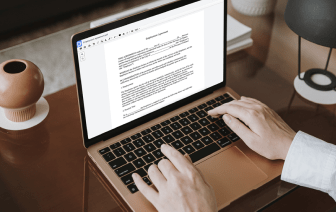

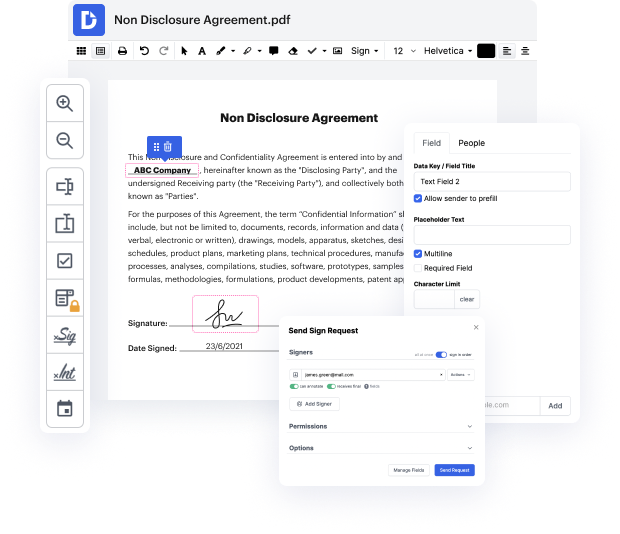

Need to swiftly set card in Form W2? Look no further - DocHub offers the answer! You can get the work completed fast without downloading and installing any software. Whether you use it on your mobile phone or desktop browser, DocHub enables you to modify Form W2 anytime, anywhere. Our versatile solution comes with basic and advanced editing, annotating, and security features, suitable for individuals and small businesses. We also provide lots of tutorials and guides to make your first experience successful. Here's an example of one!

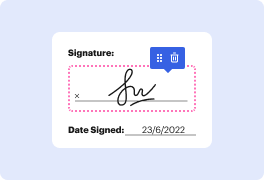

You don't have to worry about data protection when it comes to Form W2 modifying. We offer such security options to keep your sensitive data secure and safe as folder encryption, dual-factor authentication, and Audit Trail, the latter of which monitors all your actions in your document.

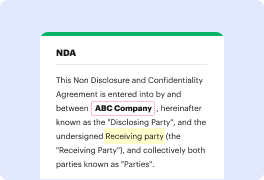

foreign [Music] lets talk about the W-2 form from the IRS which is a pretty important document when it comes to filing your taxes this is a form that employers are required to fill out and send to both you and the IRS annually and it provides information about your earnings for that previous year as well as any taxes withheld the W-2 provides details on what money was earned in that previous year plus it details any withheld taxes paid during that same time frame if you have ever worked for an employer chances are that you received a W-2 tax form at the end of the year employer must send this form to you no later than January 31st following your last year of work in order that you have enough time to file your taxes for that calendar year so what exactly is the W-2 IRS tax form and why is it essential a W-2 form is a document that summarizes your earnings and tax withholdings for the year this form has identifying information such as your name address and social security number it als