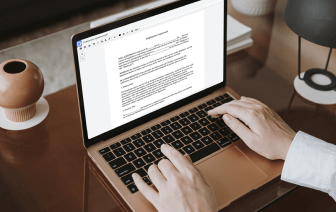

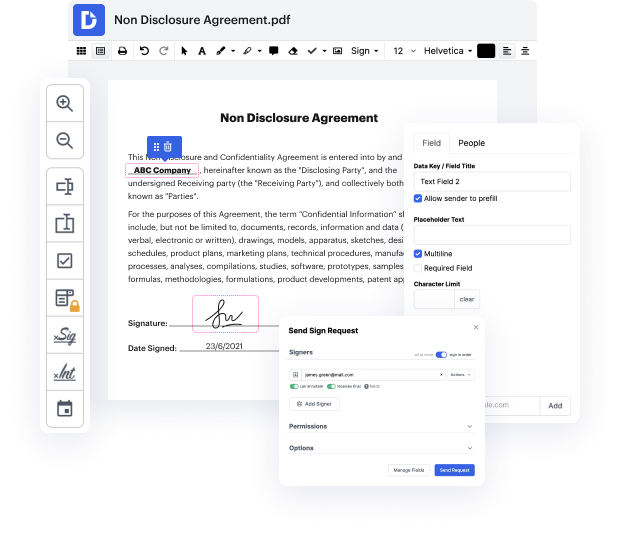

Document-based workflows can consume plenty of your time and energy, no matter if you do them regularly or only occasionally. It doesn’t have to be. In reality, it’s so easy to inject your workflows with additional productiveness and structure if you engage the proper solution - DocHub. Sophisticated enough to tackle any document-connected task, our platform lets you adjust text, pictures, comments, collaborate on documents with other parties, create fillable forms from scratch or templates, and electronically sign them. We even protect your data with industry-leading security and data protection certifications.

You can access DocHub tools from any place or device. Enjoy spending more time on creative and strategic tasks, and forget about cumbersome editing. Give DocHub a try today and see your 1099-MISC Form workflow transform!

hi everyone welcome back in todays video Im going to share everything you need to know about the IRS form 1099 miscellaneous before we begin please make sure that you are subscribed to my channel it is available on YouTube and Rumble like and comment if youre a business owner or youre planning to become one you need to get very familiar with form 1099 miscellaneous theres just no way around that today we will talk about what form 1099 miscellaneous is what type of payments are reported on form 1099 miscellaneous what you should do when you receive this form in the mail and well also talk about 1099 miscellaneous versus 1099 NEC well cover who must file form 1099 miscellaneous and how you can do it so first things first what is form 1099 miscellaneous this is a tax form used by both businesses and individual tax filers to report the payment of qualifying expenses during a year the paye the person who received a payment will use their form 1099 miscellaneous when they prepare thei