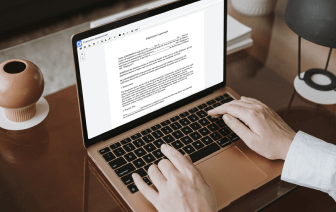

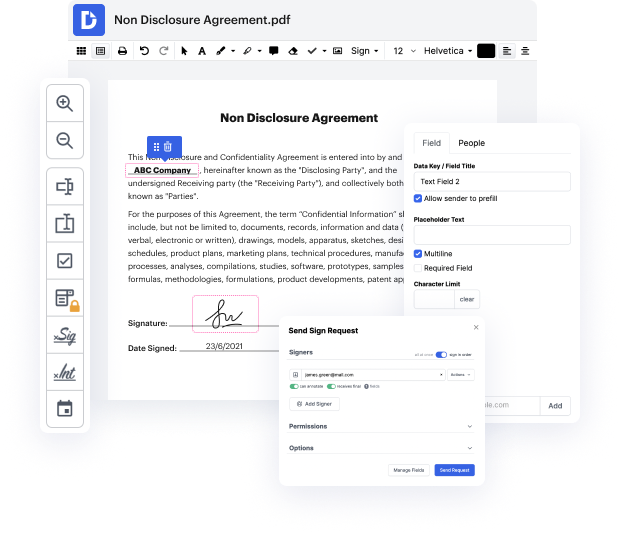

No matter how labor-intensive and challenging to change your files are, DocHub offers an easy way to change them. You can modify any part in your text without extra resources. Whether you need to tweak a single component or the whole form, you can rely on our powerful tool for fast and quality outcomes.

Additionally, it makes certain that the final document is always ready to use so that you can get on with your tasks without any delays. Our all-purpose collection of features also includes advanced productivity features and a catalog of templates, enabling you to make the most of your workflows without the need of losing time on routine activities. In addition, you can access your papers from any device and incorporate DocHub with other solutions.

DocHub can handle any of your form management activities. With an abundance of features, you can generate and export papers however you prefer. Everything you export to DocHub’s editor will be saved safely for as long as you need, with strict safety and information protection protocols in place.

Try out DocHub now and make managing your documents easier!

before we learn how to calculate federal income tax withholding letamp;#39;s go over a few more abbreviations if you see ytd that means year to date for example you might see something that says 30 000 gross wages ytd that means that that employeeamp;#39;s gross wages are thirty thousand dollars so far this year so you will need to know an employeeamp;#39;s gross wages ytd year to date for certain taxes for payroll and again if you see fit this stands for federal income tax if you see ee it stands for employee if you see er it stands for employer so the reason we use employee and employer abbreviations a lot in this chapter and the next chapter is weamp;#39;re going to find out that some payroll taxes are paid only by the employee some are paid only by the employer and some are paid by both the employee and the employer so now letamp;#39;s talk about the federal income tax withholding fit withholding so employers must withhold an estimated amount for federal income tax fro