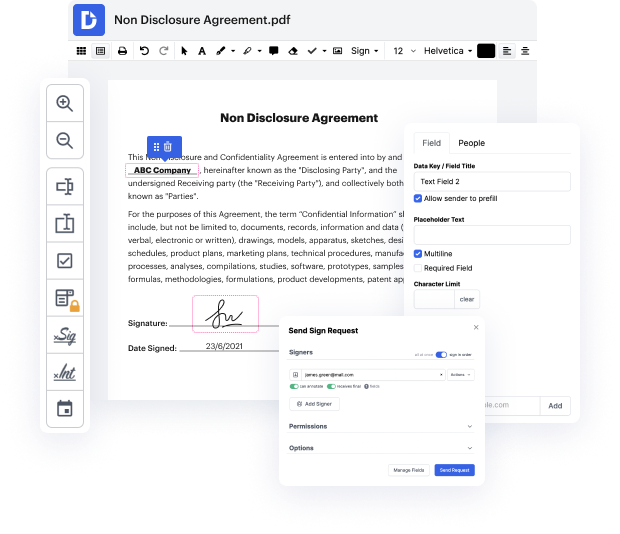

Are you having a hard time finding a reliable solution to Utilize Settlement For Free? DocHub is designed to make this or any other process built around documents much easier. It's easy to navigate, use, and make changes to the document whenever you need it. You can access the essential features for handling document-based workflows, like certifying, importing text, etc., even with a free plan. Moreover, DocHub integrates with multiple Google Workspace apps as well as solutions, making document exporting and importing a breeze.

DocHub makes it easier to edit paperwork from wherever you’re. Plus, you no longer need to have to print and scan documents back and forth in order to certify them or send them for signature. All the vital features are at your disposal! Save time and hassle by executing paperwork in just a few clicks. Don’t wait another minute today!

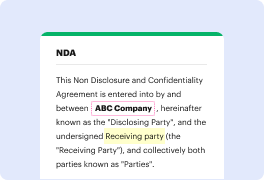

so lets talk about posts I see like these talking about the Experian and Equifax lawsuit so if you dont know in 2017 Equifax got in over 148 million people got their information leaked they both ultimately got sued and they docHubed a 525 million dollar settlement to be paid out to people who were affected by the data breeds with that being said do not believe the social media hype not everybody qualifies for a payment you cannot do the Experian claim without having a notice ID if you are a part of that data bdocHub they have already sent you or theyre sending you your notice ID so you can do the claim for the experienced settlement if youre trying to claim the Equifax settlement you have to provide documents and proof that you lost wages due to the data bdocHub meaning you had to lose some type of money due to identity theft like calling other words to file a police report hearing a lawyer to help out with identity theft and any other expenses you occur while dealing with ide

At DocHub, your data security is our priority. We follow HIPAA, SOC2, GDPR, and other standards, so you can work on your documents with confidence.

Learn more