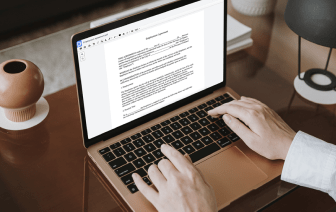

People who work daily with different documents know very well how much productivity depends on how convenient it is to use editing tools. When you Tax Sharing Agreement files must be saved in a different format or incorporate complicated elements, it might be difficult to handle them using classical text editors. A simple error in formatting might ruin the time you dedicated to tack note in Tax Sharing Agreement, and such a basic job shouldn’t feel challenging.

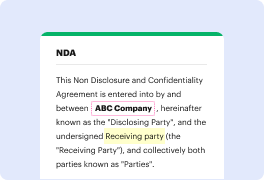

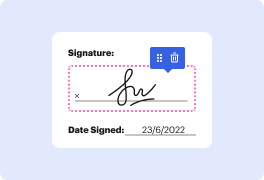

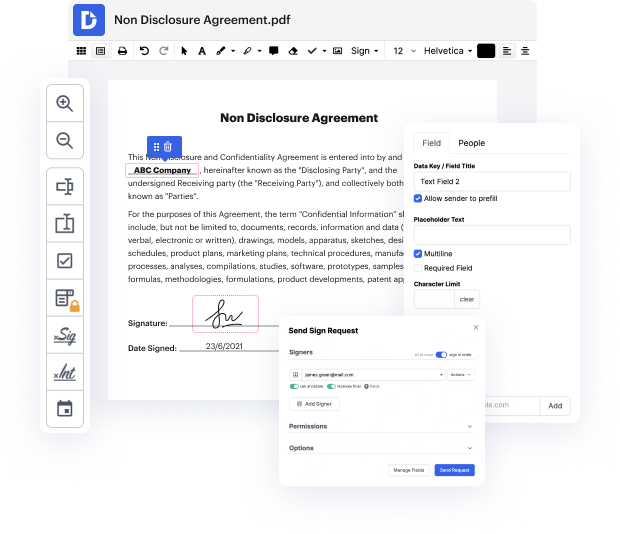

When you find a multitool like DocHub, such concerns will in no way appear in your projects. This robust web-based editing platform can help you easily handle paperwork saved in Tax Sharing Agreement. It is simple to create, modify, share and convert your documents anywhere you are. All you need to use our interface is a stable internet connection and a DocHub profile. You can register within a few minutes. Here is how easy the process can be.

With a well-developed editing platform, you will spend minimal time figuring out how it works. Start being productive the minute you open our editor with a DocHub profile. We will make sure your go-to editing tools are always available whenever you need them.

Michael from Offshore Citizen received a question from a viewer, Stephen Dally, asking for a video on tiebreaker rules in treaties. He addresses the importance of understanding these rules and how they apply. If you need help with international tax optimization, setting up an international business, or relocating abroad, you can contact Michael through his website.