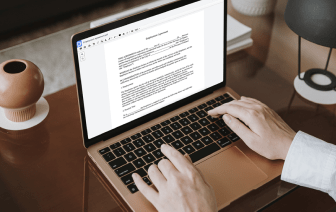

There are numerous document editing solutions on the market, but only a few are compatible with all file types. Some tools are, on the contrary, versatile yet burdensome to work with. DocHub provides the solution to these challenges with its cloud-based editor. It offers powerful functionalities that allow you to accomplish your document management tasks effectively. If you need to promptly Void FATCA in WPS, DocHub is the perfect choice for you!

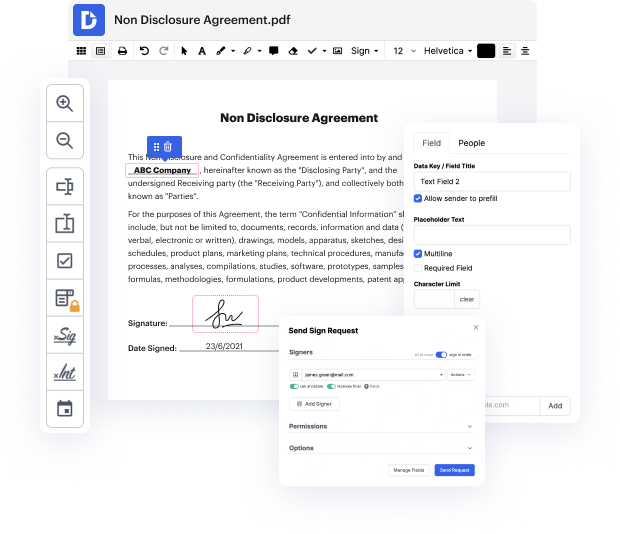

Our process is very simple: you import your WPS file to our editor → it automatically transforms it to an editable format → you apply all necessary adjustments and professionally update it. You only need a couple of moments to get your work ready.

Once all alterations are applied, you can turn your paperwork into a multi-usable template. You simply need to go to our editor’s left-side Menu and click on Actions → Convert to Template. You’ll find your paperwork stored in a separate folder in your Dashboard, saving you time the next time you need the same template. Try out DocHub today!

welcome to this installment of clarifying tax situations with attorney and cpa david w crossing what are the cryptocurrency fbar and facta reporting obligations if youve been living outside the united states and you kept your bitcoin wallet outside the united states or your cryptocurrency wallet outside the united states or youve been engaging with transactions with offshore brokerages coin brokerages you could wind up facing a problem with non-reporting of the foreign account at this point in time its not even exactly clear whether an offshore wallet or an offshore coin brokerage will result in an f bar reporting whats an f bar f bar stands for foreign bank account reporting and eventually this definition has expanded to almost any type of financial account offshore an investment account all right back in 2014 theres only been one time where the government was approached and asked if they had to do an fbar filing related to offshore wallets and offshore investments in cryptocurre