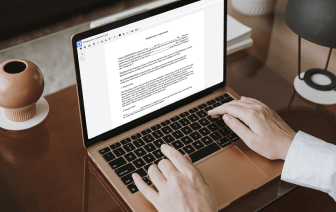

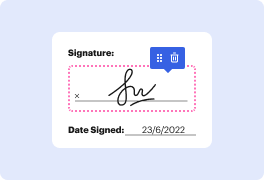

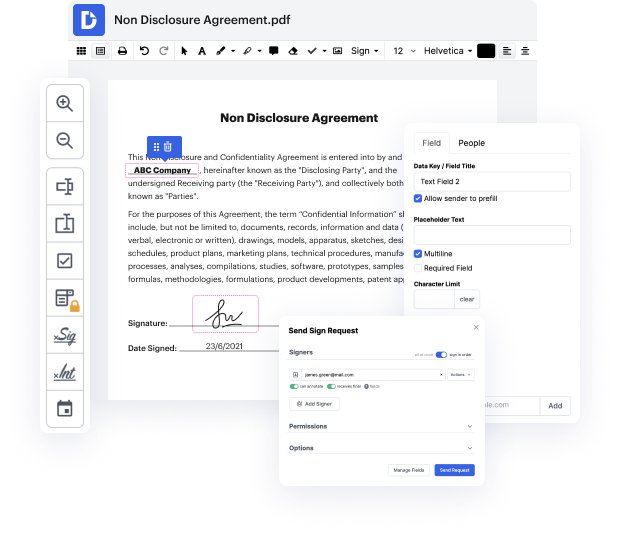

Handling and executing documents can be monotonous, but it doesn’t have to be. No matter if you need assistance everyday or only occasionally, DocHub is here to supply your document-based tasks with an extra productivity boost. Edit, comment, fill out, sign, and collaborate on your Donation Receipt quickly and effortlessly. You can modify text and pictures, create forms from scratch or pre-built web templates, and add eSignatures. Owing to our top-notch safety precautions, all your data stays safe and encrypted.

DocHub offers a complete set of tools to streamline your paper workflows. You can use our solution on multiple platforms to access your documents anywhere and anytime. Enhance your editing experience and save hours of handiwork with DocHub. Try it for free right now!

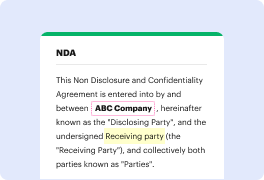

a donation receipt documents the details of a cash or property donation thats gifted to an individual cause or organization its often used by organizations and individual taxpayers as a proof of a charitable contribution for tax deductions and write-offs in this video well review crucial information regarding donation receipts and their content as well as where to get an official template lets start by discussing what is considered a donation a donation refers to a gift either in the form of cash or property to a charitable cause organization or campaign typically any contribution to non-profit groups institutions and funds can be considered a charitable donation by the irs these contributions are often tax deductible whereas other donations such as contributions to political campaigns or civic groups are not lets briefly go through some types of donations some common examples include donations to charitable organizations causes and funds religious organizations educational and me