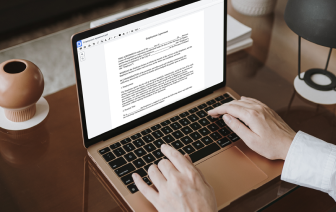

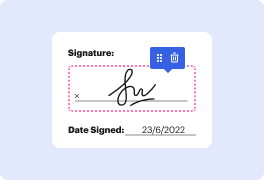

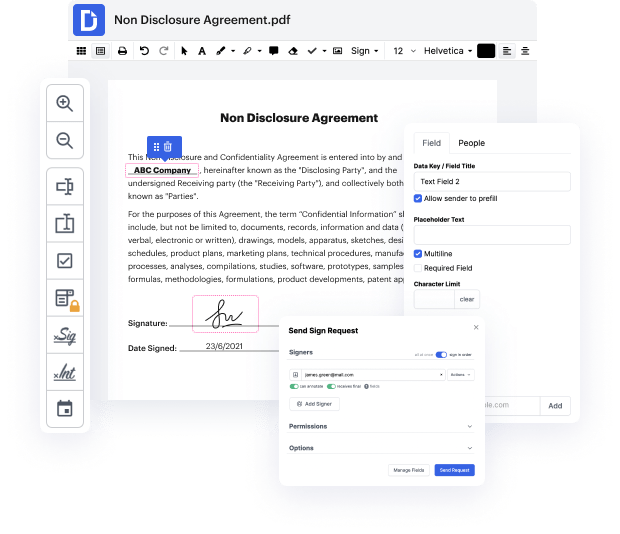

Managing and executing documents can be tiresome, but it doesn’t have to be. No matter if you need help day-to-day or only occasionally, DocHub is here to equip your document-centered projects with an extra productivity boost. Edit, comment, fill in, eSign, and collaborate on your Loan Consent Agreement rapidly and effortlessly. You can alter text and pictures, create forms from scratch or pre-made web templates, and add eSignatures. Owing to our top-notch security measures, all your information remains secure and encrypted.

DocHub offers a comprehensive set of tools to simplify your paper processes. You can use our solution on multiple platforms to access your work anywhere and whenever. Improve your editing experience and save time of handiwork with DocHub. Try it for free today!

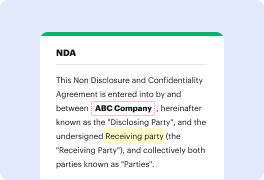

a loan agreement is a written agreement between a borrower and lender that stipulates terms to recoup lent money the foundation of a loan agreement is the borrowers promise to pay back the loan in line with an agreed-upon repayment schedule with regular payments or a lump sum as a lender a loan agreement is very useful as it legally enforces the borrower to repay the loan types of loan agreements a normal loan agreement is useful for many situations such as business personal home equity car and student loans loan agreements can come in many variations but the function of each type is to set up the terms to pay back money owed these are other types of loan agreements and related documents family loan agreement for the borrowing of money from one family member to another IOU the acceptance and confirmation of money that has been borrowed from one party to another this is a simple form that doesnt commonly give details about how or when money will be paid back or any interest rate payme