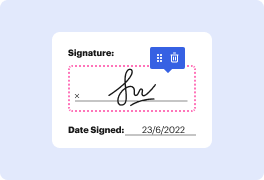

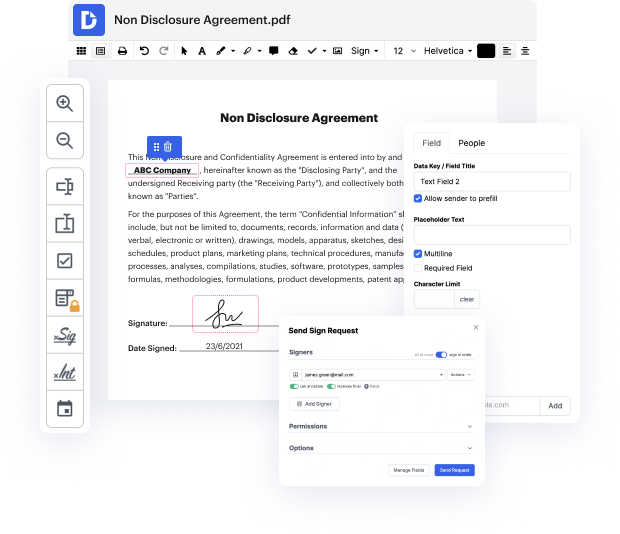

INFO may not always be the best with which to work. Even though many editing capabilities are available on the market, not all give a easy solution. We designed DocHub to make editing effortless, no matter the document format. With DocHub, you can quickly and easily tack FATCA in INFO. Additionally, DocHub provides an array of additional tools including form creation, automation and management, sector-compliant eSignature services, and integrations.

DocHub also enables you to save time by producing form templates from paperwork that you use frequently. Additionally, you can take advantage of our a lot of integrations that allow you to connect our editor to your most utilized applications easily. Such a solution makes it fast and simple to work with your files without any delays.

DocHub is a handy tool for personal and corporate use. Not only does it give a all-encompassing collection of capabilities for form creation and editing, and eSignature implementation, but it also has an array of capabilities that prove useful for creating multi-level and streamlined workflows. Anything imported to our editor is kept safe in accordance with major industry standards that shield users' information.

Make DocHub your go-to choice and simplify your form-based workflows easily!

hi Iamp;#39;m Jennifer from tax TV with some basic information about the foreign account tax compliance act better known as fatka in 2010 President Obama signed the hiring incentives to restore Employment Act that included fatka in an effort to combat tax evasion by us persons holding investments in offshore accounts the new legislation becomes effective December 31st 2012 and applies to certain foreign financial institutions and US taxpayers holding Financial assets outside the country fater requires us taxpayers holding foreign Financial assets with an aggregate value exceeding $50,000 to report information about those Holdings failure to file can result in a penalty of $10,000 being new the fatka rules are not fully understood and the IRS has continued to issue guidance to help businesses that may be affected generally the new rules apply as follows the new law requires foreign financial institutions and non-financial foreign entities to report directly to the IRS informati