Definition and Purpose of the MBOB Change Request Form

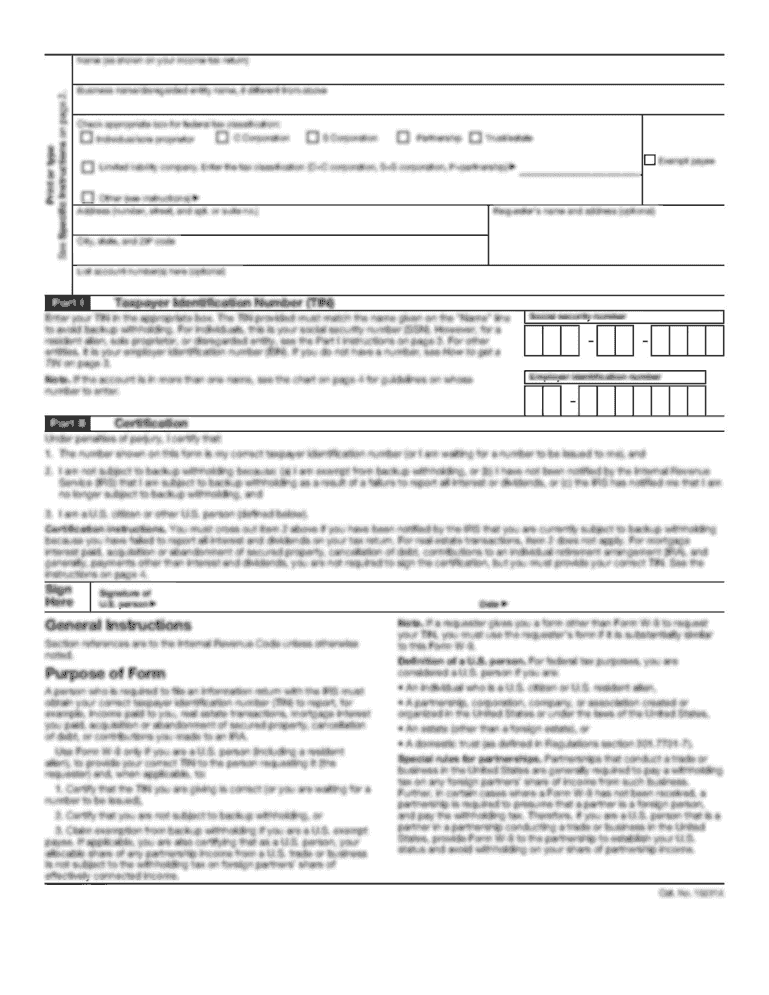

The MBOB change request form is an essential document used by customers of the Bank of Bhutan Limited to initiate various changes related to their banking services. This form permits customers to request updates such as changing contact information, deactivating accounts, or resetting PINs. It also enables users to enable or disable merchant status, among other functions. The clear structure of the form ensures that all necessary changes can be communicated efficiently and accurately.

When filling out the MBOB change request form, users must provide mandatory fields that typically include personal identification details such as their name, account number, and contact information. This information is critical for the bank to verify the identity of the requester and ensure the correct implementation of requested changes.

Common Uses of the MBOB Change Request Form

- Updating Contact Information: Whether changing a phone number or mailing address.

- Account Management: Deactivating a bank account or service.

- Transaction Security: Requesting a new PIN for added security.

Steps to Complete the MBOB Change Request Form

Completing the MBOB change request form involves a systematic approach to ensure that all necessary information is accurately captured. Below are the steps to follow:

- Obtain the Form: Access the form from the official Bank of Bhutan Limited website or by requesting it from a local branch.

- Fill in Personal Information:

- Enter your full name as registered with the bank.

- Include your account number for identification.

- Provide up-to-date contact information, including your phone number and email address.

- Specify Change Details: Clearly indicate which changes you are requesting. This may include:

- Changing a phone number.

- Updating email addresses.

- Merger or deactivation of accounts.

- Sign and Date the Form: Application validity requires your signature and the date of submission.

- Submit the Form: Deliver the completed form through:

- Online submission via the bank’s digital platform.

- Mail the form to the bank’s designated address.

- Submit in person at a local branch.

Important Considerations

- Ensure all sections of the form are complete to avoid delays.

- Review the form for accuracy before submission to prevent errors.

How to Obtain the MBOB Change Request Form

Acquiring the MBOB change request form can be done through several convenient methods:

- Official Website: Navigate to the Bank of Bhutan Limited's official website, where downloadable forms may be available.

- Direct Branch Visit: Visit a local branch to request a physical copy of the form from a customer service representative.

- Customer Support: Reach out to the bank’s customer service via their contact number or WhatsApp to request the form directly.

Obtaining the form is straightforward, and ensuring you have the latest version will facilitate your request process.

Important Terms Related to the MBOB Change Request Form

Familiarity with key terms relevant to the MBOB change request form is vital for effective communication with the bank. Here are some important terms:

- Account Holder: The individual or entity that holds the bank account and is eligible to request changes.

- PIN (Personal Identification Number): A confidential number used for account verification and security.

- Merchant Status: A designation that allows account holders to accept payments for goods or services.

- Deactivation: The process of suspending an account’s functionality either temporarily or permanently.

Understanding these terms will aid in accurately filling out the request form and engaging with the bank regarding your changes.

Legal Use of the MBOB Change Request Form

The MBOB change request form serves a legal purpose within banking operations. Properly filled out, it acts as a formal request for alterations to your account, thus initiating a binding process between you and the Bank of Bhutan Limited. The signatures on the form affirm that the request is legitimate and authorized by the account holder.

Compliance and Security

- Ensure compliance with all banking regulations when submitting the form.

- Provide accurate information to prevent identity theft or fraud.

This legal standing emphasizes the importance of completing the form with precision and care to ensure that your banking needs are met efficiently and securely.