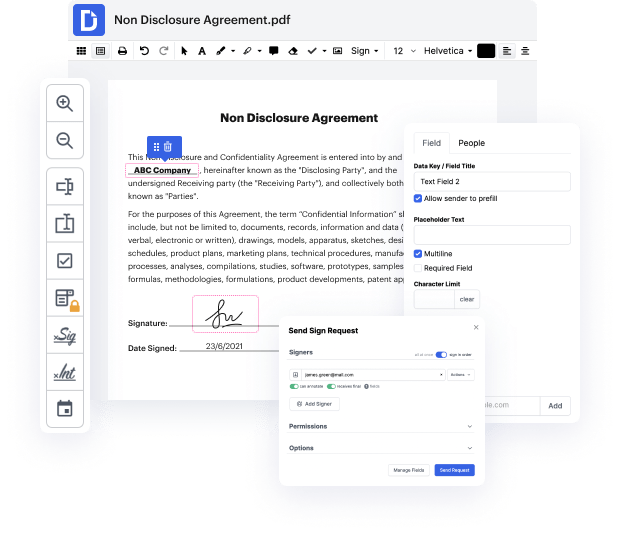

Having complete control of your files at any moment is essential to alleviate your daily duties and increase your efficiency. Achieve any goal with DocHub features for papers management and convenient PDF editing. Access, adjust and save and incorporate your workflows with other protected cloud storage services.

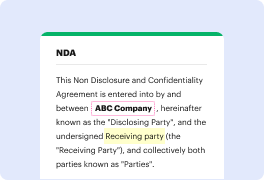

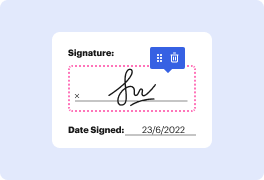

DocHub provides you with lossless editing, the opportunity to use any formatting, and safely eSign papers without the need of searching for a third-party eSignature software. Maximum benefit of your file managing solutions in one place. Try out all DocHub capabilities right now with the free account.

hi this is jason huval broker for central metro realty and today im going to talk about the registration agreement between brokers this is a form that you would use if you are not sure uh how youre going to get paid i guess from another broker this came up i had an agent that was a member of our local mls and he was he wanted to work with a buyer and another mls system a neighboring mls system but he didnt have their um you know their access and so typically the mls says if youre both members you dont need this form uh so long as everybody agrees on you know unless youre i guess you could use it technically if youre trying to get more money from another broker but if you have a commission rate lets say its two percent or three percent or four percent whatever it is on the mls system that is what they agree that selling broker that listing broker agrees to pay to uh the buyers uh our cooperating broker that amount as long as youre both members thats the handshake its alread