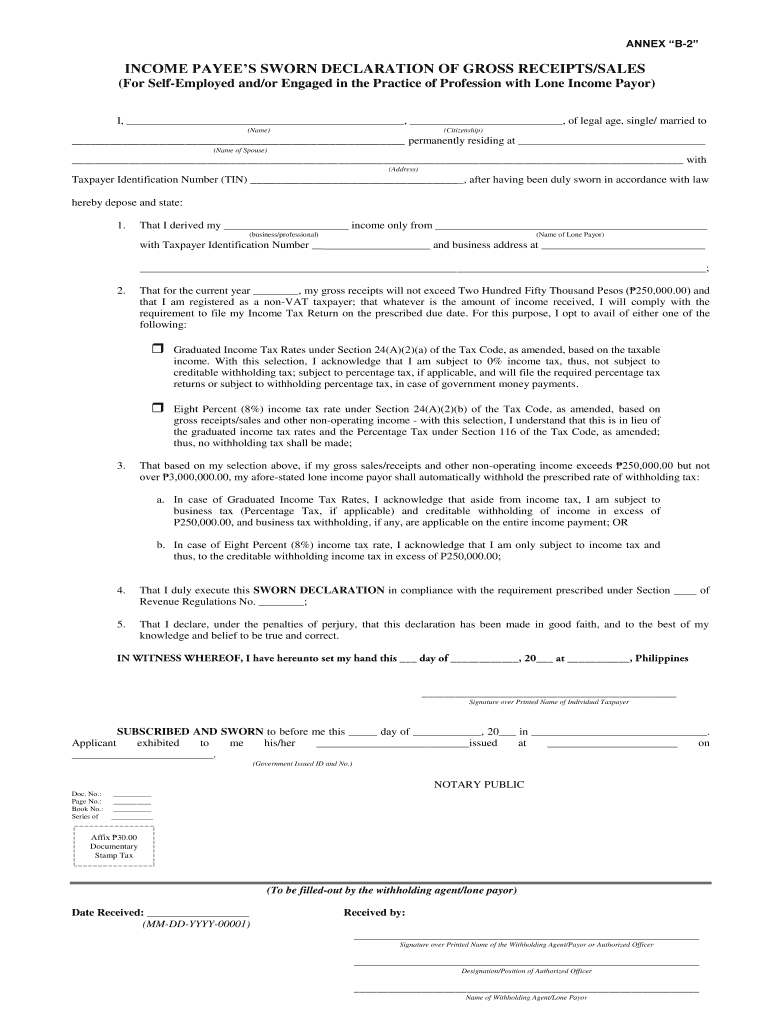

Understanding the Income Payees Sworn Declaration of Gross Receipts Sales Annex B-2

The Income Payees Sworn Declaration of Gross Receipts/Sales Annex B-2 serves as a crucial document for self-employed individuals and other income payees. This form is primarily used to affirm that a taxpayer's gross receipts or sales do not exceed ₱250,000. It plays a significant role in tax compliance and showcases adherence to U.S. tax regulations.

Key Components of the Annex B-2 Form

The Annex B-2 form contains several essential sections that provide clarity and structure for reporting gross receipts or sales.

- Taxpayer Identification: This section requires the taxpayer’s name, address, and Tax Identification Number (TIN), ensuring proper identification.

- Income Source: Taxpayers must provide details regarding the source of their income, making it clear what business activities or services they are engaged in.

- Tax Options: Individuals can choose between the Graduated Income Tax Rates or the Eight Percent income tax rate. This choice must be clearly indicated to comply with the Internal Revenue Service (IRS) guidelines.

- Compliance Statement: The form includes a declaration that the information provided is accurate and complies with applicable tax laws. Misrepresentation can lead to penalties.

- Notarization Requirement: The form must be notarized, adding a layer of authenticity and legal backing to the declaration. This step ensures the submitted information is confirmed and verifiable.

Instructions for Completing the Annex B-2 Form

Filling out the Annex B-2 form accurately is vital for compliance and ease of processing by tax authorities.

- Gather Necessary Information: Before starting, collect all relevant documentation including income statements and other forms related to your gross sales.

- Complete Personal Details: Fill in your name, address, and TIN in the designated fields. Ensure that this information matches your tax records.

- Detail Your Income Source: Clearly describe your main source of income. This could be self-employment activities, freelance work, or other income-generating activities.

- Choose Your Tax Rate Option: Indicate whether you are opting for the Graduated Income Tax Rates or the Eight Percent income tax rate. Understanding each option's implications is important for legal compliance and financial planning.

- Review for Accuracy: Double-check all entered information to avoid errors, which could lead to complications or delays in processing.

Filing and Submission Methods for the Annex B-2 Form

The submission process for the Annex B-2 form can be done through multiple channels, ensuring convenience for taxpayers.

- Online Submission: Many taxpayers prefer filing online for expedience. The form may be submitted through designated IRS portals or local tax authority websites, depending on jurisdiction.

- Mail Submission: Alternatively, individuals can print the completed form and mail it to their local tax authority. It is advisable to use certified mail for tracking purposes.

- In-Person: Some may choose to submit the form in person at a local IRS office or tax authority. This option can provide immediate confirmation of submission.

Typical Users of the Income Payees Sworn Declaration Form

Various individuals and business entities primarily use the Annex B-2 form, including:

- Self-Employed Individuals: Freelancers, consultants, and contractors often utilize this form to declare their earnings accurately.

- Small Business Owners: Sole proprietors or small business owners who may not have complex financial structures benefit from using this straightforward declaration.

- Tax Professionals: Accountants and tax preparers often assist clients in completing this form to ensure compliance and accuracy in income reporting.

Penalties for Non-Compliance with the Annex B-2 Form

Failure to correctly complete and submit the Annex B-2 form can result in serious penalties.

- Fines and Fees: Inaccuracies may lead to fines from tax authorities, with amounts varying based on severity.

- Legal Consequences: Filing false information may result in legal action or more severe penalties, including potential audits.

- Denial of Tax Benefits: Non-compliance can hinder access to certain tax benefits and deductions, affecting financial planning and net income.

Important Considerations and Exceptions

While the form is straightforward, there are important considerations to keep in mind.

- Variations by State: Different states may have specific regulations regarding income declarations, so it's crucial to verify local requirements.

- Business Variations: Certain types of businesses may qualify for additional forms or exemptions, making it necessary to consult with tax advisers for tailored advice.

- Income Fluctuations: Individuals with fluctuating incomes may need to reassess their gross receipts periodically, ensuring they remain below the ₱250,000 threshold.

This comprehensive overview of the Income Payees Sworn Declaration of Gross Receipts Sales Annex B-2 aims to provide clarity and guidance for self-employed individuals and other payees navigating U.S. tax compliance. Understanding the nuances of the form and associated regulations can foster better financial management and facilitate smoother interactions with tax authorities.