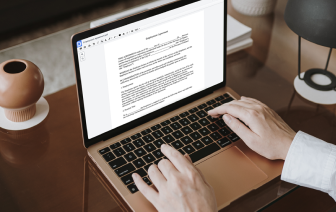

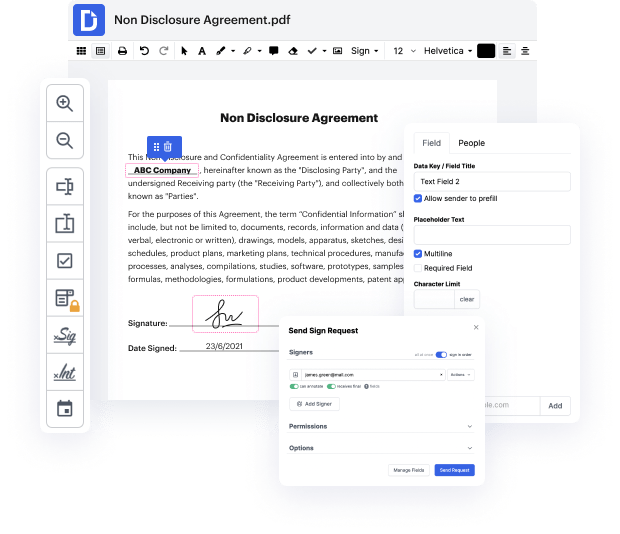

DocHub provides all it takes to easily tweak, generate and handle and securely store your VAT Invoice Template and any other paperwork online within a single tool. With DocHub, you can stay away from form management's time-consuming and effort-intense transactions. By reducing the need for printing and scanning, our ecologically-friendly tool saves you time and minimizes your paper usage.

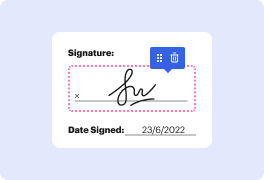

Once you’ve registered a DocHub account, you can start editing and sharing your VAT Invoice Template in mere minutes with no prior experience required. Unlock various pro editing capabilities to set sign in VAT Invoice Template. Store your edited VAT Invoice Template to your account in the cloud, or send it to users using email, dirrect link, or fax. DocHub allows you to convert your form to popular file types without the need of toggling between applications.

You can now set sign in VAT Invoice Template in your DocHub account anytime and anywhere. Your files are all saved in one platform, where you can tweak and handle them quickly and effortlessly online. Give it a try now!

how to set up an invoice template in QuickBooks hey everyone my name is Matt holtquist with the QuickBooks University and I wanted to show you how to easily set up an invoice template in QuickBooks so we are here with QuickBooks desktop and you know QuickBooks comes with a lot of default and voices in other forms you know just in their own format but a lot of times you know most people at least a lot of people I meet business owners want to customize those invoice templates and even set up their own so that it just creates you know a better look for the company and so thats what were going to talk about in this video today all right so first what were going to do you go up to the list menu up here youre going to see an option here that says templates and you can see here there are lots of different this is a sample company file so when you go into you know a new company file there there will be some templates in there just the standard templates that it comes with but you can set u