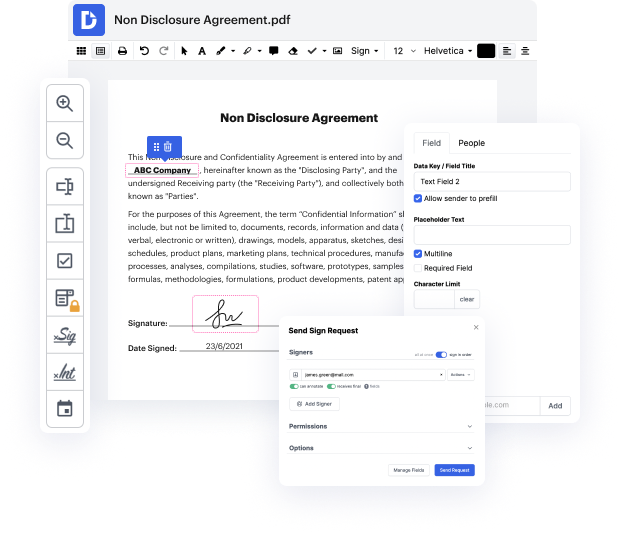

People often need to undo ein in binary when processing forms. Unfortunately, few programs offer the features you need to complete this task. To do something like this typically involves changing between multiple software applications, which take time and effort. Luckily, there is a service that suits almost any job: DocHub.

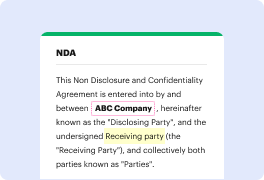

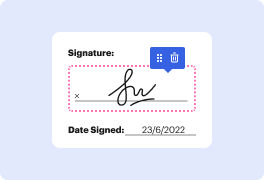

DocHub is an appropriately-built PDF editor with a complete set of helpful capabilities in one place. Altering, approving, and sharing documents is straightforward with our online solution, which you can access from any online device.

By following these five simple steps, you'll have your revised binary quickly. The user-friendly interface makes the process quick and effective - stopping switching between windows. Start using DocHub now!

my name is Lola an experienced Trader in almost 2 years Iamp;#39;m sharing my experience with my followers every day I do free telegram signal so if youamp;#39;re excited and if youamp;#39;re interested in and if you want to trade with me follow the link that you can find only in the description or in the first P comment I will be waiting for you there and letamp;#39;s get the success together hello everyone Lolly is here and in todayamp;#39;s video I will share with you my new s strategy I know that you really love it because you usually write under about this under my YouTube videos so thank you so much for your comments itamp;#39;s really really important for me itamp;#39;s how you can help my YouTube channel to grow and I really really appreciate also I remind you about my telegram channel itamp;#39;s for free you can get free telegram signals and all of my links you can find in the description also I have to remind you that I will be waiting for y