Not all formats, including OSHEET, are created to be easily edited. Even though numerous tools will let us tweak all file formats, no one has yet created an actual all-size-fits-all tool.

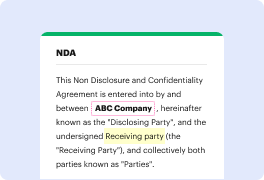

DocHub provides a simple and streamlined tool for editing, taking care of, and storing documents in the most widely used formats. You don't have to be a technology-savvy user to work in FATCA in OSHEET or make other modifications. DocHub is robust enough to make the process simple for everyone.

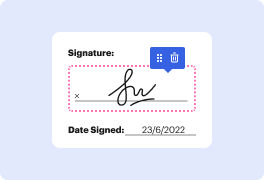

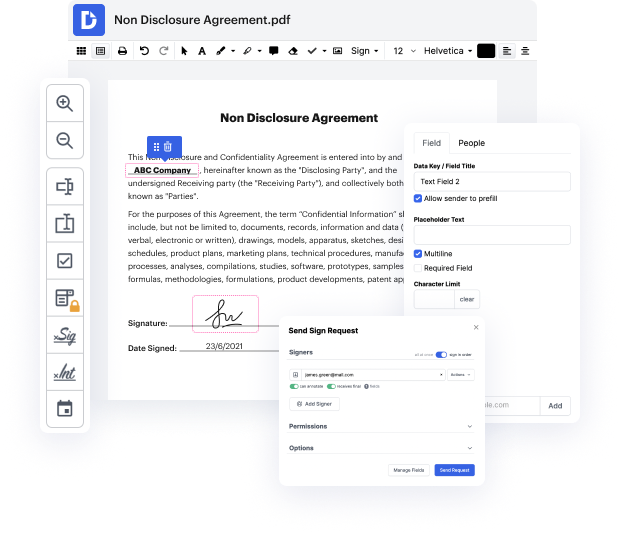

Our tool enables you to modify and tweak documents, send data back and forth, generate interactive forms for information gathering, encrypt and safeguard paperwork, and set up eSignature workflows. Moreover, you can also generate templates from documents you use regularly.

You’ll locate a great deal of other features inside DocHub, including integrations that let you link your OSHEET file to various business apps.

DocHub is an intuitive, cost-effective way to deal with documents and simplify workflows. It offers a wide array of capabilities, from creation to editing, eSignature professional services, and web form creating. The application can export your documents in many formats while maintaining maximum security and adhering to the greatest information protection criteria.

Give DocHub a go and see just how simple your editing transaction can be.

hello Anthony hello Cody so on April 26th you and I attended a hearing in Washington DC reviewing the unintended consequences of the foreign account Tax Compliance Act during that hearing Professor Elise beamed has defined she was a minority expert witness and talk about why FATCA was great chairman mark meadows said to her can you please give me three recommendations on how to improve the legal framework of FATCA during the hearing she gave to and sheamp;#39;s also now provided an additional three so letamp;#39;s go over those the two that she provided at the hearing number one factor penalties one key concern related to FATCA includes these sometimes large penalties imposed on those who violate FATCA disclosure obligations or failed to pay taxes owed sheamp;#39;s a little wrong there yeah fact that disclosure obligations are completely independent of your income earned abroad so it doesnamp;#39;t matter you could have no income you could have a loss you still have disclosure requ