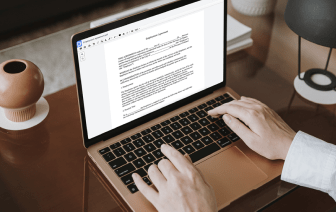

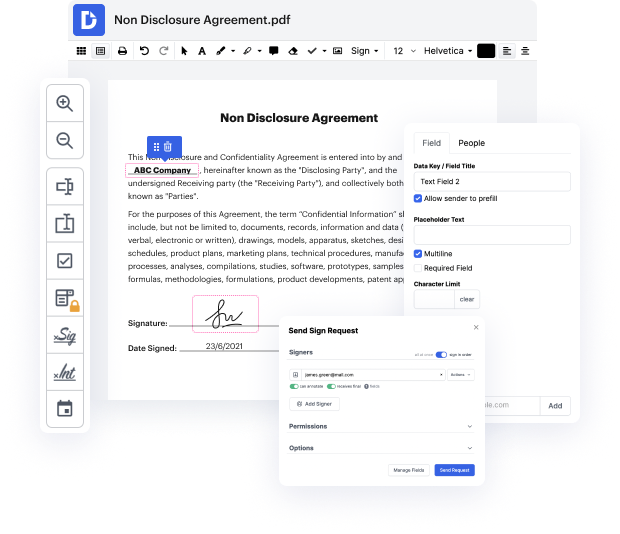

With DocHub, you can easily shade FATCA in WPS from anywhere. Enjoy capabilities like drag and drop fields, editable textual content, images, and comments. You can collect eSignatures securely, add an extra layer of defense with an Encrypted Folder, and collaborate with teammates in real-time through your DocHub account. Make changes to your WPS files online without downloading, scanning, printing or sending anything.

You can find your edited record in the Documents folder of your account. Prepare, submit, print out, or convert your document into a reusable template. Considering the variety of advanced tools, it’s simple to enjoy effortless document editing and managing with DocHub.

good afternoon this is sean golden with golden golden here to discuss the basics of what fatca the foreign account tax compliance act penalties are what taxpayers can do to avoid them and what to do if you find yourself in the matrix in order to minimize or obey penalties fatca is not the same as f bar you see the two acronyms kind of simultaneously everywhere but theyamp;#39;re not the same factor refers to the foreign account tax compliance act it was introduced on the u.s tax return back in 2012 or 2011. since 2014 i believe the u.s has centered into more than 110 fatca agreements which are otherwise known as igas intergovernmental agreements uh with more than 110 countries and hundreds of thousands of foreign financial institutions actively report information to the us government which means if youamp;#39;re a u.s person and you have accounts overseas those foreign financial institutions report that information to the u.s government now when it comes to fatca itamp;#39;s more th