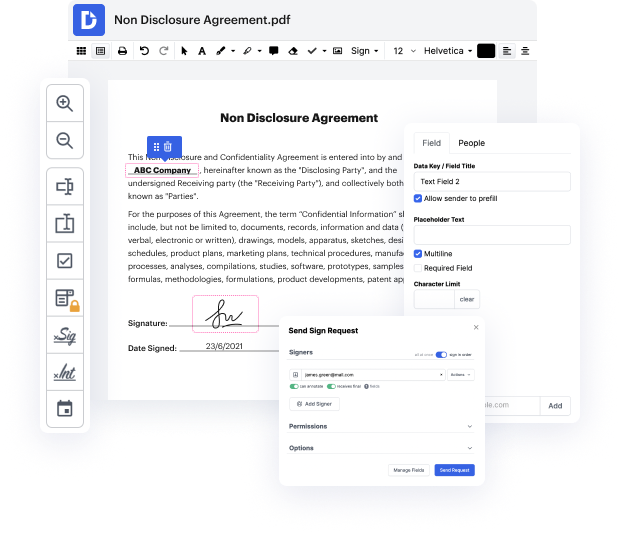

Are you searching for a straightforward way to slide type in Liquidating Trust Agreement? DocHub offers the best solution for streamlining form editing, certifying and distribution and document completion. With this all-in-one online platform, you don't need to download and install third-party software or use complex document conversions. Simply import your form to DocHub and start editing it in no time.

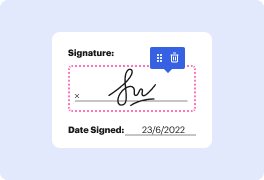

DocHub's drag and drop user interface allows you to quickly and easily make changes, from easy edits like adding text, images, or graphics to rewriting entire form components. In addition, you can endorse, annotate, and redact documents in just a few steps. The solution also allows you to store your Liquidating Trust Agreement for later use or turn it into an editable template.

DocHub provides more than just a PDF editing program. It’s an all-encompassing platform for digital form management. You can utilize it for all your documents and keep them safe and swiftly readily available within the cloud.

going over IRS form 966 corporate dissolution or liquidation as required under section 6043-a of the Internal Revenue code who must file this tax form a corporation or a farmers Cooperative must file form 966 if it adopts a resolution or plan to dissolve the corporation or liquidate any of its stock exempt organizations and qualified subchapter S subsidiaries should not file form 966. exempt organizations should see the struct instructions for form 990 return of organization exempt from income tax or form 990 PF return of private Foundation or section 4947 A1 trust treated as private Foundation sub chapter S subsidiaries should see form 8869 qualified subchapter S subsidiary election did not file form 966 for a deemed liquidation such as a section 338 election or an election to be treated as a disregarded entity under Treasury regulations Section 301 decimal 7701-3 you should file form 966 within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate

At DocHub, your data security is our priority. We follow HIPAA, SOC2, GDPR, and other standards, so you can work on your documents with confidence.

Learn more