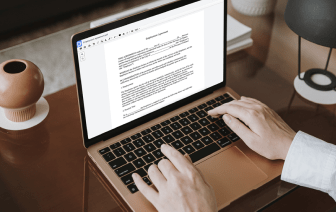

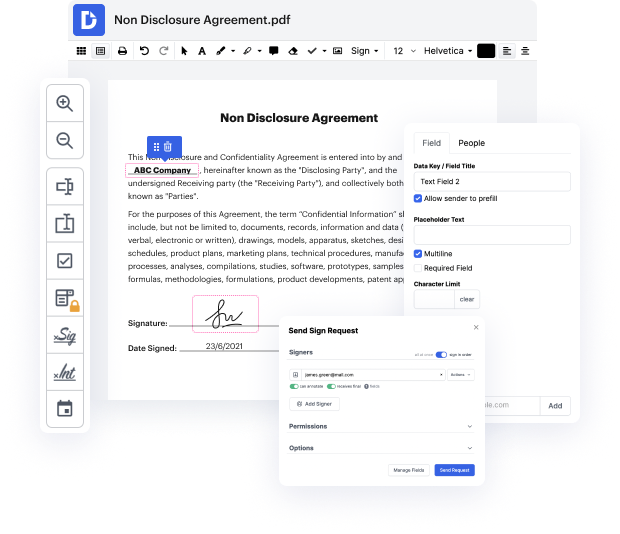

No matter how labor-intensive and challenging to edit your files are, DocHub delivers an easy way to change them. You can change any part in your Troff without extra resources. Whether you need to fine-tune a single component or the whole form, you can rely on our powerful tool for quick and quality outcomes.

In addition, it makes sure that the final document is always ready to use so that you can get on with your tasks without any slowdowns. Our comprehensive collection of tools also features sophisticated productivity tools and a catalog of templates, enabling you to make the most of your workflows without the need of losing time on routine tasks. Additionally, you can gain access to your documents from any device and integrate DocHub with other apps.

DocHub can handle any of your form management tasks. With an abundance of tools, you can create and export paperwork however you prefer. Everything you export to DocHub’s editor will be saved securely for as long as you need, with rigid security and information safety protocols in place.

Try out DocHub now and make handling your files simpler!

hey folks Iamp;#39;m talking today on FATCA vs. the common reporting standard the coming reporting standard is which is called CRS itamp;#39;s an information standard for the automatic exchange of information regarding bank accounts on a global level between tax authorities which the Organisation for Economic Cooperation and Development which is called the OECD developed in 2014 its purpose is to combat tax evasion the idea was based on the u.s. foreign account Tax Compliance Act which is FATCA 97 countries had signed an agreement to implement it with more countries intended to son later first reporting occurred in 2017 with many of the rest starting in 2018 until 2014 the parties to most treaties for sharing assets incomes and tax information internationally and shared it upon request which was not effective in preventing tax evasion the new system was intended to transfer all relevant information automatically and systematically the agreement has informally been referred to as Gatk