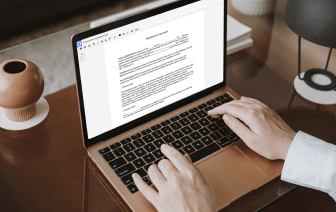

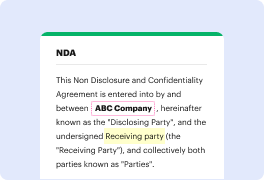

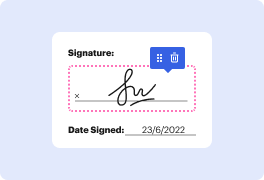

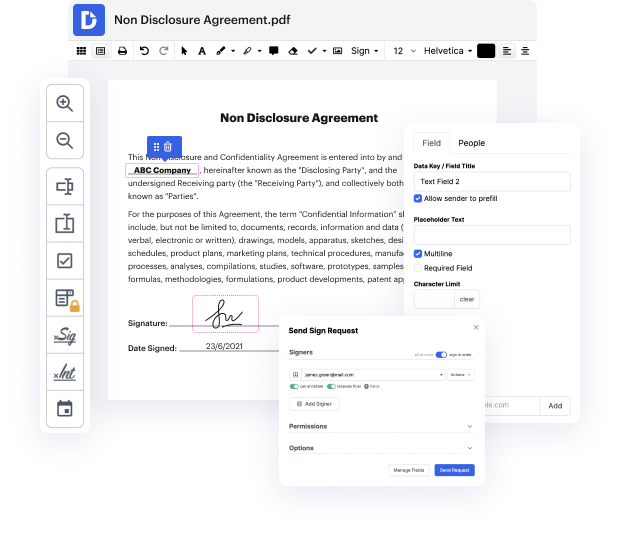

Handling and executing documents can be cumbersome, but it doesn’t have to be. No matter if you need assistance day-to-day or only occasionally, DocHub is here to equip your document-based projects with an extra efficiency boost. Edit, leave notes, fill out, sign, and collaborate on your Partnership Agreement rapidly and easily. You can adjust text and images, create forms from scratch or pre-built web templates, and add eSignatures. Due to our high quality security measures, all your data stays secure and encrypted.

DocHub offers a comprehensive set of features to streamline your paper processes. You can use our solution on multiple platforms to access your work wherever and whenever. Enhance your editing experience and save time of handiwork with DocHub. Try it for free right now!

today well be talking about chapter 12 which is accounting for partnerships and limited liability companies were going to start by discussing proprietorships partnerships and llcs were excluding corporations because we are going to cover that in chapter 13. so a proprietorship is a company owned by a single individual and because of this it is quite simple to form its just you it could be something as simple as a business you run out of your home one of the main disadvantages of proprietorships is the fact that they have no limitation on legal liability so what this means is the owner is personally liable so if youre suing the proprietorship you are suing the owner for everything they have it could be any of their personal assets like their home their car etc so thats a main disadvantage proprietorships are not taxable and what i mean by that is proprietorships are considered passed through entities and well talk about this more we discuss taxes but basically the proprietorship