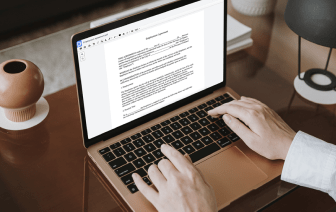

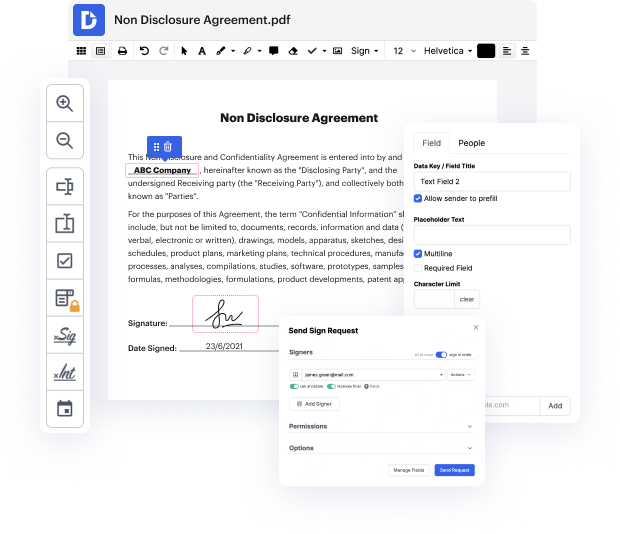

Having full control over your files at any moment is essential to ease your daily duties and increase your efficiency. Accomplish any objective with DocHub features for papers management and practical PDF file editing. Gain access, change and save and integrate your workflows along with other protected cloud storage services.

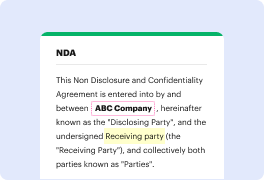

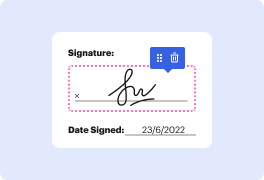

DocHub provides you with lossless editing, the possibility to work with any format, and safely eSign papers without the need of looking for a third-party eSignature software. Maximum benefit from the document managing solutions in one place. Consider all DocHub functions right now with your free of charge profile.

In this video, Jeff Smith from Coldwell Banker discusses bridge loans. A bridge loan is a short-term loan that enables buyers to leverage the equity from their current home to purchase a new property without selling their existing home first. This is particularly useful in competitive real estate markets, where homes can sell quickly, making contingent offers less favorable. Jeff outlines the benefits of bridge loans, such as avoiding delays in purchasing a new home while waiting for a current home to sell, and also covers the qualifying criteria for obtaining bridge loans. Overall, he aims to explain how bridge loans can facilitate a smoother transition between properties.