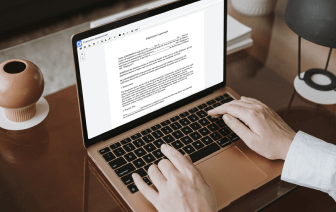

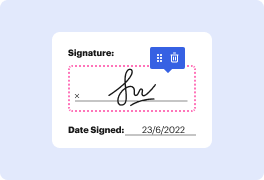

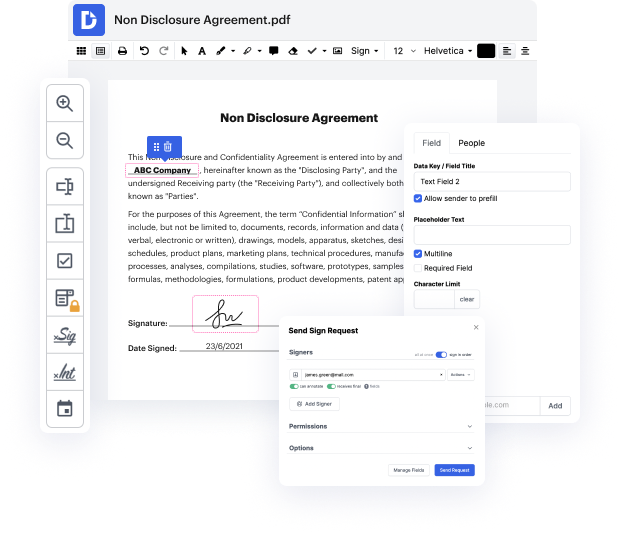

With DocHub, you can easily take out state in tex from anywhere. Enjoy capabilities like drag and drop fields, editable textual content, images, and comments. You can collect eSignatures safely, add an extra layer of protection with an Encrypted Folder, and collaborate with teammates in real-time through your DocHub account. Make adjustments to your tex files online without downloading, scanning, printing or mailing anything.

You can find your edited record in the Documents folder of your account. Edit, submit, print out, or turn your file into a reusable template. With so many advanced tools, it’s simple to enjoy trouble-free document editing and managing with DocHub.

where you choose to live in retirement is a very important consideration if weamp;#39;re trying to optimize our retirement plan for instance the difference between living in a high tax state versus a low tax state can be a multiple hundred thousand dollar decision for your retirement and may even cost you a few percentage points when it comes to your probability of success score now the problem I see a lot of retirees run into is they just focus on a state income tax rate in order to make this decision on how tax friendly a state is well in this video today Iamp;#39;m going to talk about five additional considerations outside of that income tax rate that you should be considering in determining what state is best for your retirement on the screen I have a map of the United States that shows the top marginal state income tax rate in each given State and just looking at this from a service level we can see that some states are certainly more tax friendly than others for instance if we