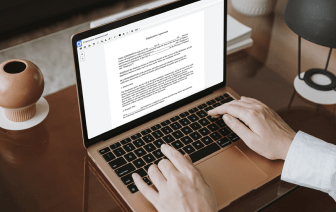

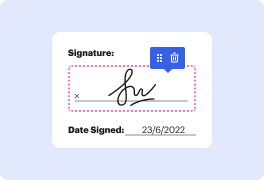

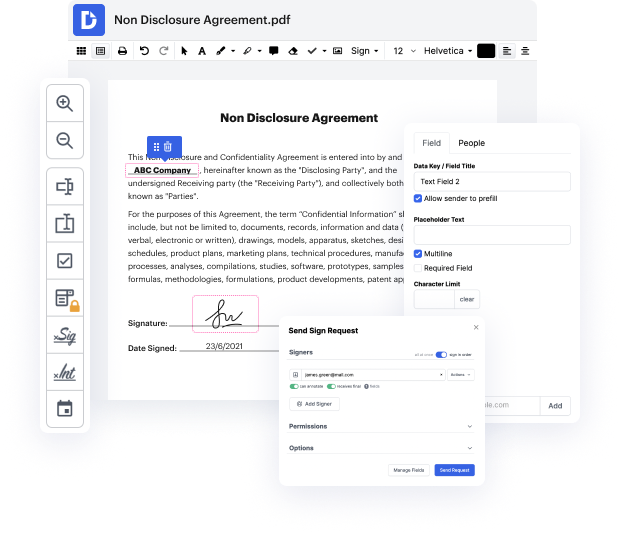

Do you want to prevent the difficulties of editing W-9 Tax Form online? You don’t have to bother about downloading untrustworthy solutions or compromising your paperwork ever again. With DocHub, you can set formula in W-9 Tax Form without spending hours on it. And that’s not all; our easy-to-use platform also offers you highly effective data collection tools for gathering signatures, information, and payments through fillable forms. You can build teams using our collaboration capabilities and effectively interact with multiple people on documents. On top of that, DocHub keeps your data safe and in compliance with industry-leading security requirements.

DocHub enables you to access its tools regardless of your device. You can use it from your notebook, mobile phone, or tablet and modify W-9 Tax Form effortlessly. Start working smarter today with DocHub!

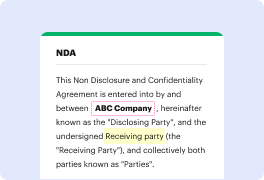

Hi everyone. Im Ara Oghoorian with ACap Advisors and Accountants, and welcome to another edition of the ACap ReCap, where we go behind the blog and answer some of your most important questions. Today were going to talk about W-4s, W-2s, W-9s, and why the IRS has so many of these forms, and which one you should complete. But, before we begin, remember to subscribe, like and share our channel, and if theres a topic you want us to cover, email us or send it or put a message in the comments section below, and well be sure to cover it in a future video. The key variable, that dictates, which form you need to complete is whether or not youre an employee or an employer. So, lets start off with the easy one, which is the employee: if youre an employee, you have to complete whats called the W-4. Now, whats the purpose of the W-4? Its to let your employer know how much of your paycheck you want taken out to for federal taxes, because during the year, when y