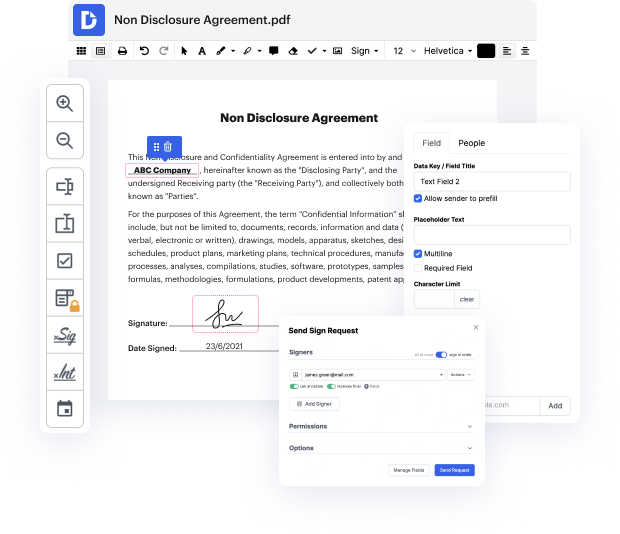

Many people find the process to strike out ein in RPT quite challenging, especially if they don't frequently work with paperwork. Nevertheless, nowadays, you no longer need to suffer through long guides or wait hours for the editing app to install. DocHub allows you to change forms on their web browser without setting up new applications. What's more, our powerful service provides a full set of tools for professional document management, unlike so many other online solutions. That’s right. You no longer have to donwload and re-upload your templates so often - you can do it all in one go!

No matter what type of paperwork you need to adjust, the process is simple. Take advantage of our professional online service with DocHub!

okay in this video i wanted to talk about the procedures for canceling an ein with the irs so an ein is an employer identification number itamp;#39;s effectively the tax id number thatamp;#39;s assigned to a business so itamp;#39;s a sole proprietorship business or business entity it can even be assigned to trusts estates joint ventures charitable organizations effectively itamp;#39;s the tax id number for anything thatamp;#39;s not letamp;#39;s say an individual person okay now so just to start with um you canamp;#39;t actually cancel your ein so once the ein is assigned to a business entity or again like a trust a state charitable organization sole proprietorship joint venture whatever it is once that ein is issued it remains attached to that entity name or business name and itamp;#39;s never reused or recycled and so for those reasons you canamp;#39;t actually cancel it because again itamp;#39;s never going to come up again so the only way you can really cancel it or one o