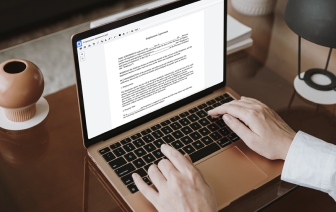

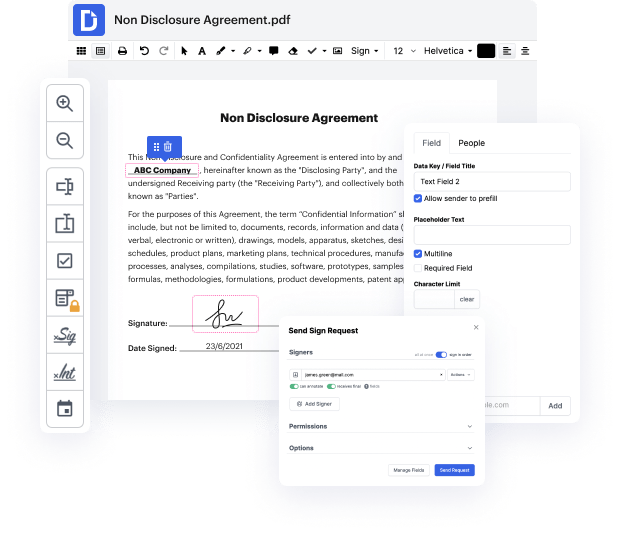

Dealing with documents implies making minor modifications to them every day. Sometimes, the task runs almost automatically, especially when it is part of your everyday routine. Nevertheless, in other instances, working with an uncommon document like a Bankruptcy Agreement can take valuable working time just to carry out the research. To ensure every operation with your documents is effortless and quick, you should find an optimal modifying solution for such jobs.

With DocHub, you can see how it works without taking time to figure everything out. Your tools are organized before your eyes and are easily accessible. This online solution will not require any specific background - education or expertise - from the customers. It is all set for work even when you are not familiar with software typically used to produce Bankruptcy Agreement. Quickly make, modify, and send out papers, whether you work with them daily or are opening a new document type for the first time. It takes minutes to find a way to work with Bankruptcy Agreement.

With DocHub, there is no need to study different document types to figure out how to modify them. Have the go-to tools for modifying documents close at hand to streamline your document management.

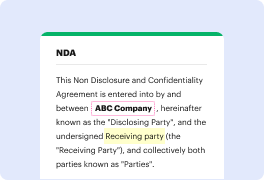

good afternoon im attorney lee pearlman i want to talk to my family law friends and colleagues about how to bankruptcy proof your divorce settlement right now first let me lay a little groundwork for everyone bankruptcy code section 523 a15 i know i promise this will be the only bankruptcy code section i cite in this video simply provides that debts incurred during the course of divorce are non-dischargeable in chapter 7 and 11. but a chapter 13 is different a chapter 13 bankruptcy is more expansive so it can discharge any non-support obligations associated with divorce unlike 7 and 11. family lawyers are most at risk when they are drafting marital settlement agreements we see it all the time or court judgments that direct one spouse to pay or indemnify another spouse in the future the spouse assigning the obligation or what we say as doing the directing thats the creditor spouse this is the spouse who needs to be cautious and careful some examples of clauses that could be subject t