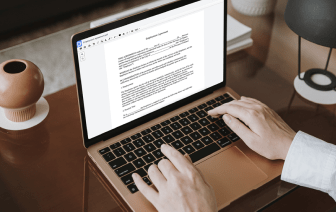

Working with papers means making small corrections to them every day. Sometimes, the task goes almost automatically, especially when it is part of your everyday routine. Nevertheless, in some cases, working with an unusual document like a W-9 Tax Form may take precious working time just to carry out the research. To ensure every operation with your papers is effortless and quick, you need to find an optimal modifying solution for such tasks.

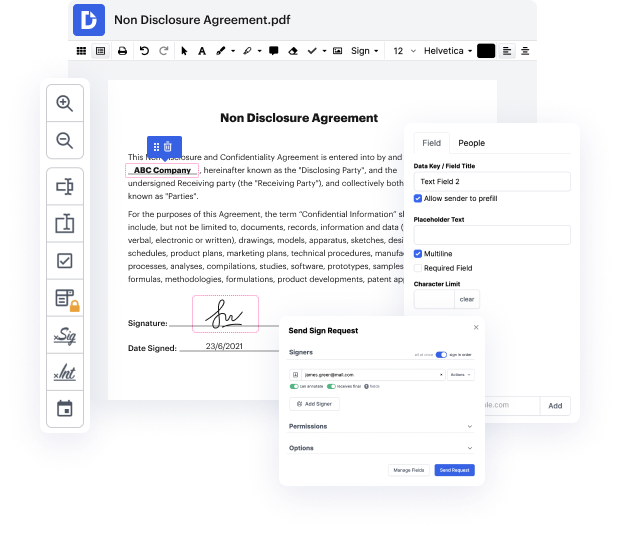

With DocHub, you may learn how it works without spending time to figure it all out. Your tools are laid out before your eyes and are easily accessible. This online solution will not require any sort of background - training or expertise - from its customers. It is all set for work even if you are not familiar with software traditionally used to produce W-9 Tax Form. Quickly make, edit, and send out documents, whether you work with them every day or are opening a brand new document type the very first time. It takes moments to find a way to work with W-9 Tax Form.

With DocHub, there is no need to research different document kinds to learn how to edit them. Have the essential tools for modifying papers close at hand to streamline your document management.

- [Instructor] Hey there. The next few minutes, I wanna show you how to fill out an IRS form called the W-9. Kind of a strange sounding form, but really, this is a form that gets used for all kind of different purposes, and its probably going to come up at some point in the life our your real estate investing business. Sometimes youre gonna have to fill this out on behalf of yourself, and sometimes youre gonna have to request that somebody else fill out this form for you. And really the whole purpose of this form is pretty simple. Its just so that one party can get the information they need from the other party in order to file a specific form with IRS. So for example, whenever a property is being bought or sold and the closer needs to file a form called the 1099S, in order to get that information, they could get it from this form if its filled out and signed and dated by the appropriate party. Or for example, if you as the seller on a seller financed deal need to send out whats