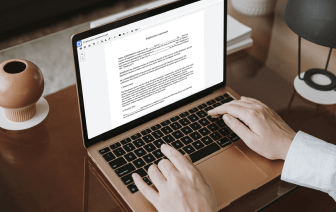

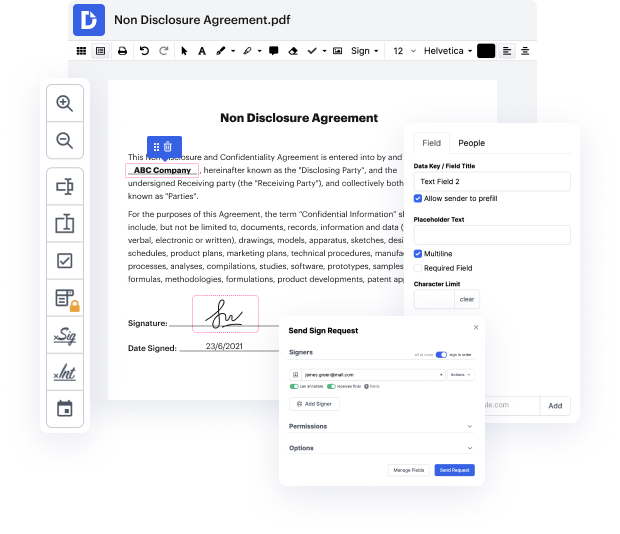

Are you looking for a straightforward way to work in detail in Plan of Dissolution? DocHub offers the best platform for streamlining form editing, signing and distribution and document execution. Using this all-in-one online platform, you don't need to download and install third-party software or use multi-level file conversions. Simply upload your form to DocHub and start editing it quickly.

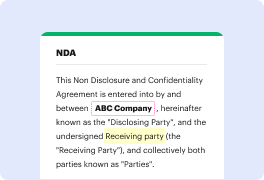

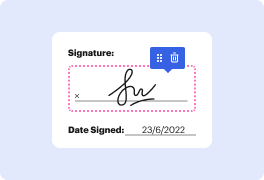

DocHub's drag and drop user interface allows you to swiftly and easily make tweaks, from simple edits like adding text, graphics, or visuals to rewriting entire form components. In addition, you can endorse, annotate, and redact papers in just a few steps. The solution also allows you to store your Plan of Dissolution for later use or transform it into an editable template.

DocHub provides beyond you’d expect from a PDF editing program. It’s an all-encompassing platform for digital form management. You can utilize it for all your papers and keep them safe and easily readily available within the cloud.

In this YouTube tutorial, the focus is on IRS Form 966, which pertains to corporate dissolutions or liquidations. The video explains that if you have a U.S. corporation or an LLC that elects to be taxed as a C-Corp and decides to shut down, you must file Form 966 within 30 days of adopting a plan to close the entity. The presenter goes through the form's components, highlighting necessary details like the corporation’s name, mailing address, EIN, and the return type, which is typically a standard C-Corp return (Form 1120). The tutorial aims to guide viewers in correctly completing the form and its required elements.