Safety should be the primary consideration when searching for a document editor on the web. There’s no need to waste time browsing for a trustworthy yet cost-effective tool with enough capabilities to Undo word in 1040 Form. DocHub is just the one you need!

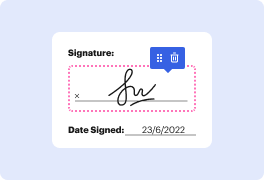

Our solution takes user privacy and data safety into account. It complies with industry regulations, like GDPR, CCPA, and PCI DSS, and continuously improves its compliance to become even more hazard-free for your sensitive data. DocHub allows you to set up two-factor authentication for your account settings (via email, Authenticator App, or Backup codes).

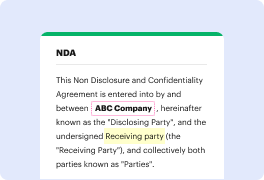

Hence, you can manage any paperwork, such as the 1040 Form, absolutely securely and without hassles.

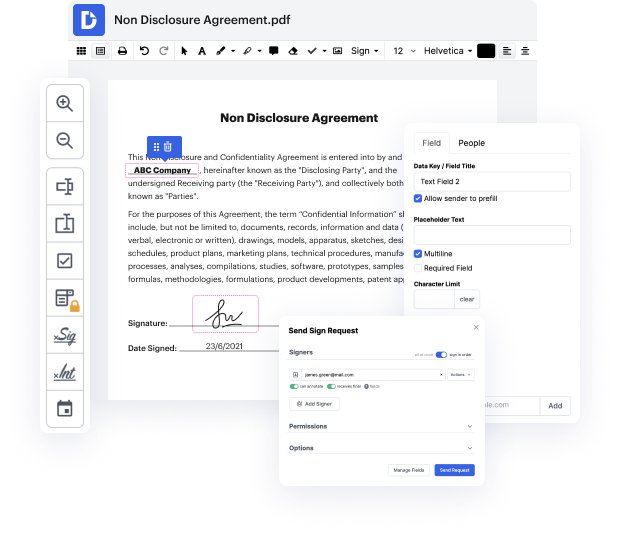

In addition to being trustworthy, our editor is also very straightforward to use. Follow the guideline below and ensure that managing 1040 Form with our tool will take only a couple of clicks.

If you often manage your paperwork in Google Docs or need to sign attachments you’ve got in Gmail rapidly, DocHub is also a good option to choose, as it perfectly integrates with Google services. Make a one-click form upload to our editor and complete tasks in a few minutes instead of continuously downloading and re-uploading your document for processing. Try out DocHub today!

[Music] how to fill out the 2021 irs form 1040 the 1044 may look complex however dont be overwhelmed with doing taxes and filling out the form here we will step through some of the more common lines for the 1040 to help give you an idea of what things you likely will need to fill out first what is form 1040 form 1040 is the u.s individual income tax return it is a federal income tax form that people use to report their income to the irs and claim tax deductions or credits it is used to calculate their tax refund and tax bill for the year you may file your tax return online with tax software or you can also download form 1040 directly from the irs website if you prefer to complete your return by hand what is on the 1040 tax form before we get into the details of the 1040 lets take a quick overview of what we will be looking at first it asks you who you are the top of form 1040 collects basic information such as your name address social security number your tax filing status and how ma