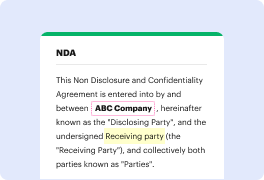

People frequently need to wipe out FATCA in binary when managing documents. Unfortunately, few applications provide the options you need to accomplish this task. To do something like this normally requires changing between a couple of software applications, which take time and effort. Thankfully, there is a solution that is applicable for almost any job: DocHub.

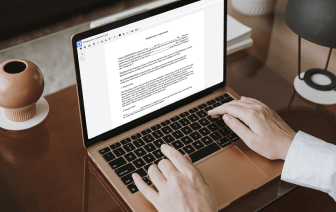

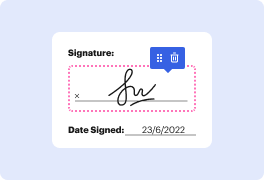

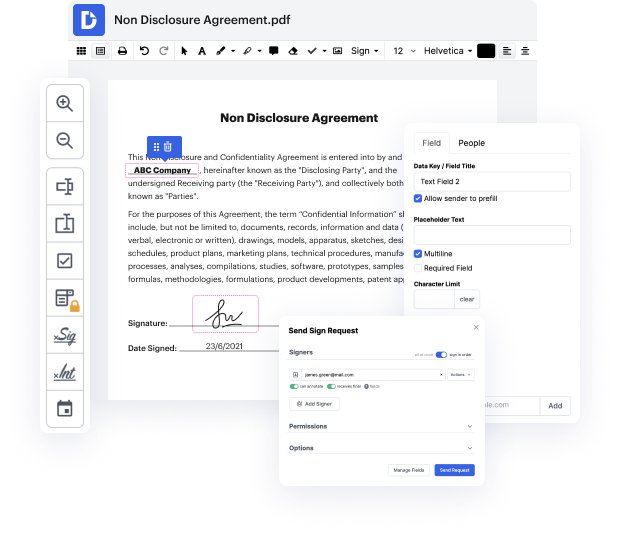

DocHub is a professionally-built PDF editor with a complete set of helpful capabilities in one place. Modifying, signing, and sharing documents gets straightforward with our online solution, which you can use from any online device.

By following these five easy steps, you'll have your revised binary rapidly. The user-friendly interface makes the process fast and productive - stopping jumping between windows. Try DocHub now!

hey Anthony hey Claudine weamp;#39;re continuing our FATCA series today weamp;#39;re talking about penalties weamp;#39;ve mentioned penalties a lot and they never want to get down until yeah and everything just gets better and better yes and that with that code now weamp;#39;re going to this is our capstone video we may add to it later as more wonderful things happen yes because what weamp;#39;re talking about today is penalties for individuals we started to investigate penalties for foreign financial institutions and it was sort of like going into a rabbit hole mm-hmm so weamp;#39;re gonna do a little more investigation and then talk about that and also the impact weamp;#39;re gonna try to do a video with both of them theyamp;#39;re like oh god no thereamp;#39;s much too much so FATCA individual penalties and weamp;#39;re talking specifically today about form 8938 there are other forms we know thereamp;#39;s f bars form 54 71 thereamp;#39;s separate penalties for every for