down the reasons for disputing each transaction to provide clarity.

- Attach Documentation: Include copies of supporting documents, such as receipts or statements, to bolster your case.

- Review Your Form: Ensure all information is accurate and complete before submission.

- Submit the Form: Send the completed form to the appropriate Green Dot address via the method of your choice (mail or online).

Following these steps can help streamline the dispute process and improve the likelihood of a favorable outcome.

How to Obtain the Green Dot Dispute Form

Obtaining the Green Dot dispute form is straightforward. Here's how to do it:

- Online Access: The form is typically available for download from the Green Dot website.

- Customer Support: Contact Green Dot customer service for assistance in receiving the form, whether through email or by request.

- Mobile App: If you use the Green Dot mobile app, check under account services or help sections, where forms may be directly accessible.

Providing a quick and easy way for cardholders to access dispute forms contributes to better customer service and satisfaction.

Who Typically Uses the Green Dot Dispute Form

The Green Dot dispute form is primarily utilized by individuals who are cardholders of Green Dot accounts. Typical users include:

- Consumers: Everyday users disputing unauthorized transactions or errors on their transactions.

- Small Business Owners: Business accounts may also need to dispute charges related to business expenses or fraud.

- Individuals experiencing Fraud: Users who believe they have become victims of fraud on their Green Dot accounts.

Understanding who uses the form provides insight into the customer base that Green Dot serves and the importance of an effective dispute resolution process.

Importance of Submission Methods for the Green Dot Dispute Form

Proper submission of the Green Dot dispute form can significantly impact the processing of the dispute. Consider the following methods:

- Online Submission: If available, online submission offers a quicker response time and immediate confirmation of receipt.

- Mail Submission: For those who prefer physical documentation, mailing the form ensures that all materials are submitted securely.

- In-Person Submission: In some cases, visiting a Green Dot customer service location can provide direct assistance and quicker resolution to disputes.

Choosing the right submission method can enhance communication with Green Dot and improve the speed of dispute handling.

Important Terms Related to the Green Dot Dispute Form

Familiarity with specific terminology is crucial for effectively navigating the dispute process. Relevant terms include:

- Provisional Credit: Refers to temporary credit issued while a dispute is under investigation.

- Unauthorized Transaction: A charge made without the cardholder’s knowledge or consent.

- Dispute Status: The current progress or outcome of the dispute process.

- Supporting Documentation: All evidence submitted alongside the dispute form to validate the claim.

Understanding these terms plays a vital role in enabling cardholders to communicate effectively with Green Dot during the dispute resolution.

Examples of Using the Green Dot Dispute Form

Real-world scenarios illustrate the application of the Green Dot dispute form, showing its importance:

- Example One: A consumer notices a charge for a service they did not authorize. They would complete the form, providing details about the transaction, and submit it to seek a refund.

- Example Two: A small business owner finds an unexpected fee for a missed payment on a subscription service they canceled. Using the dispute form, they can assert their case and provide documentation to back their claim.

- Example Three: An individual detects recurring fraudulent charges on their account and files a dispute to protect their finances and recover lost funds through Green Dot’s processing system.

These examples exemplify the practical use of the Green Dot dispute form in various situations.