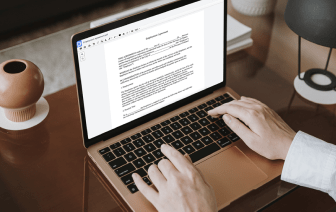

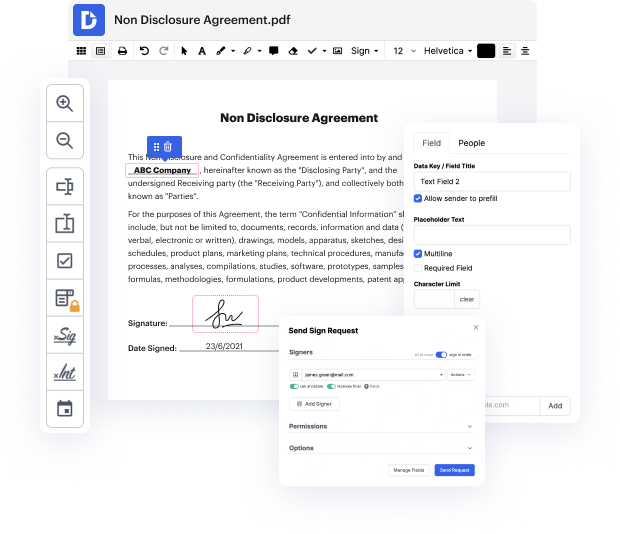

With DocHub, you can quickly vary FATCA in UOML from anywhere. Enjoy features like drag and drop fields, editable text, images, and comments. You can collect eSignatures safely, add an additional level of defense with an Encrypted Folder, and work together with teammates in real-time through your DocHub account. Make adjustments to your UOML files online without downloading, scanning, printing or sending anything.

You can find your edited record in the Documents tab of your account. Prepare, share, print out, or turn your file into a reusable template. With so many robust features, it’s easy to enjoy effortless document editing and managing with DocHub.

A new sensation from the USA: FATCA But what is this exactly? No, not exactly. FATCA is actually a US law and means amp;#39;Foreign Account Tax Compliance Actamp;#39;. Itamp;#39;s really not as complicated as it seems. Basically just like many other countries, the USA is dealing with a huge budget deficit. Thatamp;#39;s why the USA needs money. And what are the possible sources of a income for a country like this? Thatamp;#39;s right. One possibility is tax it. In the past, the USA didnamp;#39;t take full advantage of this possibility. After all, every US citizen who lives abroad actually has to pay taxes in the USA, but only a few really do so. This means the United States are losing a lot of money. Thatamp;#39;s why the US government past the new FATCA law. Foreign banks such as banks in Germany are now supposed to identify which of their customers are US citizens. Private customers as well as corporate customers. Even all shareholders who are US citizens and hold more than 25