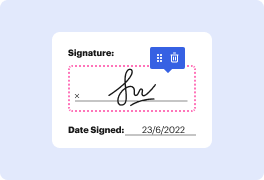

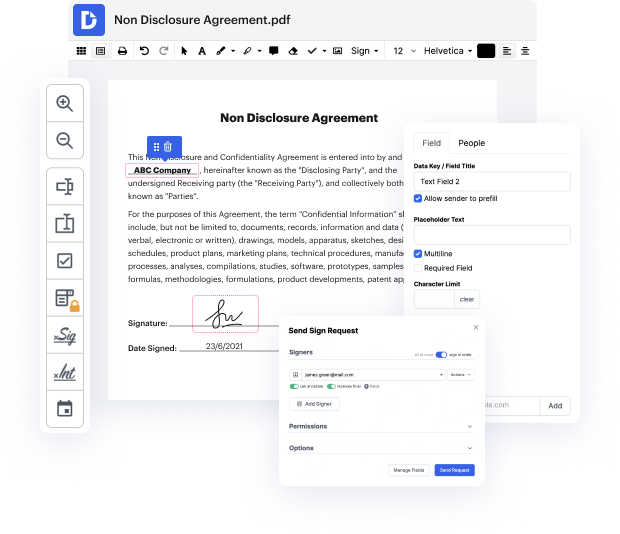

Whether you deal with papers day-to-day or only occasionally need them, DocHub is here to help you make the most of your document-based projects. This platform can strike point in Donation Agreement, facilitate user collaboration and create fillable forms and legally-binding eSignatures. And even better, every record is kept safe with the highest protection standards.

With DocHub, you can access these features from any place and using any device.

In this tutorial, you will learn how to accept donations on Square through a step-by-step process. Begin by signing into your Square account. Click on the three lines in the top left corner, then select "Edit" under Quick Access. Scroll down to find "Online Checkout" and enable it. After saving, access the Online Checkout section. Here, you'll delete any pre-existing links and then click on "Payment Links" to create a new link for donations. Follow the prompts to finalize the setup, allowing you to start accepting donations efficiently.