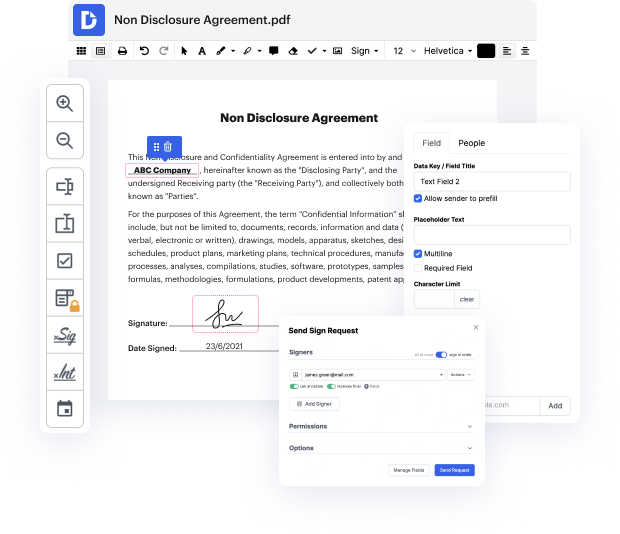

No matter how complex and challenging to modify your files are, DocHub gives an easy way to modify them. You can alter any part in your ODM with no extra resources. Whether you need to fine-tune a single element or the entire form, you can entrust this task to our robust solution for fast and quality outcomes.

Additionally, it makes sure that the output file is always ready to use so that you’ll be able to get on with your projects without any slowdowns. Our extensive group of tools also comes with pro productivity features and a library of templates, enabling you to take full advantage of your workflows without the need of losing time on routine operations. Additionally, you can gain access to your documents from any device and incorporate DocHub with other solutions.

DocHub can handle any of your form management operations. With a great deal of tools, you can generate and export papers however you choose. Everything you export to DocHub’s editor will be saved securely as much time as you need, with strict protection and information protection protocols in place.

Try out DocHub today and make managing your documents easier!

hi iamp;#39;m jack from the global compliance institute and iamp;#39;m here to assist you in understanding fatca and crs this video will explain the w8 bani faca form to factor responsible officers in foreign financial institutions worldwide there are three main topics that fat rose should clearly understand firstly the purpose of this form secondly who should fill it thirdly how to complete this form now letamp;#39;s go through the topics firstly what is the purpose of form wa benny w8 ban e is a certificate of status a beneficial owner for united states tax withholding and reporting for entities as discussed in our previous videos fatca w9 form can be completed by either individuals or entities while in the irs w8 forms there are two different forms one for individuals w8 ben and another one for entities w8 ben e the w8 band e is the form that fak ros should take from their corporate clients to document their u.s tax status foreign persons are subject to u.s tax at a 30 rate on wi